Calculate Your Gain Percentage Accurately

To find gain percentage, investors need to know the formula. It's (Price sold - Purchase price) / Purchase price x 100. This formula is key to seeing how an investment is doing and its risk level. It helps investors check how well their investments are doing and make smart choices.

Getting the gain percentage right is vital for investors and financial experts. It shows how much an investment's value has changed. To find the gain percentage, subtract the selling price from the purchase price. Then, divide by the purchase price and multiply by 100. This gives you the gain percentage, which is important for checking how well an investment is doing and comparing different ones.

Key Takeaways

- Understanding the gain percentage formula is essential for investors to evaluate investment performance.

- The gain percentage formula is (Price sold - Purchase price) / Purchase price x 100.

- Accurate calculations are vital for investors and financial experts to make informed decisions.

- The gain percentage helps investors see how much their investment's value has changed.

- Investors can use the gain percentage to compare different investments and evaluate their performance.

- To find gain percentage, investors must consider all the factors that affect the investment's value, including transaction costs and dividend income.

- The gain percentage formula is a valuable tool for investors to assess their investment's progress and risk.

What is Gain Percentage?

Gain percentage is key for checking how well investments do over time. It shows how much an investment has grown or shrunk. To find it, use this formula: ((Difference in Value / Original Investment Cost) x 100).

For example, if an investment worth $50,000 now is $60,000, it's up 20%. But if it drops to $40,000, it's down 20%. Looking at past gains or losses helps investors plan better for the future.

Some important things to remember when figuring out gain percentage include:

- Knowing the formula and how to use it for different investments

- Keeping an eye on investments to make changes when needed

- Looking at gains or losses in different types of investments, like stocks, bonds, and real estate

By understanding gain percentage, investors can make smarter choices. This helps them improve their investment plans and reach their financial goals.

How to Calculate Gain Percentage

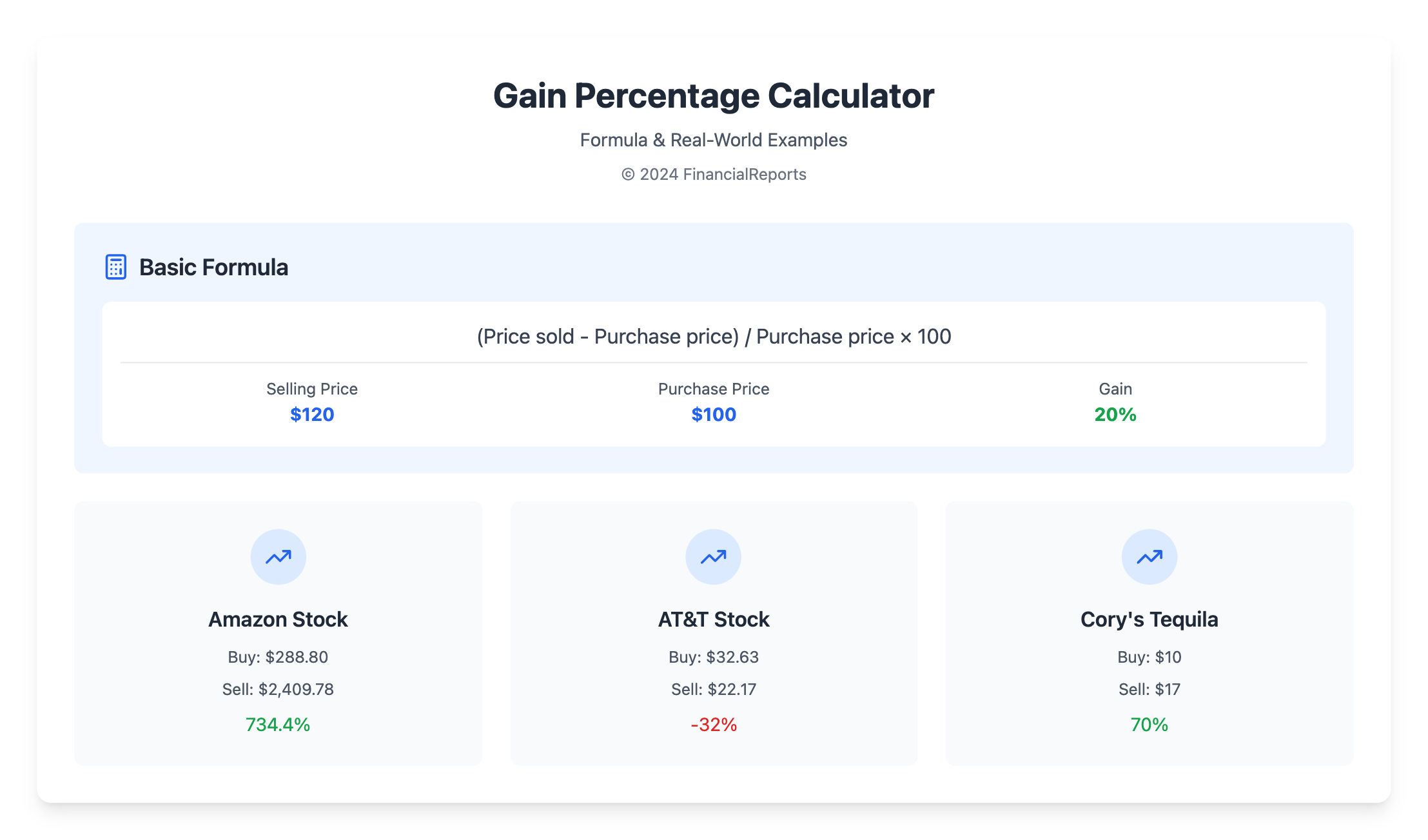

To find gain percentage, you need to know the formula. The basic formula is: [(Selling Price - Purchase Price) / Purchase Price] x 100. This formula shows the gain or loss on an investment. It helps you understand your investment's performance.

The Basic Formula Explained

The formula has two parts: the selling price and the purchase price. The selling price is when you sell, and the purchase price is when you buy. Subtracting the purchase price from the selling price gives you the gain or loss.

Then, divide this by the purchase price and multiply by 100. This gives you the gain percentage.

Examples of Calculating Gain Percentage

For example, let's say you buy a stock for $100 and sell it for $120. The gain percentage is: [(120 - 100) / 100] x 100 = 20%. You made a 20% gain.

Using this formula, you can calculate gain percentage for different investments. This includes real estate or index funds. It helps you compare their performance over time.

Knowing how to calculate gain percentage helps you make better investment choices. The gain percentage formula is a key tool for investors. It helps you find gain percentage and improve your investment strategy.

Different Scenarios for Finding Gain Percentage

Gain percentage is used in many financial areas, like stock investments, real estate, and pricing in retail. To calculate gain percentage, it's important to know how it's applied in different situations. For example, in investments, it helps measure how well stocks, bonds, and mutual funds are doing.

In retail, gain percentage is key for setting prices and profits. It helps businesses price their products right and make more money. Knowing how to find gain percentage helps retailers decide on prices and manage their stock better.

| Scenario | Gain Percentage Calculation |

|---|---|

| Investment Returns | (Selling Price - Cost Price) / Cost Price * 100 |

| Retail Markup | (Selling Price - Cost Price) / Cost Price * 100 |

Using gain percentage in different ways helps businesses and investors make better choices. Whether it's for investment returns or setting retail prices, knowing how to apply it is vital. It's all about achieving financial success in the world of finance.

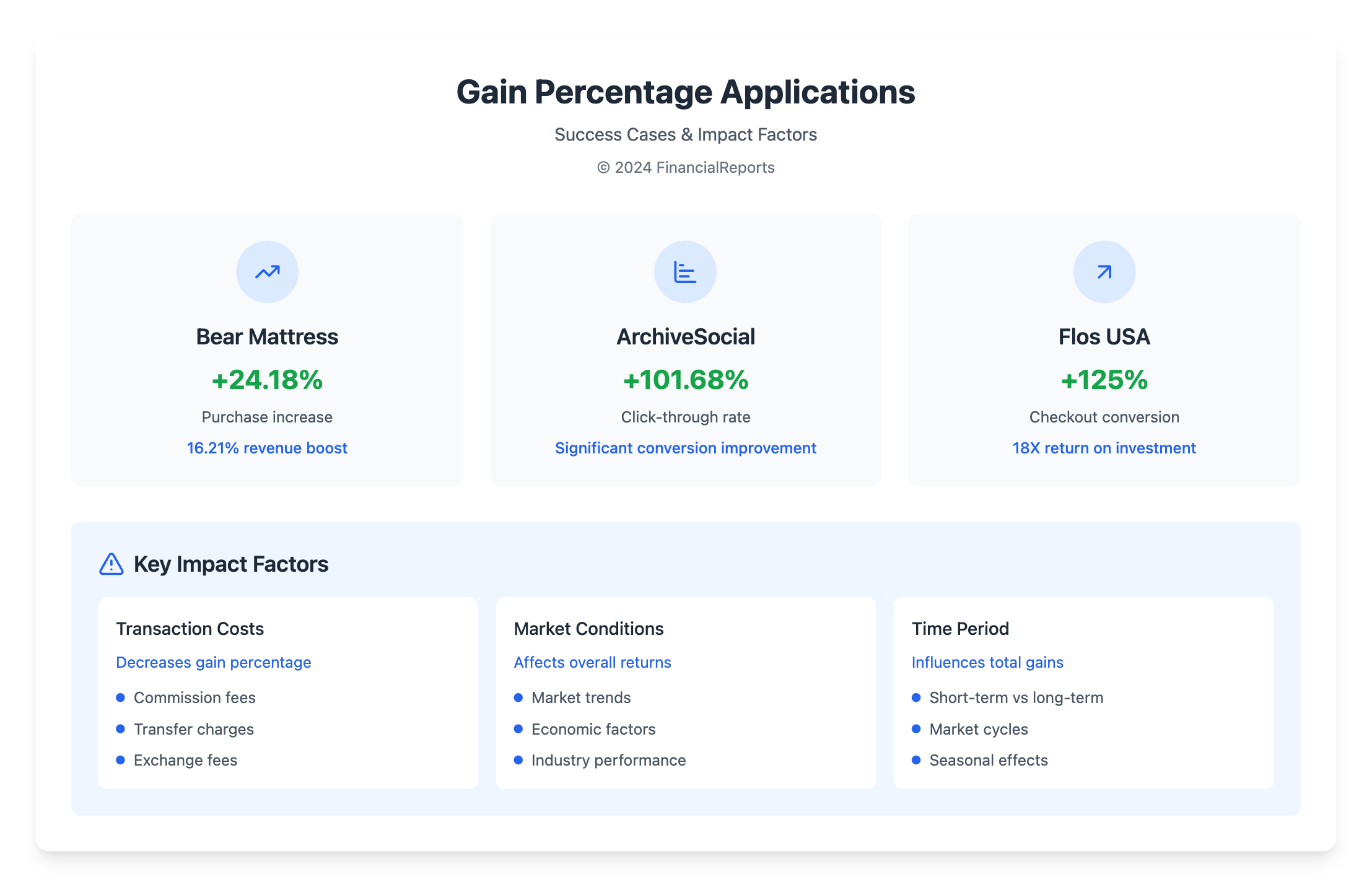

Factors Affecting Gain Percentage

Calculating gain percentage involves looking at several key factors. The formula is important, but it's not everything. Transaction costs, dividends, and market conditions also play a big role.

For example, buying 1,000 shares at 30 USD each and selling them at 31 USD gives a 3.3% gain. But, if a 2.5 USD commission fee is added, the gain drops. If the investor also gets 0.44 USD in dividends per share, the gain goes up.

Cost Price and Selling Price Variations

The cost and selling prices of assets can change, affecting the gain percentage. Let's say an investor buys 100 shares of The Coca-Cola Company at 55 USD each and sells them at 64 USD each. This would result in a 16.36% gain. But, adding in commission fees and taxes would lower the actual gain.

Market Trends and Consumer Demand

Market trends and consumer demand also matter. When the market is going up, gains are higher. But, if it's going down, gains are lower. Knowing these trends helps investors make better decisions and calculate gains more accurately.

The table below shows how different factors can change the gain percentage:

| Factor | Impact on Gain Percentage |

|---|---|

| Transaction costs | Decreases gain percentage |

| Dividends | Increases gain percentage |

| Market conditions | Affects gain percentage |

By taking these factors into account and using the gain percentage formula, investors can make more precise calculations and better decisions.

Common Mistakes When Calculating Gain Percentage

When you're figuring out gain percentage, it's key to steer clear of common mistakes. One big error is forgetting about extra costs like transaction fees and taxes. These can really change the gain percentage. So, it's important to include all costs and expenses in your calculation.

Another mistake is mixing up gain percentage with profit percentage. While they sound similar, they mean different things. Gain percentage shows how much value increased. Profit percentage shows the profit compared to the cost. Knowing the difference helps you make better financial choices.

Some common errors in gain percentage calculations include:

- Neglecting transaction fees and taxes

- Ignoring inflation adjustments

- Confusing gain percentage with profit percentage

To avoid these mistakes, take a detailed and careful approach. Make sure to include all costs, expenses, and factors that can affect the gain percentage. This way, you can get accurate results and make smart decisions.

| Mistake | Description |

|---|---|

| Overlooking additional costs | Neglecting transaction fees, taxes, and other expenses |

| Misinterpretation of profit percentages | Confusing gain percentage with profit percentage |

Using Gain Percentage in Business

Businesses use gain percentage to make smart choices, like setting prices and checking how they're doing. The gain percentage formula helps figure out how profitable something is. It helps companies price things right, check their money, and make choices based on facts.

The gain percentage is found by subtracting the cost price from the selling price, then dividing by the cost price. After that, you multiply by 100. This shows the profit margin, helping businesses adjust their prices. For example, if a product is sold for $100 and costs $70, the gain percentage is 42.86%.

Pricing Strategies

Companies use gain percentage to set good prices. They look at the profit to decide how much to charge. This way, they stay competitive and keep making money.

Performance Evaluation

The gain percentage helps check how well a business is doing. By watching the gain percentage, companies can spot where to get better. For instance, if a company's gain percentage is 20%, they might try to make more money by cutting costs or getting more efficient.

| Company | Gain Percentage | Revenue |

|---|---|---|

| ABC Inc. | 25% | $1 million |

| XYZ Corp. | 30% | $500,000 |

By using the gain percentage formula, businesses can make better choices. This helps them grow and stay ahead in the market.

Tools for Calculating Gain Percentage

There are many online tools and software apps to help find gain percentage. They make it easy to calculate, saving time and avoiding mistakes. You can use online calculators or spreadsheet software like Microsoft Excel and Google Sheets.

Accuracy is key when calculating gain percentage. Online tools like the percentage increase calculator by SmallSEOTools help a lot. They show how much a value has increased as a percentage of the original amount. You can use them as many times as you need to.

Benefits of Online Calculators

- 100% accuracy

- Unlimited usage

- No installation requirements

- Easy accessibility

Spreadsheet software is also great for calculating gain percentage. You can create your own formulas and templates. For example, to find the percentage increase, use this formula: Percentage Increase = [(Final Value – Initial Value / |Initial Value|)] × 100.

| Investment | Purchase Price | Sale Price | Gain Percentage |

|---|---|---|---|

| Amazon Stock | $288.80 | $2,409.78 | 734.4% |

| AT&T Stock | $32.63 | $22.17 | -32% |

| Cory's Tequila Company | $10 per share | $17 per share | 70% |

Using these tools and software makes it easy to find gain percentage. This helps you make smart choices about your investments and money.

Practical Applications of Gain Percentage

The gain percentage formula is used in many areas, like stock market analysis and real estate. In the stock market, it helps evaluate stocks and compare investments. It also shows how well a portfolio is doing.

For example, investors can find out the return on investment (ROI) for a stock. This helps them decide what to add to their portfolio.

In real estate, gain percentage shows the possible return on investment for new properties. It compares the initial cost to the property's selling price. Calculating gain percentage helps investors and developers make smart choices.

Some main uses of gain percentage are:

- Evaluating stocks and comparing investments

- Checking how well a portfolio is doing

- Figuring out the return on investment for new properties

- Comparing the initial cost to the selling price of a property

The gain percentage formula is very useful for investors and developers. It gives a clear way to check investments and make smart choices. By using it, they can maximize their returns and reduce risks. This helps them reach their financial goals.

| Application | Description |

|---|---|

| Stock Market Analysis | Evaluating individual stocks and comparing different investment options |

| Real Estate Transactions | Calculating the possible return on investment for new properties |

Understanding the Difference: Gain vs. Profit Percentage

To find gain percentage, it's key to know the difference between gain and profit percentage. Gain percentage shows the increase in value. Profit percentage shows the profit compared to the cost or selling price. The formula for gain percentage is: Investment percentage gain = (Price sold - purchase price) / purchase price x 100.

In business, showing profit or gain in percentage is important for checking performance. The formulas and methods for gain percentage help understand value changes. For example, if an investment costs $100 and sells for $120, the gain is 20%.

Clarifying the Terminology

The terms gain and profit are often mixed up, but they mean different things. Gain is the increase in value. Profit is what's earned after costs are subtracted. To find gain percentage, look at the original price and the selling price. The profit margin formula is: Profit Margin = [Net Income / Net Sales] * 100.

When to Use Each Percentage

Choosing between gain percentage and profit percentage depends on the situation. Gain percentage is good for checking investment success. Profit percentage is better for looking at business performance. Here's a table showing the difference:

| Percentage Type | Formula | Usage |

|---|---|---|

| Gain Percentage | (Price sold - purchase price) / purchase price x 100 | Investment evaluation |

| Profit Percentage | Profit Margin = [Net Income / Net Sales] * 100 | Business performance assessment |

In conclusion, knowing the difference between gain and profit percentage is vital for good financial analysis. By using the right formulas and methods, businesses and investors can make smart choices. They can find gain percentage to check their investments and performance.

Case Studies: Gain Percentage in Action

Many successful businesses use gain percentage analysis. Companies like Etsy, Nasty Gal, and Growth Hackers have seen big growth thanks to it. For example, Etsy's sales hit nearly $14 billion in 2021. They had over 4 million sellers and almost 40 million active buyers.

This success came from smart use of gain percentage analysis. Other companies, like Bear Mattress and ArchiveSocial, also grew a lot. They improved their websites and marketing with gain percentage analysis.

- Bear Mattress: 24.18% increase in purchases and 16.21% boost in revenue

- ArchiveSocial: 101.68% increase in click-through rate

- Flos USA: 125% increase in checkout conversion rates, resulting in an 18X return on investment

These stories show how gain percentage analysis helps businesses succeed. By using the gain percentage formula, companies can make better decisions. This leads to more growth and profit.

| Company | Gain Percentage Analysis Outcome |

|---|---|

| Etsy | Reached nearly $14 billion in sales in 2021 |

| Bear Mattress | 24.18% increase in purchases and 16.21% boost in revenue |

| ArchiveSocial | 101.68% increase in click-through rate |

Conclusion: Mastering Gain Percentage Calculation

Mastering gain percentage calculation is key for smart financial choices and investment success. Knowing the gain percentage formula helps you check investment returns, set prices, and see how well your business or portfolio is doing.

We've looked at what gain percentage is, why it matters, and how it's used in different areas. It's useful in the stock market and real estate, giving you insights into your finances. By being careful and avoiding errors, your gain percentage calculations will be accurate.

Keep working on your gain percentage skills as you explore finance and investing. Use online tools and spreadsheets to get better at it. The more you practice, the more you'll know how to make smart financial moves.

FAQ

What is gain percentage and why is it important in financial analysis?

Gain percentage shows how much an investment or asset has changed in value. It's key for financial experts and investors. It helps compare different investments or business areas in a clear way.

How do you calculate the gain percentage?

To find the gain percentage, use this formula: Gain Percentage = (Selling Price - Cost Price) / Cost Price x 100. It shows the value change from start to end.

In what different scenarios can gain percentage be applied?

Gain percentage is useful for many things. It helps check stock market gains, real estate profits, retail prices, and business performance.

What factors can influence the gain percentage?

Several things can change the gain percentage. These include cost and selling price changes, market trends, and economic conditions. Knowing these impacts helps in making smart financial choices.

What are some common mistakes to avoid when calculating gain percentage?

Don't forget extra costs like fees and taxes. Also, don't mix up gain percentage with profit percentage. Accurate calculations are vital.

How can businesses leverage gain percentage calculations?

Businesses can use gain percentage for better pricing, checking product and company performance, and making expansion and investment choices.

What tools are available for calculating gain percentage?

Many tools exist, like online calculators and software like Microsoft Excel and Google Sheets. Even advanced financial software is available.

How do gain percentage and profit percentage differ, and when should each be used?

Gain percentage shows value changes, while profit percentage is about revenue profit. Knowing when to use each is important for good financial analysis.

Can you provide real-world examples of how gain percentage analysis has been applied successfully?

Yes, there are examples of businesses growing thanks to gain percentage. Also, there are cases where poor gain percentage use led to bad decisions.