Cash Flow From Operating Activities: A Complete Guide

Financial experts and big investors must fully understand cash flow from operating activities (CFO). It's a key measure that shows how much cash a company's daily business operations generate. Unlike other financial numbers, cash from operating activities gives a clear view of a company's real ability to make money by focusing on the cash it makes through its main activities, without the impact of investments or big purchases.

This detailed look into CFO shows why it's so important in the cash flow statement operating activities section. It's vital for evaluating a company's liquidity and planning for the future. CFO isn't just an accounting term; it's a clear indicator of a company's overall health and smart financial management. Understanding this helps people involved in a business make better decisions and plan strategically for what's ahead.

Key Takeaways

- Cash flow from operating activities highlights the efficiency of a company's main operations, without the confusion of investment and finance details.

- To figure out operating cash flow, we start with net income then adjust for things like non-cash expenses and changes in working capital.

- Unlike EBITDA, CFO gives a more accurate picture of how effectively a company turns its operations into cash, considering working capital changes.

- There are two ways to calculate CFO: the direct method, which lists cash transactions, and the indirect method, which tweaks net income.

- To find out Free Cash Flow, which shows the cash available after crucial investments, we deduct Capital Expenditures from CFO.

- Being good at reading a cash flow statement helps stakeholders understand a company's financial health and its future direction better.

What is Cash Flow from Operating Activities?

Cash flow from operating activities is key in understanding a company's cash generation. It's vital for experts to gauge the efficiency and financial health of a business. It shows how well a company can create cash through its main operations.

Definition and Importance

Net cash flow from operating activities starts with net income. Then, adjustments to net income in calculating operating cash flows include items like non-cash expenses and changes in working capital. It explicitly deals with the cash from daily business activities, leaving out investments and financing efforts.

Key Components

To find out this cash flow, you need net income, non-cash expenses like depreciation, and stock-based compensation. Adjustments are key. They correct for things that don't directly change cash, such as deferred taxes and accruals.

| Item | Net Income Adjustment | Relevance to Cash Flow |

|---|---|---|

| Depreciation & Amortization | Added back | Increase in cash flow |

| Stock-Based Compensation | Added back | Increase in cash flow |

| Deferred Taxes | Added back | Increase in cash flow |

| Accounts Receivable | Deducted | Decrease in cash flow |

| Inventory | Deducted | Decrease in cash flow |

| Accounts Payable | Added back | Increase in cash flow |

Difference Between Cash Flow and Net Income

Knowing how net cash flow from operating activities differs from net income is key. Net income looks at profit, counting all revenues and expenses. But net cash flow from operating activities shows cash used or made just from business activities. This is crucial for understanding a company's actual financial state. It helps to know if a business can have high profit but still face cash problems.

How to Calculate Cash Flow from Operating Activities

Learning how to calculate cash flow from operating activities is key for finance experts and businesses. This part explains the process using the direct and indirect methods. It uses real data and math to make financial results clear and accurate.

Direct Method

The direct method looks at actual money movements to find cash flow from operations. It counts cash coming in and going out from business activities. For example, money from customers and money paid to suppliers and workers are included to find net cash flow.

Indirect Method

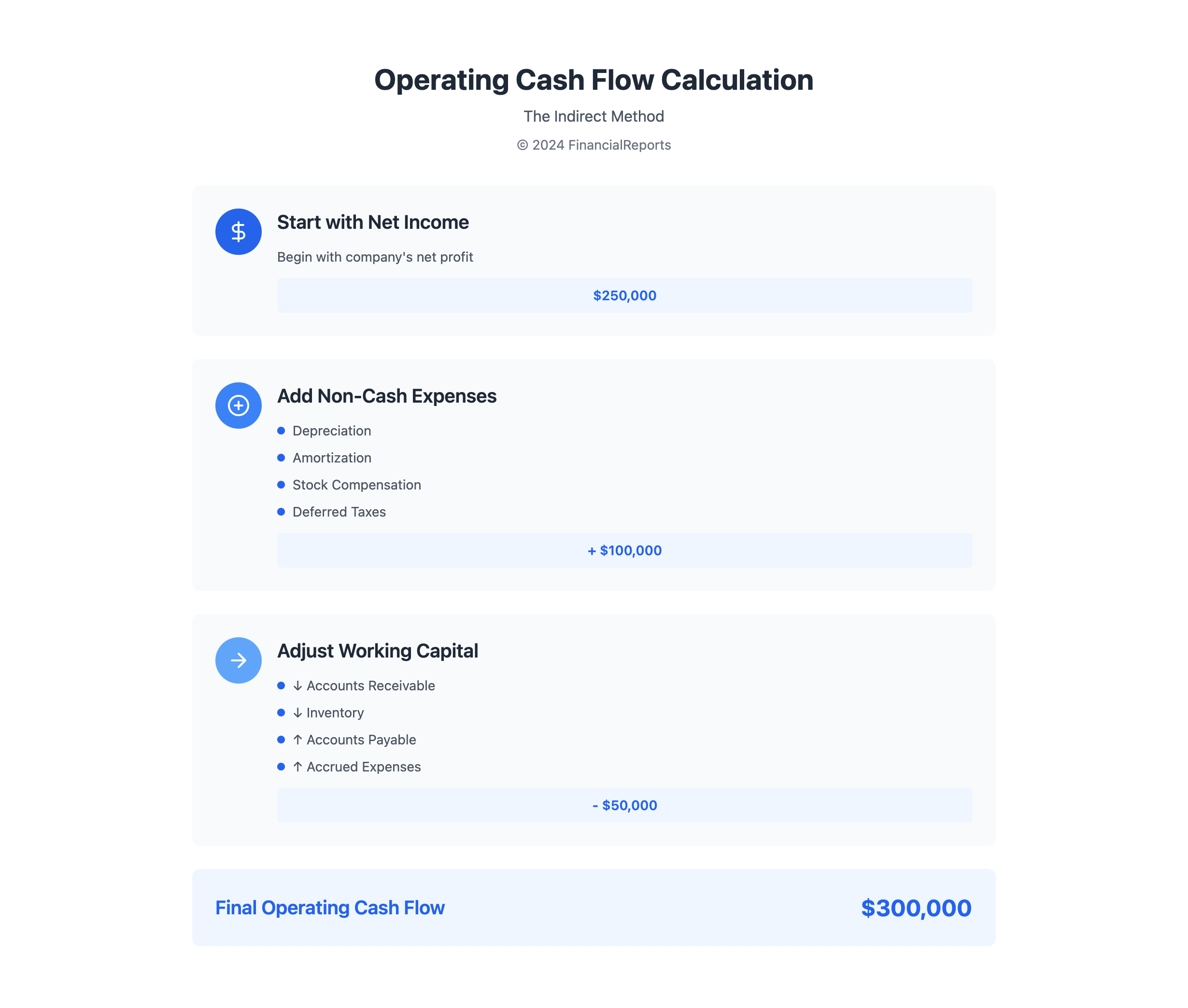

The indirect method is often chosen for its fit with accrual accounting. It starts with net income. Then, it adjusts for all transactions not involving cash and any working capital changes. This approach shows how business plans turn into real cash changes, beyond just profit on paper. A straightforwatrd cash flow from operating activities example using the indirect method is:

Operating Cash Flow (OCF) = Net Income + Non-Cash Expenses – Change in Working Capital

Let's say a business's net income is $250,000, with non-cash costs like depreciation at $100,000, and working capital dropped by $50,000. The operating cash flow would look like this:

- Net Income: $250,000

- + Non-Cash Expenses: $100,000

- – Change in Working Capital: $50,000

Thus, Operating Cash Flow = $300,000

Steps for Calculation

To clear up how to analyze Operating Cash Flow, here are the basics, adaptable for both methods:

- Identify the Method: Pick direct or indirect method, depending on your data and the company's reporting style.

- Gather Relevant Data: Collect all needed info such as net income, cash receipts and payments, and non-cash transaction records.

- Perform Calculations: Use the chosen method's equation to figure out the real cash flow from operating activities. Make sure to correctly account for all non-cash charges and working capital changes.

- Analyze Results: Look over the final number to understand how well the business runs and makes money.

Figuring out cash flow from operating activities right shows a company's financial health and its power to make cash through its main business. This number is crucial not just for the company's leaders but also for investors looking into the business's growth and stability future.

Understanding the Components of Cash Flow

The operating activities in a cash flow statement are crucial. They show how money moves in and out of a company. This movement tells us if the business can keep itself running. It's important to know about operating revenues, expenses, and working capital changes. These help in making good financial decisions.

Operating Revenues

Operating revenues are a key part of the cash flow. They are the main way a company gets cash. This money comes from selling products and services. Keeping an eye on these revenues helps understand if the business is doing well in sales and competition.

Operating Expenses

Operating expenses are also crucial. They are the money spent on the main business activities. This includes paying for materials, employee salaries, and everyday costs. Managing these expenses well is important. It affects the cash flow and how the business runs.

Working Capital Changes

Changes in working capital are about short-term financial health. They include shifts in receivables, inventories, and payables. Tracking these changes shows how well a company handles its cash. It's about making sure the business can pay its bills and keep running.

Looking at these three elements gives us a full view of a company’s operating cash. It's vital for those who want to check on the business's financial health and performance. With a good grasp on operating revenues, expenses, and working capital changes, financial experts can make plans. These plans help improve cash flow and support long-term growth.

Why Cash Flow from Operating Activities Matters

For any business that wants to do well and keep up in the market, it's key to understand cash flow from operating activities. It shows how well a company’s main operations are doing. Plus, it gives a clear view of the company's financial strength. Let’s see how this important number affects a business.

Indicator of Financial Health

What does operating cash flow tell you? It clearly shows if a company is financially healthy. If the cash flow from these activities is good, it means the company is making more money than it spends. This is a basic sign of financial health. It tells investors and those who lend money that the business can cover its costs, handle unexpected needs, and take on new projects. And it can do this without having to borrow more money or give away part of its ownership.

Influence on Business Decisions

The information about cash flow from operating activities matters a lot for future planning. It helps make smart choices about where to spend money, whether to create new products, enter new markets, or change how things are done. It points out where money is used well or could be used better. This lets managers control costs, change how things are priced, and use their money more effectively.

Table: Comparative Analysis of Cash Flow Metrics

| Cash Flow Component | Importance | Typical Value Range | Impact on Business |

|---|---|---|---|

| Operating Cash Flow Ratio | Indicates ability to cover liabilities | 1.0 - 1.5 | High values indicate strong financial health |

| Net Cash Flow | Shows liquidity status | Positive or Negative Values | Direct indicator of cash surplus or deficit |

| Cash Flow from Operations | Core business profitability | Data driven by earnings and expenses | Essential for strategic planning and investments |

| Cash Conversion Ratio | Speed of converting inventory to cash | Industry-specific | Efficiency in asset management |

Using this detailed financial data in everyday management and planning can really help a business. It can excel in today’s unpredictable economic climate.

Analyzing Cash Flow from Operating Activities

For any business, managing and analyzing cash flow from operations is key. This is vital for maintaining financial health and efficiency. This part talks about in-depth analysis methods. They help understand the cash flow that business activities generate.

Trends Over Time

Looking at cash flow patterns over time can reveal a lot about a company. It shows how well operations are running and what the market looks like. Stakeholders can spot both positive growth and worrying trends. This helps address issues before they impact finances deeply.

Comparison with Peers

Comparing a company’s cash flow with that of its peers sheds light on its performance. It helps see if a company is doing better or worse than others in its field. This could highlight areas for improvement.

Ratio Analysis

Ratio analysis uses many financial metrics to check how well cash flow from operations is doing. Here is a table with key ratios for understanding cash flow and a company’s operational health:

| Ratio | Description | Company A Data | Industry Average |

|---|---|---|---|

| Operations/Net Sales Ratio | Reflects the efficiency in generating cash from sales | 1.45 | 1.25 |

| Free Cash Flow (FCF) | Net operating cash flow minus capital expenditures | $19.89 billion | $15 billion |

| Free Cash Flow Coverage Ratio | Assesses how much free cash is generated relative to total operating cash | 37% | 45% |

Comparing these ratios to industry standards offers insight into a company’s operational strength. It shows how deftly it manages cash flow from operations.

Cash Flow Management Strategies

To keep a business stable and running, managing cash flow well is key. Using smart strategies helps keep enough cash on hand and cuts down on borrowed money. This lets businesses handle ups and downs better and grow. We'll look at important ways to do this. These include getting paid faster, paying bills wisely, and keeping inventory in check.

Improving Receivables Collection

Getting cash in quickly is vital. Sending out bills right away, setting clear payment rules, and rewarding early payments help a lot. Using tech to guess when customers will pay can also cut down on late payments. Plus, automating billing can make things more accurate and fast. This boosts your cash flow.

Managing Payables

Handling what you owe smartly keeps cash flowing smoothly. Timing payments well, using payment terms, and automating bill pay can save time. Also, talking with suppliers to delay payments or get discounts can help. This approach makes sure money is there when you really need it for business stuff.

Inventory Management Techniques

Too much stock ties up cash, so managing inventory right is crucial. Using Just-in-Time (JIT) systems cuts costs and keeps stock fresh. Checking how fast items sell helps match stock to what customers want, avoiding waste. Good inventory management puts more cash in your hands for key business needs.

Using these strategies is essential for a strong cash flow. Businesses that do can run smoother, face fewer money worries, and grow sustainably.

Common Pitfalls in Cash Flow Reporting

Accurate cash flow statements are key for many, from investors to managers. Yet, pitfalls often reduce their reliability and usefulness. Knowing and managing these pitfalls is vital for the full benefits of cash flow reporting.

Misclassification of Cash Flow

One big mistake in cash flow reporting is misclassifying cash flow activities. This can happen by mistake or from not understanding well. Mistakes like putting operating cash as financing or investing can change how a company looks financially. It messes with the picture of how efficient operations are and affects important financial ratios. This influences big decisions.

Ignoring Non-Cash Transactions

Non-cash transactions don't change cash flow directly but show a lot about financial health. Leaving out things like depreciation or stock-based compensation can make operational cash seem different than it is. They help explain the difference between net income and actual cash from operations. Missing them hides the real financial picture.

Overreliance on Accrual Accounting

Accrual accounting gives a full view of earnings, but focusing on it too much can risk financial assessments. A company might look profitable but have trouble keeping cash on hand. This shows how crucial it is to analyze cash flow along with accrual statements. It makes sure financial summaries are balanced and clear.

- Teach standard cash flow classification well to avoid mistakes.

- Add non-cash transactions to summaries for a better view of financial health.

- Check cash flow statements regularly to make sure they show true liquidity and efficiency.

Fixing these common cash flow reporting issues improves financial statement openness. It also builds trust in the financial data provided. Focus on right cash flow analysis helps companies make better strategic decisions.

Real-World Applications

The importance of cash flow management in keeping businesses running and growing is huge. We look at case studies to learn valuable business lessons. We learn from both successes and failures in managing cash, using real examples to gain important insights.

Case Studies of Successful Cash Flow Management

In 2017, Apple Inc.'s financial results showed excellent cash flow management. They had a net income of $48.4 billion. Their net cash from operations was $63.6 billion. This was thanks to smart adjustments and managing their working capital well.

Adjustments included $10.2 billion for depreciation and amortization. $4.8 billion was for share-based compensation, and $6 billion for deferred income tax expense. Their effective handling of accounts payable, bringing in $9.6 billion, shows the benefits of managing payables well on cash flow.

| Financial Element | Value (Billion USD) | Impact on Cash Flow |

|---|---|---|

| Net Income | 48.4 | Baseline cash generation |

| Depreciation & Amortization | 10.2 | Non-cash adjustment |

| Share-Based Compensation | 4.8 | Non-cash adjustment |

| Deferred Income Taxes | 6.0 | Non-cash adjustment |

| Accounts Payable | 9.6 | Cash inflow |

Lessons from Failed Businesses

Looking at failed businesses teaches us about common cash flow mistakes. A big issue is not fixing cash flow problems fast enough. For example, slow accounts receivable can create cash flow issues. Failing to adjust spending when cash is tight can hurt a business. Even with good sales, running out of cash can stop growth and lead to bankruptcy.

To wrap up, studying real examples like Apple offers powerful lessons in cash flow management. These case studies show what to do and what not to do. They help businesses aim for stronger, more flexible finances. This know-how is key to better financial planning for business pros.

Conclusion: Mastering Cash Flow from Operating Activities

Understanding cash flow is key to building a strong financial plan. It's all about getting how cash moves in and out of a business. This includes looking at the Statement of Cash Flows.

This statement has three parts: Operating, Investing, and Financing Activities. Knowing these parts helps experts check if a company is doing well. It's especially important to see the money made from daily business.

Summary of Key Points

Good cash management tracks money coming in and going out. It looks at customer payments and money spent on supplies and salaries. Not all spending is bad, though.

Investing might mean a company is planning to grow. However, we must be careful with Financing Activities to avoid too much debt. The way to prepare cash flow statements shows if a company can adapt financially. It mixes profit details with changes in what the company owns and owes.

Final Thoughts on Financial Strategy

Mastering cash flow is about planning and acting smart. It involves a CFO using their know-how to guide a firm’s financial plans. They have to keep an eye on both assets and cash movements.

This approach helps businesses understand their money better. It gives them the insights needed to make smart choices. This way, they stay financially strong and agile over time.

FAQ

What is the significance of cash flow from operating activities?

Cash flow from operating activities shows the cash in and out from the main work of a business. It's important for knowing if a business can make cash through its basic tasks. This helps us see its financial health.

How do you calculate net cash flow from operating activities?

You can find net cash flow from operations in two ways. The direct method adds cash transactions. The indirect method changes net income based on non-cash items and working capital. Both are okay by accounting standards.

What is the difference between cash flow from operating activities and net income?

Cash flow from operations looks at cash flow from main business tasks. Net income counts all earnings and costs, including non-cash items. Cash flow shows the real cash a company has, which matters for its liquidity.

What adjustments to net income are included when calculating operating cash flows?

To find operating cash flows, adjust net income. Add back non-cash costs like depreciation. Change it for working capital, deferred taxes, and more. These don't affect cash but do change net income.

Can you provide a cash flow from operating activities example?

Sure, to get the operating cash flow, start with net income. Add non-cash costs like depreciation. Adjust for changes in accounts like receivables, inventory, and payables. Then, you get the net cash from operations.

What does operating cash flow tell you about a business?

Operating cash flow tells if a business can make enough cash to grow. It shows if a company is financially healthy and efficient. It also indicates if a company can pay debts, reinvest, and give returns.

How can analyzing cash flow from operations help a business?

Looking at operating cash flow helps businesses see trends and check their efficiency. It's key for planning and makes comparing with others in the industry easier. It also highlights strong and weak spots in operations.

What cash flow management strategies are important for maintaining a healthy CFO?

Good cash flow management means collecting payments fast, paying smart, and keeping inventory in check. These steps help increase cash coming in and manage cash going out. This keeps the business stable without needing loans.

What are some common pitfalls in cash flow reporting?

The main mistakes in cash flow reports are putting items in the wrong categories and ignoring non-cash transactions. Also, focusing too much on bookkeeping numbers without looking at real cash flow can mislead companies about their cash status.

Why are case studies important for understanding cash flow management?

Case studies give real examples of good or bad cash management. They teach businesses how to handle their finances well using lessons from other companies' experiences.

What are the critical elements for mastering cash flow from operating activities?

Mastering cash flow means knowing how to measure, track, and use that info to make operations better. Doing these well improves financial choices and operational success.

How do financial strategy insights contribute to an organization's success?

Financial insights help guide a company in using resources well, picking good investments, and managing risks. They help build a business that lasts and meets its long-term goals.