Cash Flow: Understanding the Lifeblood of Business

In today's dynamic business environment, understanding and managing cash flow is crucial for sustainable growth and financial stability. This comprehensive guide explores the intricacies of cash flow, its importance, and how businesses can leverage this vital metric to drive success.

What is cash flow and why is it important?

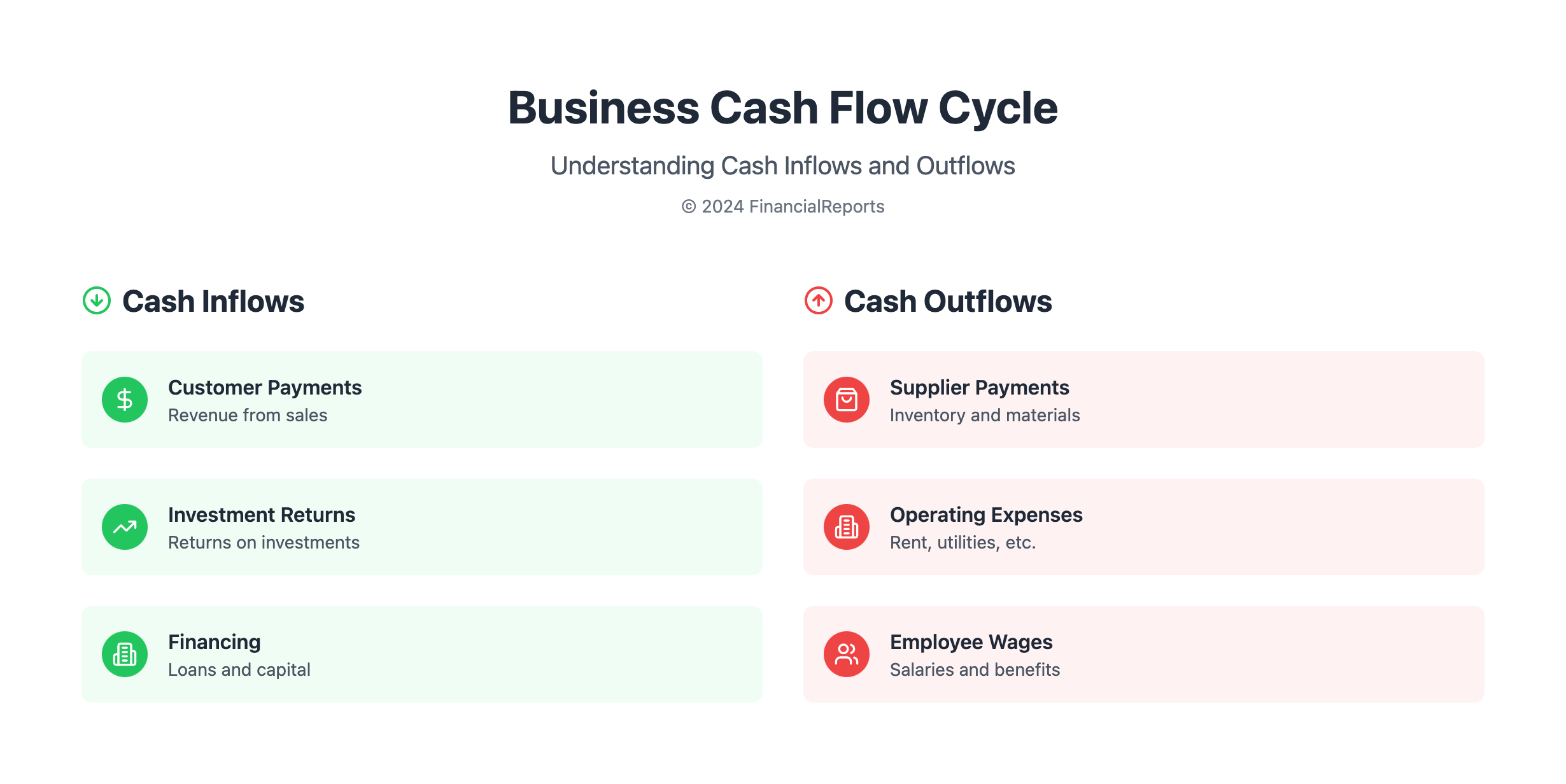

Cash flow represents the movement of funds in and out of a business over a specific period. This crucial metric measures the cash a company generates and utilizes, providing essential insights into its financial health and operational efficiency. At its core, cash flow tracks two key components: cash inflows (money received) and cash outflows (money spent).

The significance of cash flow for a business cannot be overstated. It ensures liquidity and solvency, enabling a company to meet short-term obligations and cover operating expenses. Robust cash flow facilitates growth and investment, providing the means to expand, acquire new equipment, or fund research and development. It also offers financial flexibility, creating a buffer against unforeseen challenges and allowing companies to capitalize on opportunities. Furthermore, investors and lenders closely scrutinize a company's cash flow to assess its financial stability and growth potential.

It is crucial to note that profitability does not always equate to positive cash flow. A company can be profitable on paper but still face cash flow challenges if it cannot collect payments promptly or maintains high inventory costs. For effective cash flow management, businesses typically focus on three main categories: operating cash flow (from core business activities), investing cash flow (used for or generated from investments), and financing cash flow (from activities such as issuing stock or acquiring debt).

Cash flow statements - The key to financial clarity

A cash flow statement, also known as a statement of cash flows, is a critical financial document that provides a comprehensive view of a company's cash movements over a specific period. This financial report offers invaluable insights into an organization's liquidity, financial health, and operational efficiency.

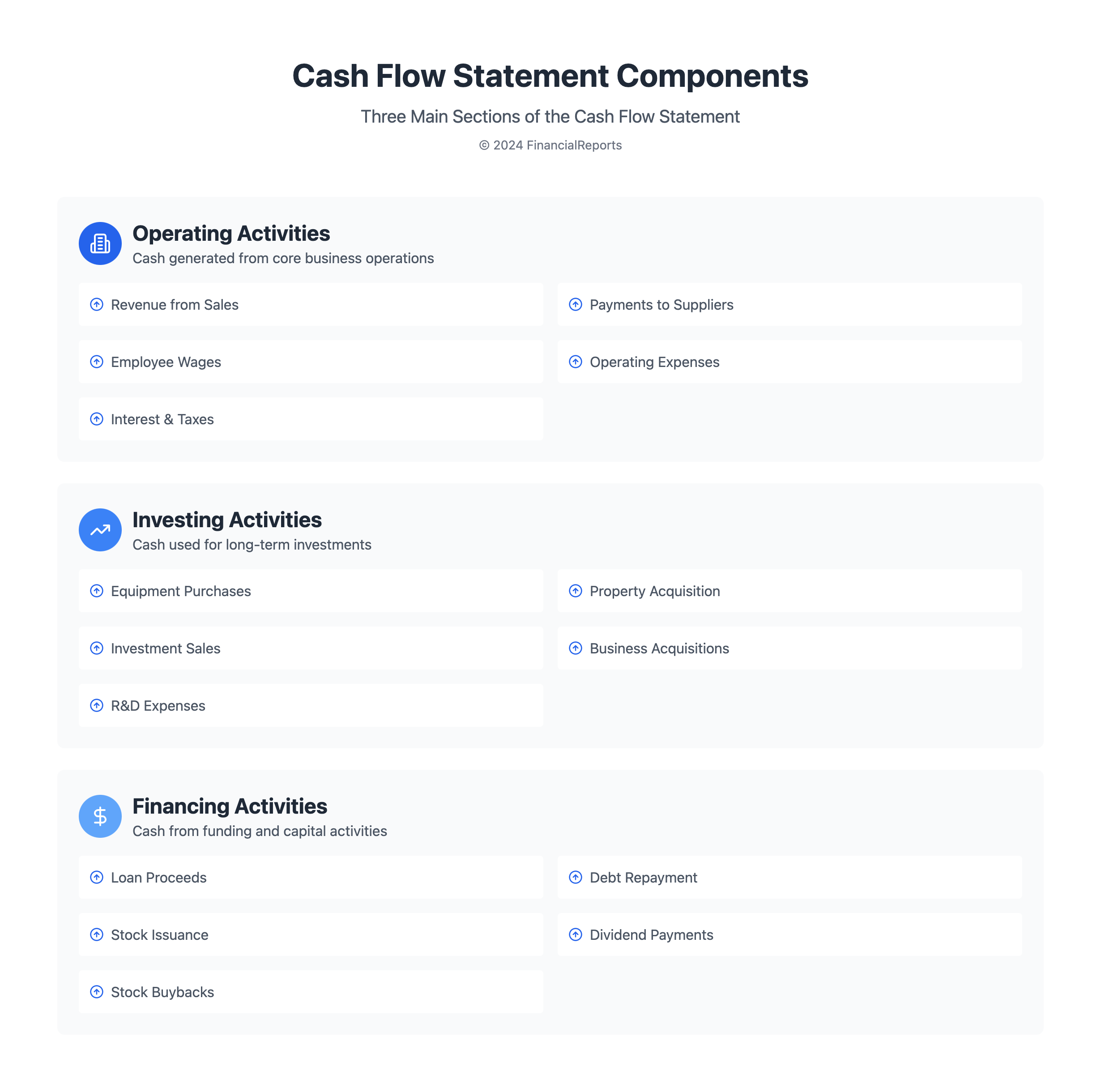

The primary purpose of a cash flow statement is to illustrate how cash and cash equivalents move in and out of a business through three main categories:

-

Operating activities: Cash generated from core business operations

-

Investing activities: Cash used for or generated from investments

-

Financing activities: Cash from financing activities, such as issuing stock or acquiring debt

A well-prepared cash flow statement enables stakeholders to assess the company's ability to generate positive cash flow, evaluate its cash management effectiveness, gauge its capacity to service debts and fund growth initiatives, and identify potential discrepancies between reported earnings and actual cash generation.

To create a cash flow statement, businesses typically employ one of two methods: the direct method (listing actual cash inflows and outflows) or the indirect method (starting with net income and adjusting for non-cash transactions). The indirect method is more commonly utilized, as it provides a clear reconciliation between the income statement and balance sheet.

By analyzing a company's cash flow statement, investors, creditors, and management can gain valuable insights into the organization's financial stability and growth potential, making it an essential tool for informed decision-making. For a detailed example of how companies report their cash flow, you can refer to the 2021 Results report of SGL Carbon SE.

Components of the cash flow statement

To fully grasp the intricacies of cash flow statements, it's essential to understand their key components. Each section of the statement provides unique insights into a company's financial activities and overall health.

The three primary sections of the statement of cash flows are:

-

Cash flow from operating activities: This section demonstrates the cash generated or used by a company's core business operations. It includes cash received from customers, cash paid to suppliers and employees, interest and taxes paid, and other operating cash receipts and payments.

-

Cash flow from investing activities: This part reflects cash used for or generated from investments. It typically includes the purchase or sale of property, plant, and equipment; acquisition or disposal of other businesses; and purchase or sale of investment securities.

-

Cash flow from financing activities: This section illustrates cash flows related to funding the company and its capital structure. It includes the issuance or repurchase of stocks, issuance or repayment of debt, and payment of dividends.

Each of these sections provides valuable insights into different aspects of a company's financial activities. Operating activities reveal the cash-generating power of the core business, investing activities demonstrate how the company is investing in its future growth, and financing activities indicate how the company is managing its capital structure.

For a practical example of how these components are reported in a real-world scenario, you can review the HelloFresh SE Quarterly Statement Q3 2021.

Cash flow analysis - Interpreting the numbers

Cash flow analysis is a critical process for understanding the financial health and performance of a business. By carefully examining the statement of cash flows, investors, managers, and analysts can gain valuable insights into a company's liquidity, operational efficiency, and overall financial stability.

When analyzing the statement of cash flows, it is essential to focus on three key areas:

-

Operating activities

-

Investing activities

-

Financing activities

When interpreting cash flow statements, it is crucial to look beyond the bottom line and consider the quality of cash flows. Key aspects to examine include consistency, cash conversion cycle, free cash flow, and the cash flow to net income ratio.

Effective cash flow analysis also involves comparing the cash flow statement with other financial statements. For instance, significant discrepancies between net income on the income statement and cash from operations may warrant further investigation into the company's accounting practices.

By mastering the art of analyzing the statement of cash flows, financial professionals can make more informed decisions about investments, assess a company's ability to meet its obligations, and predict future financial performance. For a real-world example of how companies report and analyze their cash flow, you can refer to the Wacker Neuson Group Quarterly report Q1/20.

Cash flow management strategies for business success

Effective cash flow management is crucial for the long-term success and stability of any business. By implementing intelligent strategies, companies can ensure they have sufficient liquidity to meet their financial obligations and fuel growth. Key approaches to optimize cash flow management include:

-

Accelerating receivables

-

Managing payables strategically

-

Optimizing inventory levels

-

Diversifying revenue streams

-

Leveraging technology

To effectively implement these strategies, it is essential to generate cash flow statements regularly. A cash flow statement provides a clear picture of a company's financial health by illustrating the inflows and outflows of cash over a specific period.

By mastering these cash flow management strategies and consistently generating accurate cash flow statements, businesses can maintain a healthy financial position, make informed decisions, and drive sustainable growth.

Cash flow statement examples and best practices

Understanding cash flow statements through examples is crucial for effective financial management. A basic cash flow statement example might include cash from operating activities, investing activities, and financing activities, along with the net increase in cash and beginning and ending cash balances.

The indirect method statement of cash flows is commonly employed by businesses. This method begins with net income and makes adjustments for non-cash items to arrive at the net cash from operating activities.

Best practices for cash flow statement preparation include:

-

Consistency in method used

-

Accuracy in categorizing cash flows

-

Timeliness in preparation

-

Sufficient detail

-

Reconciliation with other financial statements

When analyzing cash flow statements, pay close attention to operating cash flow trends, investment activities, financing activities, and free cash flow. By adhering to these best practices and analyzing cash flow statement examples, businesses can gain valuable insights into their financial health and make informed decisions for future growth.

Leveraging cash flow insights for strategic decision-making

As we've explored the various aspects of cash flow management, it's clear that this financial metric plays a pivotal role in business success. By effectively analyzing and interpreting cash flow data, companies can make strategic decisions that drive growth, improve operational efficiency, and ensure long-term financial stability.

To maximize the value of cash flow insights, businesses should:

-

Regularly review and update cash flow projections

-

Use cash flow data to inform investment decisions

-

Identify and address potential cash flow bottlenecks

-

Align cash flow management with overall business strategy

-

Leverage technology for real-time cash flow monitoring

By integrating these practices into their financial management processes, organizations can harness the power of cash flow analysis to navigate challenges, capitalize on opportunities, and achieve sustainable growth in today's competitive business landscape.