How to Calculate Price Per Share: Your Essential Guide

Figuring out the price per share is key to understanding a company's stock value. Knowing the price per share formula helps investors make smart choices. The market price per share (MPS) changes often, influenced by what investors think and market conditions.

By using the market value formula, investors can see if a stock is too expensive or not. This helps them decide whether to buy, sell, or hold onto a stock.

The price-to-earnings (P/E) ratio shows how a company's share price compares to its earnings per share (EPS). To find the price per share, investors divide the market capitalization by the total shares outstanding. This gives a clear view of a company's market value, helping investors make better choices.

Key Takeaways

- Understanding the price per share formula is essential for making informed investment decisions

- The market price per share (MPS) is a dynamic metric that fluctuates based on investor sentiment and market conditions

- The price-to-earnings (P/E) ratio measures a company's share price relative to its earnings per share (EPS)

- Calculating the price per share involves dividing the market capitalization by the total outstanding shares

- Knowing how to calculate price per share is vital for determining whether a stock is overvalued or undervalued

- The market value formula provides a snapshot of a company's current market value

Understanding the Concept of Price Per Share

To figure out a company's worth, investors must understand the price per share. This metric shows the company's current market value. Knowing how to find and work out market value is key for smart investment choices.

The Price Earnings Ratio (P/E Ratio) links a company's stock price to its earnings per share (EPS). It shows if the stock is overvalued or undervalued. To find the P/E Ratio, you divide the stock price by the EPS.

Definition and Importance

The price per share is a key part of a company's market capitalization. It's found by multiplying the total shares by the current market price. Knowing how to find and work out market value is essential for evaluating a company's financial health.

How It Relates to Investment Decisions

Investors use metrics like the P/E Ratio to judge a company's stock. By understanding market value, they can compare prices and decide when to buy or sell. This knowledge also helps spot good investment chances and avoid bad ones.

Key Factors Influencing Price Per Share

To find the price per share, it's key to know what affects it. Earnings per share (EPS) shows how profitable a company is. The price-to-earnings (P/E) ratio, which is EPS divided by the stock price, helps investors see if a stock is worth it. A high P/E ratio might mean the stock is too expensive, while a low one could mean it's a good deal.

Investors should also think about dividends and their effect on share price. Companies that pay steady dividends attract investors looking for income, which can raise the share price. Market conditions, like the economy and how well an industry is doing, also affect the price per share. By looking at these factors, investors can better understand the market value and make smart choices.

Earnings Per Share (EPS)

EPS is a key metric for investors. It shows how well a company is doing financially. To find EPS, you can use the formula: EPS = (net income - preferred dividends) / total shares. This helps investors see if a company can make money.

Dividends and Their Impact

Dividends have a big impact on a company's share price. When a company pays dividends, it attracts investors looking for income, which can increase the share price. On the other hand, cutting dividends can lower the share price. Investors should look at a company's dividend policy when figuring out its market value.

Market Conditions

Market conditions, like the economy and industry performance, greatly affect a company's share price. Investors should consider these when figuring out market value. By analyzing these conditions, investors can better understand how to find the price per share and make informed decisions.

| Factor | Description |

|---|---|

| Earnings Per Share (EPS) | A company's profitability, calculated by dividing net income by total outstanding shares |

| Dividends | Payments made to shareholders, which can impact share price |

| Market Conditions | Economic trends and industry performance, which can influence share price |

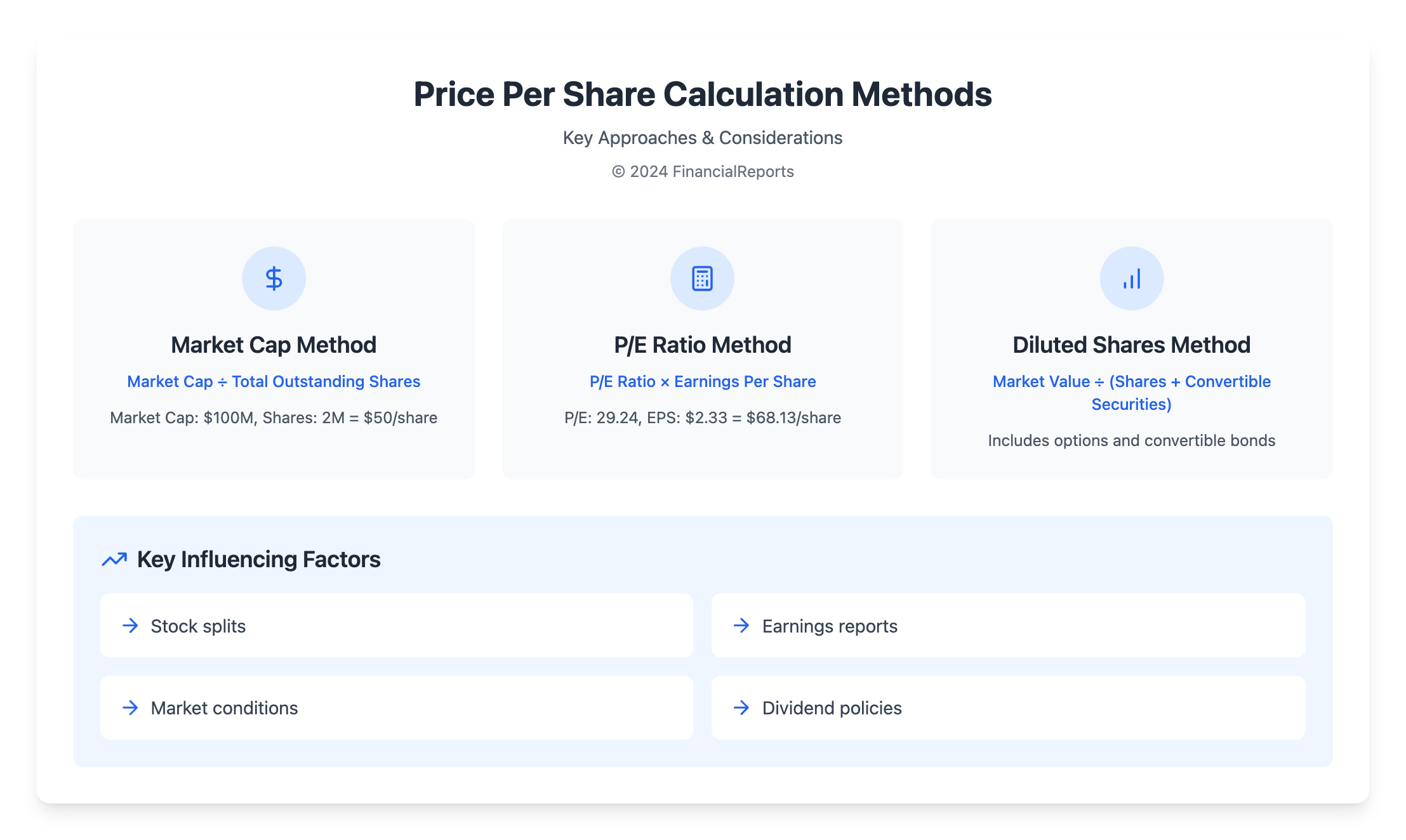

Different Methods to Calculate Price Per Share

Investors have several ways to find the market price per share. They can use the market capitalization method or the fully diluted shares method. The first method divides the market capitalization by the total shares outstanding. This gives a clear view of the price per share based on the company's value.

The fully diluted shares method looks at all shares, including options and convertible securities. It gives a detailed view of the company's shares. This helps investors get a more accurate price per share.

Looking at historical data is another good way to estimate the price per share. By studying the company's past and market trends, investors can guess the future price. They use the price to earnings (P/E) ratio for this, which is earnings per share divided by market value per share.

| Method | Description |

|---|---|

| Market Capitalization Approach | Divide market capitalization by total outstanding shares |

| Fully Diluted Shares Method | Take into account total outstanding shares, including convertible securities and options |

| Historical Data Analysis | Analyze past financial performance and market trends to estimate future price per share |

Knowing these methods helps investors make better choices. They can use the market price per share formula and figure out the market value per share more accurately.

The Formula for Price Per Share Calculation

To figure out the price per share, you need to know the market value equation. This equation helps you calculate the market value of equity. The price of a share changes all day because of how much people want to buy and sell it.

The formula for the price per share includes earnings per share, dividends, and market capitalization. To compute the market value of equity, you must look at the company's total equity and the number of shares out there. The market value equation helps find a company's market capitalization.

Here are the basic steps to calculate the price per share:

- Determine the company's earnings per share (EPS)

- Calculate the market capitalization by multiplying the share price by the total number of outstanding shares

- Use the market value equation to compute the market value of equity

By following these steps and understanding the variables involved, investors can calculate the stock price per share. This helps them make better investment choices.

| Company | Market Capitalization | Price per Share |

|---|---|---|

| Example Company | $100 million | $50 |

Common Mistakes to Avoid When Calculating

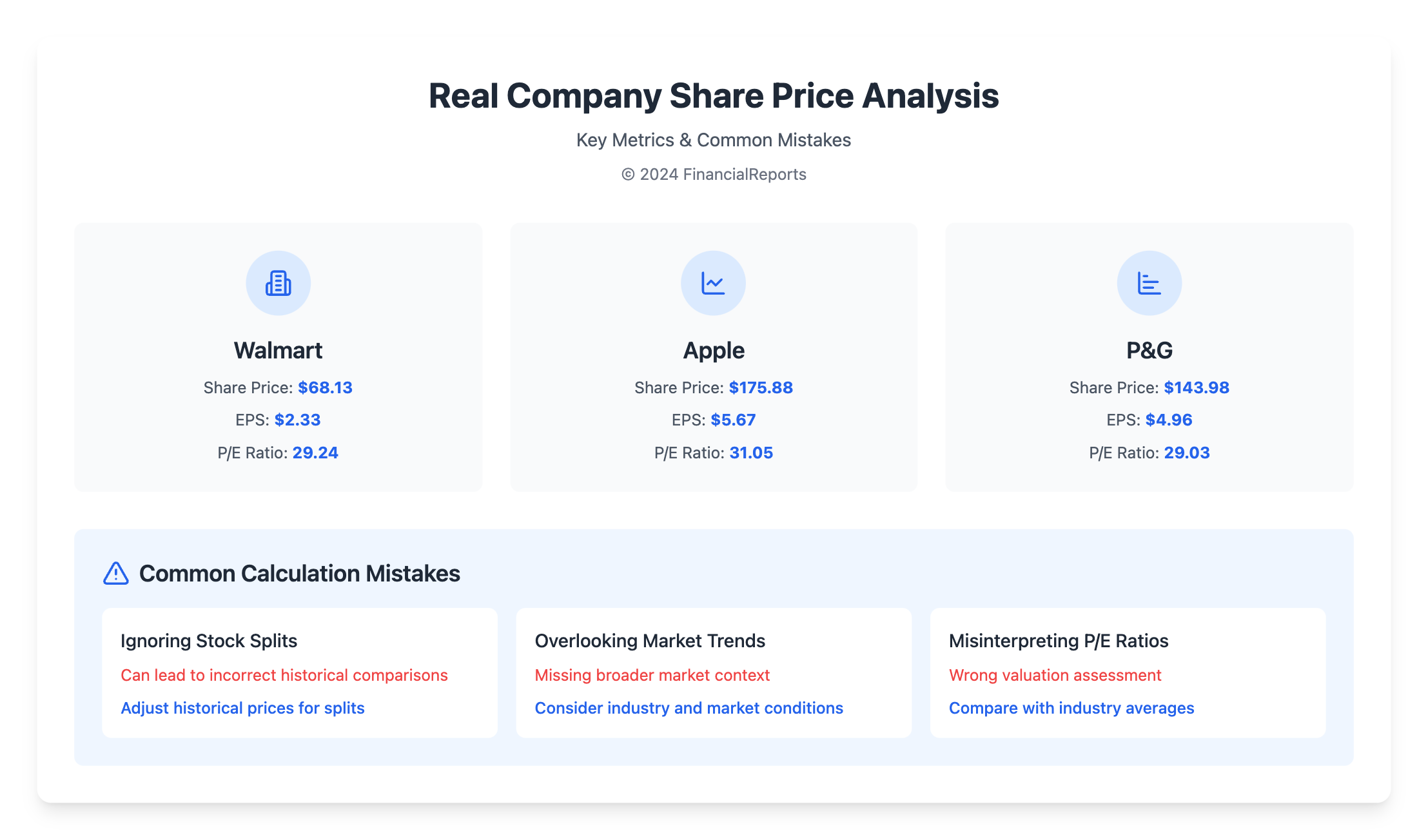

When you're figuring out the market price formula, it's key to steer clear of common errors. One big mistake is forgetting about stock splits. These can change the share price a lot, even if the company's value stays the same. To get the market value of equity right, you need to look at the company's financials and compare them to others in the industry.

Another mistake is not paying attention to market trends. This can lead to wrong ideas about a company's future growth. To figure out the market value, you should check the company's earnings per share (EPS), price-to-earnings (P/E) ratio, and other important numbers. Here's why these are so important:

| Metric | Description |

|---|---|

| EPS | Earnings per share, calculated by dividing net income by outstanding common shares |

| P/E Ratio | Price-to-earnings ratio, used to evaluate the value of a stock in terms of market willingness to pay for earnings |

| Market Trends | Broader market conditions, including industry benchmarks and competitor activity |

By avoiding these common mistakes and using the right market price formula, investors can make better choices. Remember, finding the market value is a detailed task. It involves looking at many factors, like the company's financials and how to compute market value.

Real-Life Examples of Price Per Share Calculations

To grasp how to find market price per share, let's look at real examples from tech and consumer goods. The total equity market value is key in setting the price per share. For example, Walmart's stock price was $68.13 in February 2024. With diluted earnings per share (TTM) of $2.33, its P/E ratio was 29.24. This shows how to calculate the market value of total equity and find the market price.

When figuring out the price per share, growth rates, market position, and trends are important. Here are some key points:

- Estimating future cash flows and profits to find a company's present value

- Using the Gordon growth model equation for stock valuation: \( P = \frac{D_1}{r - g} \)

- Understanding how dividends, debt, and liquidity affect share price

In the tech world, Apple and Microsoft have seen big growth, leading to higher share prices. On the other hand, consumer goods like Procter & Gamble have steady growth, with lower share prices. By studying these examples, investors can learn to find market prices and make better choices.

| Company | Stock Price | Earnings Per Share (TTM) | P/E Ratio |

|---|---|---|---|

| Walmart | $68.13 | $2.33 | 29.24 |

| Apple | $175.88 | $5.67 | 31.05 |

| Procter & Gamble | $143.98 | $4.96 | 29.03 |

By looking at these examples and understanding what affects market prices, investors can better calculate and analyze prices. This helps them make more informed investment choices.

Tools and Resources for Calculation

Investors have many tools to find the price per share. Online calculators and financial software are great for this. They help investors calculate the price per share formula and grasp the price per share equation. With these tools, investors can compute the market price per share and make smart choices.

Online calculators from financial sites and investment platforms are popular. They let investors use different methods, like market capitalization or fully diluted shares. This helps in figuring out the price per share.

Financial software also helps in calculating the price per share. It offers advanced features like analyzing past data and predicting future trends. This makes it easier to understand the market.

| Tool/Resource | Description |

|---|---|

| Online Calculators | Calculate price per share using different methods |

| Financial Software Options | Provide advanced features and functionality for calculating price per share |

Using these tools, investors can better understand the price per share equation. It's key to calculate the price per share formula right and use reliable data. This ensures accurate market price per share calculations.

How Price Per Share Affects Investors

Understanding how to calculate market price per share is key for smart investing. The formula helps investors see a stock's true value. This can guide their buy and sell choices. Investors can find the price per share through different methods, like the market capitalization approach.

The price per share greatly affects how investors manage their portfolios. A high price per share might mean a stock is overvalued. On the other hand, a low price might mean it's undervalued. The price-earnings ratio (P/E) helps figure out if a stock is over or undervalued. A higher P/E ratio means a stock's price is higher compared to its earnings.

Buy and Sell Decisions

Investors can use the market value per share formula to make smart buy and sell choices. For example, if the calculated price is higher than the current price, the stock might be a good buy. If the calculated price is lower, it might be time to sell.

Portfolio Management

Knowing how to calculate market price per share is vital for managing a portfolio well. The formula helps investors decide how to spread their investments. It also guides them on which stocks to buy or sell. Plus, it helps them keep an eye on their portfolio's performance and make adjustments when needed.

Several things can affect a stock's price per share, including:

- Buying and selling activities

- Stock splits

- Strong earnings reports

- Healthy financials

- Industry news and economic reports

By considering these factors and using the market value per share formula, investors can make better choices. This helps them improve their investment strategies.

Future Trends in Price Per Share Analysis

Financial markets are changing fast, and so is the way we analyze price per share.New tech like artificial intelligence and big data is changing how we look at share prices. Now, advanced algorithms can spot patterns and trends that were hard to see before.

Global market changes are also affecting how we value shares. Economic shifts, new investment options, and changing investor behaviors are all playing a role. Investors might use themarket value per share equationand thehow to get market price per shareto understand a company's true worth better.

As the financial world keeps evolving, being able to accurately value shares will be key for smart investing. By keeping up with these trends and using the latest tools, investors can better navigate the markets. This helps them reach their financial goals over time.

FAQ

What is the definition of price per share?

Price per share is the value of a company's stock divided by the number of shares. It shows the current price of one share of the company's stock.

Why is the price per share calculation important for investors?

It's key for investors to know the price per share. It helps them see if a stock is cheap or expensive. This info helps them make smart choices about buying or selling.

What are the key factors that influence a company's price per share?

Several things affect a company's price per share. These include earnings, dividends, and the overall market. These factors change how people see the company's value.

What are the different methods for calculating price per share?

There are a few ways to figure out price per share. These include market capitalization, fully diluted shares, and historical data. Each method has its own benefits and is chosen based on what the investor needs.

What is the formula for calculating price per share?

To find the price per share, use this formula: Price per Share = Market Capitalization / Total Outstanding Shares. This formula uses the company's market value and the number of shares available.

What are some common mistakes to avoid when calculating price per share?

Don't forget about stock splits and market trends when calculating price per share. These factors are important for getting an accurate calculation.

How can price per share calculations be applied in real-world scenarios?

Price per share calculations are useful in many situations. They help when evaluating tech companies or consumer goods. By comparing prices, investors can spot good investment chances.

What tools and resources are available for calculating price per share?

There are many tools for calculating price per share. Online calculators and financial software are available. They provide current data and help with financial planning.

How do price per share calculations impact investment decisions?

Calculating price per share is vital for making investment choices. It helps investors decide if a stock is a good buy. This info guides their decisions and helps manage their portfolios.

What are the emerging trends and future developments in price per share analysis?

New trends in price per share analysis include using artificial intelligence and big data. Changes in the market and investor behavior may also lead to new methods for valuing stocks.