Calculating Average Revenue: A Step-by-Step Guide

To find average revenue, you need to know what it is and why it matters. It shows how much money each sale or customer brings in. This helps businesses make better choices and improve their performance.

Learning to calculate average revenue is key. It lets businesses see how well they're doing in sales. By following a few steps, you can understand this important metric better.

Key Takeaways

- Average revenue is the mean amount of money generated per unit sold or per customer over a specific period.

- Learning how to find average revenue is important for making smart decisions and improving business.

- The formula for average revenue is Total Revenue / Total Units Sold or Total Revenue / Total Number of Customers.

- Understanding average revenue is vital for pricing, feature development, and marketing strategies.

- Companies can use average revenue to predict earnings and make decisions to increase revenue.

- Excluding inactive customers gives a clearer view of earnings, helping businesses make better choices.

- Calculating average revenue per unit/user helps financial advisors see sales performance and have a key number.

Understanding Average Revenue and Its Importance

Average revenue is key in business analysis. It shows how well marketing campaigns work and helps set revenue goals. The formula AR = TR/Q is important. It shows revenue per unit at a certain time.

This formula helps companies plan their pricing and promotions. It lets them estimate revenue at different sales levels. This is important for making smart business choices.

The average revenue formula is essential for businesses. It helps them figure out the best prices for their products. If average revenue goes down, they can change their pricing or promotions.

By comparing average revenue with costs, businesses can see if they're making a profit. This helps them make decisions to increase profits. The way average revenue changes depends on the market type. In perfect competition, it equals the product price. In monopoly, it goes down as more units are sold.

Key aspects of average revenue include:

- Assessing revenue generation efficiency in small businesses

- Evaluating overall performance in revenue per unit for pricing strategy assessment in large firms

- Guiding strategic decisions on pricing, output, and market entry

Key Formulas for Average Revenue Calculation

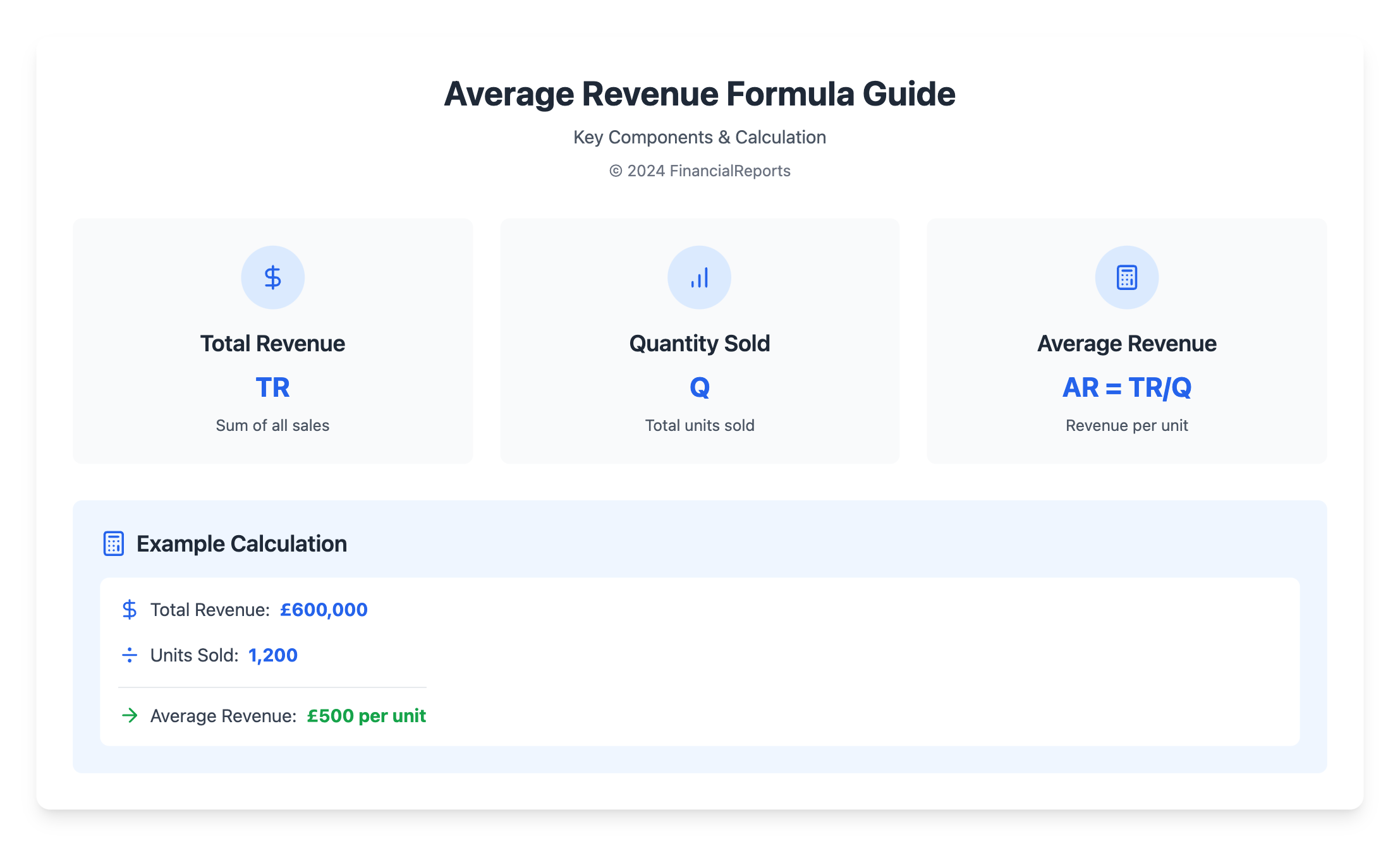

The average revenue equation is key in business analysis. It helps predict total revenue at certain sales levels. The formula is AR = TR / Q, where AR is average revenue, TR is total revenue, and Q is quantity sold.

For example, if a company sells 200 units for $10,000, the average revenue is $50 per unit. This shows how important the formula is for businesses.

The average revenue equation also helps understand how price changes affect sales. It's vital for finding the best prices to make more profit. Key points to remember include:

- Understanding the relationship between average revenue and quantity sold

- Using average revenue to determine pricing strategy adjustments

- Comparing average revenue to average costs to maximize profits

By using the average revenue equation, businesses can make smart choices on pricing and entering markets. This can lead to more revenue and profit. The average revenue per unit/user (ARPU) is also important. It's calculated by dividing total revenue by the number of units sold, users, or subscribers over a period.

| Formula | Description |

|---|---|

| AR = TR/Q | Average Revenue = Total Revenue / Quantity Sold |

| ARPU = TR/Number of Users | Average Revenue per User = Total Revenue / Number of Users |

Gathering Revenue Data for Analysis

To find the average revenue, you need to get accurate data. This means collecting information from financial statements, sales reports, and CRM systems. It's key to understand the value of data that is correct, consistent, and complete.

Getting revenue data right takes planning and effort. You must know where to find the data, pull out the right info, and put it all together. By doing this well, businesses can make sure their data is good to go.

Some important metrics to look at when collecting revenue data include:

- Customer acquisition costs

- Annual recurring revenue

- Win rate

- Average deal size

- Number of closed deals

These metrics give insights into how revenue is made. They help businesses plan for more growth.

Knowing how to find average revenue and getting the right data helps businesses make smart choices. This can lead to more money, better profits, and growth.

| Metric | Description |

|---|---|

| Revenue Per Customer (RPC) | Calculated by dividing total revenue by the number of customers |

| Average Revenue Per Unit (ARPU) | Calculated by dividing total revenue by the average number of subscribers |

Steps to Calculate Average Revenue

To find the average revenue, follow a few steps. First, decide on the time frame you want to look at. This could be a month, quarter, or year. Then, collect the total revenue data for that time. You can find this in your financial statements or accounting records.

The average revenue formula is simple yet effective. It divides the total revenue by the total output. For instance, if a company makes £600,000 by selling 1,200 units, the average revenue is £500 per unit. The formula is AR = TR / Q, where AR is the average revenue, TR is the total revenue, and Q is the total units sold.

Step 1: Determine the Period

Choosing the right period is key to calculating average revenue. Pick a time frame that makes sense for your business. This could be a month, quarter, or year. The time frame you choose will impact the total revenue and output, affecting the average revenue.

Step 2: Gather Total Revenue

The next step is to get the total revenue data. You can find this in your financial statements or accounting records. Make sure the data is correct and complete for an accurate average revenue calculation.

Step 3: Calculate Average Revenue

With the total revenue and output in hand, you can now calculate the average revenue. Use the formula AR = TR / Q, where AR is the average revenue, TR is the total revenue, and Q is the total units sold. For example, if a company makes £600,000 by selling 1,200 units, the average revenue is £500 per unit.

| Formula | Example |

|---|---|

| AR = TR / Q | £500 = £600,000 / 1,200 |

Variations of Average Revenue Analysis

When dealing with multiple products or services, a weighted average revenue calculation is more accurate. This is key for businesses with various products or services at different prices. The average revenue equation helps calculate the weighted average revenue, considering each product's revenue and units sold.

The average revenue per unit sold is a critical metric. It guides pricing and production decisions. By analyzing this, businesses can spot areas for improvement. They can then adjust their pricing and production to boost revenue.

Average Revenue per Unit Sold

This metric is found by dividing total revenue by total units sold. For example, if a company makes $10 million and sells 100,000 units, the average revenue per unit is $100. This helps compare different products or services and make better decisions.

Average Revenue by Product Line

Another way to analyze average revenue is by product line. This means dividing each product line's total revenue by its units sold. By doing this, businesses can see which product lines are most profitable. They can then adjust their pricing and production to focus on these areas.

Common Mistakes in Average Revenue Calculation

Working with average revenue in marketing can lead to mistakes. To find average revenue, you need to know the total revenue and the number of customers or units sold. But, errors like ignoring distribution, neglecting costs, and over-relying on averages can happen.

Another mistake is failing to segment data or using inconsistent time periods. These errors can skew your results. It's important to understand how to find average revenue to avoid these mistakes.

| Mistake | Description |

|---|---|

| Ignoring Distribution | Failing to consider the distribution of revenue among customers or products |

| Neglecting Costs | Overlooking the costs associated with generating revenue |

| Over-relying on Averages | Relying too heavily on average revenue figures without considering other metrics |

Knowing these common mistakes helps businesses avoid errors in average revenue. It's key for financial professionals and investors to understand how to find average revenue. This knowledge is vital for making smart financial decisions.

Tools and Software for Calculating Average Revenue

Understanding a company's financial health is key, and calculating average revenue is a big part of that. Many tools and software make this easier. You can use the average revenue formula in apps like Excel or Google Sheets. These apps have formulas and functions to help with the math.

For deeper analysis, tools like Tableau, Power BI, or Looker are great. They offer data visualization and help create dashboards to track important metrics, like average revenue. CRM systems, like Salesforce or HubSpot, also help manage customer interactions and analyze revenue.

Some top tools for figuring out average revenue are:

- Spreadsheet software (e.g., Excel, Google Sheets)

- Business intelligence platforms (e.g., Tableau, Power BI, Looker)

- CRM systems (e.g., Salesforce, HubSpot)

- Marketing analytics tools (e.g., Google Analytics, Mixpanel)

Using these tools, businesses can quickly and accurately calculate their average revenue. This helps them make smart choices to grow and stay profitable. The average revenue formula is a basic but important part of this process.

| Tool | Description |

|---|---|

| Excel | A spreadsheet software for calculating average revenue using formulas and functions |

| Tableau | A business intelligence platform for data visualization and custom dashboard creation |

| Salesforce | A CRM system for managing customer interactions and analyzing revenue streams |

Case Studies: Average Revenue in Action

Calculating the average revenue equation is key for businesses to make smart marketing choices. Let's look at some real-life examples where this calculation is used:

- Evaluating the impact of a new marketing campaign

- Comparing performance across different market segments

- Assessing the impact of a new pricing strategy

A study by McKinsey showed that personalization can cut customer churn by 10-15%. It also boosts customer lifetime value by 10-30%. This shows how vital the average revenue equation is for improving business strategies.

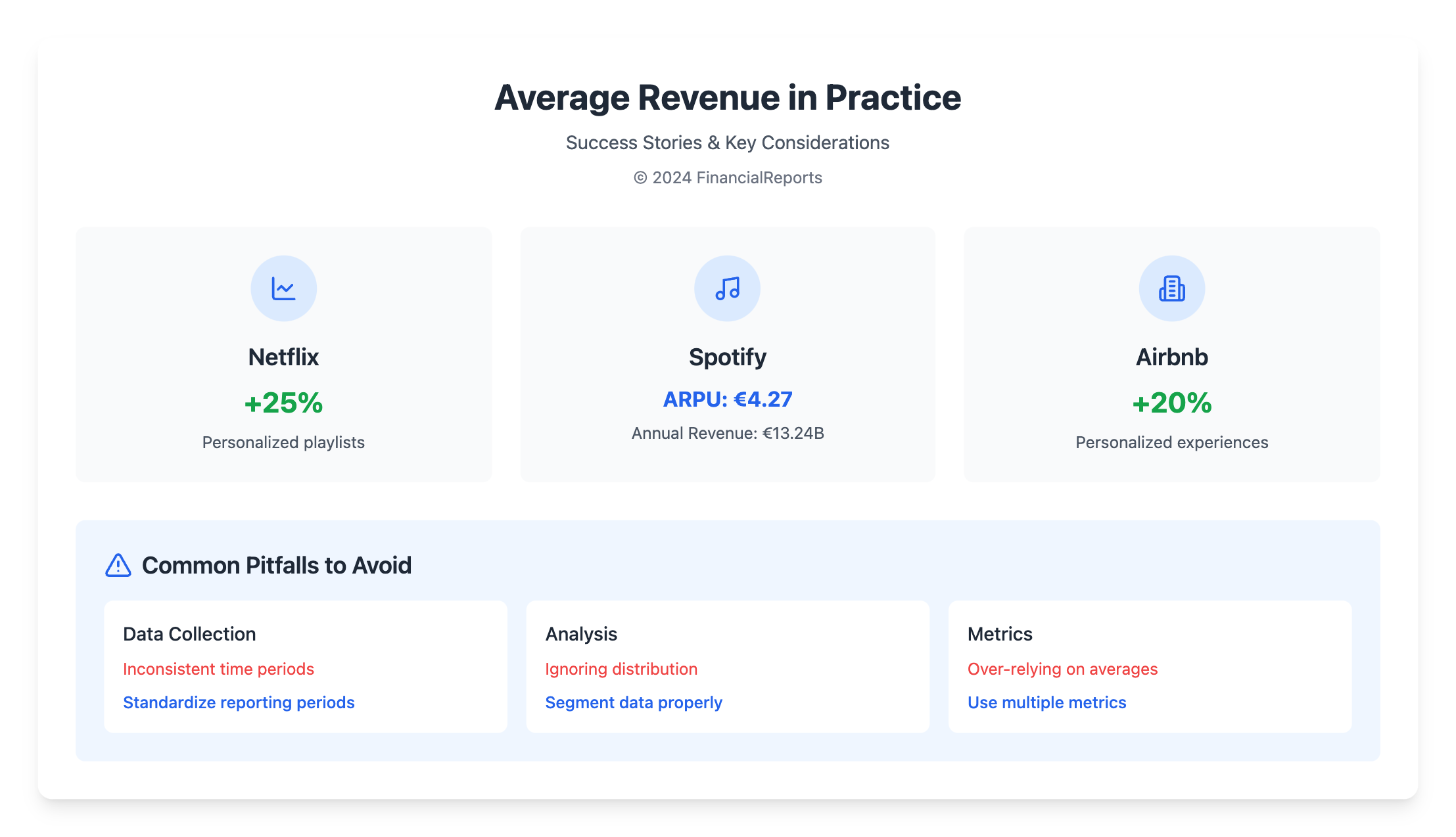

Companies like Netflix, Airbnb, and Sephora have boosted their average revenue per user (ARPU) by tailoring experiences. For example, Netflix saw a 25% ARPU increase with personalized playlists and podcasts.

| Company | ARPU Increase | Strategy |

|---|---|---|

| Netflix | 25% | Personalized playlists and podcasts |

| Airbnb | 20% | Personalized travel experiences |

| Sephora | 15% | Personalized beauty advice and products |

By using the average revenue equation, businesses can spot areas for growth. They can then tweak their strategies to boost revenue and keep customers engaged.

How to Use Average Revenue for Business Strategy

Knowing how to find average revenue is key for businesses. It helps them focus on the right customers, spend wisely on marketing, and sell more. For example, Spotify, with an ARPU of €4.27 in 2023, can tweak its prices to keep more customers.

To make the most of average revenue, businesses should:

- Refine target audience: Use average revenue data to find valuable customers and target them better.

- Optimize marketing spend: Spend wisely by knowing which marketing channels work best.

- Develop upselling strategies: Find chances to boost revenue per user with special offers.

Using average revenue data wisely can lead to growth and new ideas. By looking at past trends and what others do, businesses can see if they're doing well. A high average revenue means they're making good money from their customers, helping the business grow.

| Company | ARPU | Annual Revenue |

|---|---|---|

| Spotify | €4.27 | €13.24 billion |

Conclusion: Mastering Average Revenue Calculations

As we wrap up this guide, it's clear that knowing how to calculate average revenue is key. This skill is vital for financial experts and business leaders. The average revenue formula helps you understand your company's performance and growth.

Recap of Key Points

In this article, we covered the basics of average revenue analysis. We talked about the importance of collecting revenue data and how to calculate it. We also looked at how to use this metric to improve your business.

By learning these concepts, you can use average revenue to set prices, predict growth, and make smart decisions. This knowledge can help your business grow.

Next Steps for Further Learning

If you want to learn more, check out topics like revenue segmentation and customer lifetime value. Also, keep up with industry trends and best practices. This will help you improve your average revenue calculations and make better business decisions.

FAQ

What is the definition of average revenue?

Average revenue is the total money made by a business divided by the number of items sold or customers served. It shows how well a business is doing financially and helps with pricing.

Why is average revenue important in business analysis?

It's key for understanding a business's pricing and financial health. It helps in making smart decisions about pricing, product mix, and forecasting.

What is the basic formula for calculating average revenue?

To find average revenue, you divide the total money made by the number of items sold or customers. This simple formula shows the average revenue per item or customer.

What are some alternative methods for calculating average revenue?

There are other ways to calculate average revenue, like weighted average revenue and cohort analysis. These methods give deeper insights, useful for complex revenue streams or diverse products.

Where can I find reliable revenue data for average revenue calculations?

You can find revenue data in financial statements, sales reports, and CRM systems. It's important to make sure the data is accurate and complete for reliable calculations.

What are the key steps in calculating average revenue?

To calculate average revenue, first pick a time period. Then, gather total revenue data. Lastly, divide the total revenue by the number of items sold or customers.

How can I analyze average revenue by product line or customer segment?

By analyzing average revenue for different products or customer groups, you can see how they perform. This helps in making better decisions about pricing, resource allocation, and product development.

What are some common mistakes to avoid when calculating average revenue?

Avoid misinterpreting revenue sources and not adjusting for seasonal changes. It's important to understand the data well and account for any factors that might affect the metrics over time.

What tools and software are available for calculating and analyzing average revenue?

Many tools and software help with calculating and analyzing average revenue. They range from simple spreadsheets to advanced accounting software. These tools make the process easier and provide insights for better decision-making.

How can average revenue analysis inform business strategy and decision-making?

Analyzing average revenue can greatly influence business strategy and decision-making. It helps in optimizing pricing, improving forecasting, and making informed decisions about resources, product development, and marketing.