How to Calculate Net Revenue: A Complete Guide

To figure out net revenue, businesses must look at several things. This includes refunds, returns, discounts, and deductions. Net revenue is what a business makes after these costs are subtracted. Knowing how to calculate net revenue is key for financial experts and leaders. It shows how profitable and growing a company is.

The net revenue formula is a basic idea in finance. Learning it well is important for making smart choices with data. In this guide, we'll dive into the details of net revenue calculation. We'll cover the net revenue formula and show a step-by-step way to get it right.

For example, a retail company might have a gross revenue of $2 million and sell 100,000 products. They need to adjust for returns and discounts to find their net revenue. With an average order value of $20 and 5% returns, they must consider these when calculating net revenue. Using the net revenue formula helps businesses figure out their net revenue after adjusting for these costs. This is key for checking their financial health.

Introduction to Net Revenue Calculation

Figuring out net revenue is vital for businesses to check their financial health and make smart choices. The net revenue formula shows a company's revenue after subtracting costs. This lets businesses see how profitable and growing they are. By learning how to calculate net revenue, financial experts and leaders can get important insights into their company's financial state. They can then make choices based on data to help their business grow.

Key Takeaways

- Net revenue is the total amount a business earns from its operations after subtracting costs.

- The net revenue formula is a fundamental concept in financial analysis.

- Mastering the net revenue formula is essential for making data-driven decisions.

- Calculating net revenue provides insights into a company's profitability and growth.

- Understanding how to calculate net revenue is critical for financial professionals and business leaders.

- The net revenue formula helps businesses evaluate their financial performance and make informed decisions.

- How to calculate net revenue is a key part of financial analysis, and the net revenue formula is a key part of this process.

What is Net Revenue?

Net revenue is a key financial metric. It shows how much money a company makes after some costs are taken out. These costs include customer returns and discounts. To find net revenue, you need to know the net revenue equation. This means subtracting selling expenses from gross revenue.

This gives a clearer picture of a company's real profit. It considers all the deductions.

Knowing about net revenue is vital for financial experts. It shows how well a company is doing financially. The formula to calculate net revenue is: Net Revenue = Gross Revenue - Directly Related Selling Expenses. This helps businesses show their true profit. It aids in making better decisions.

Definition of Net Revenue

Net revenue is what a company makes after discounts and returns are taken out. Costs removed from net revenue include discounts, returns, and other expenses. These can be salaries, wages, and overheads.

Importance of Net Revenue in Business

Looking at net revenue can show where a business is making more or less money. This helps in making decisions. Investors look at gross revenue growth, but net revenue shows a company's health.

By learning how to find net revenue and using the net revenue equation, businesses can improve. They can manage costs better and make smart choices about growing or buying other companies.

| Financial Metric | Definition | Importance |

|---|---|---|

| Net Revenue | Gross revenue minus directly related selling expenses | Key indicator of financial health |

| Gross Revenue | Total sales revenue before deductions | Indicator of sales performance |

The Formula for Net Revenue

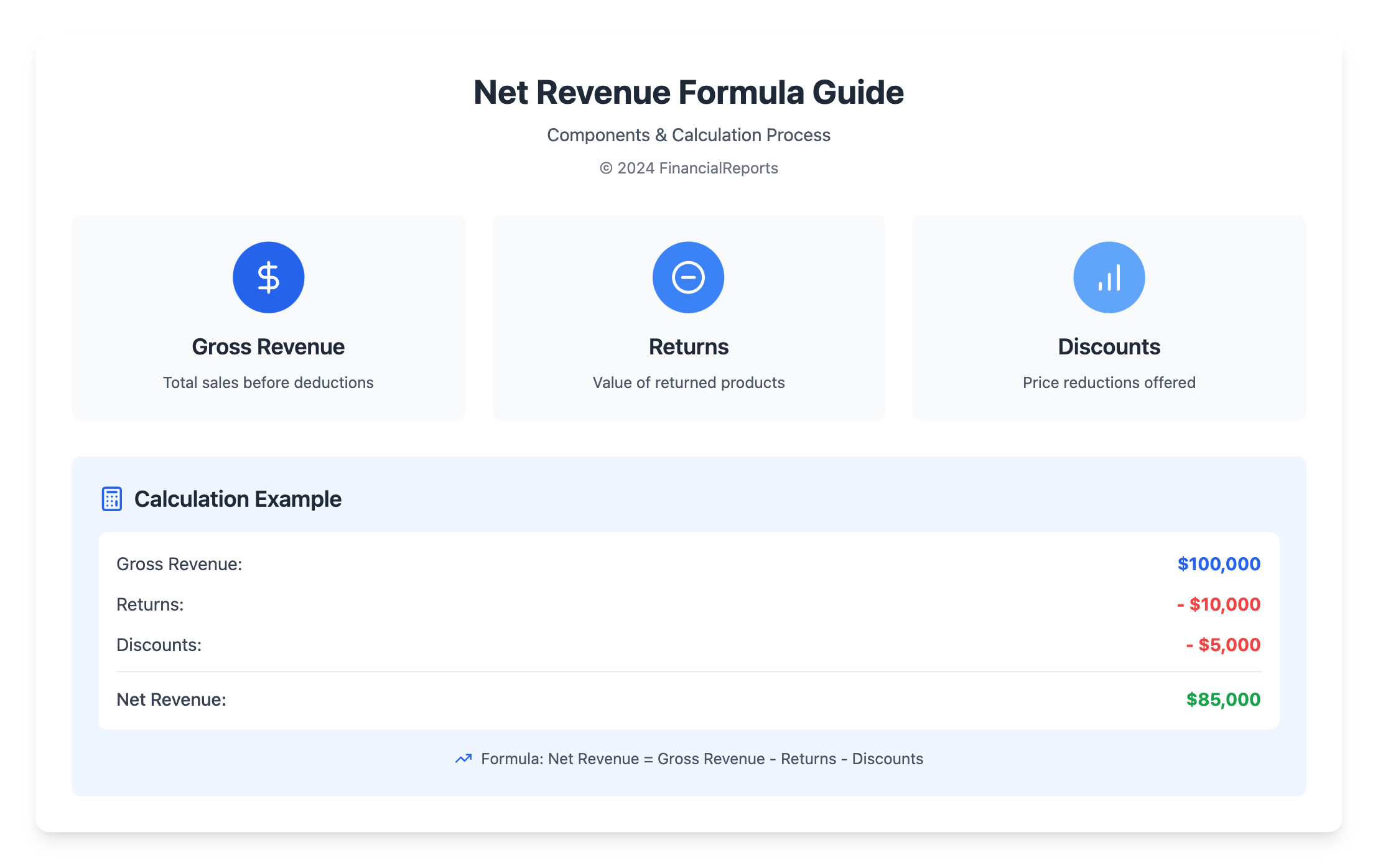

To figure out net revenue, you need to know the net revenue formula. It's simple: Net Revenue = Gross Revenue – Returns – Discounts – Sales Allowances. This shows a company's earnings after sales costs like returns and discounts are subtracted.

When using the net revenue formula, you must look at several parts. These include gross revenue, returns, discounts, and sales allowances. Gross revenue is the total sales before any deductions. Returns and discounts lower revenue, and sales allowances are also subtracted to get net revenue.

Basic Equation to Determine Net Revenue

The basic net revenue equation is key in finance. By taking away returns, discounts, and sales allowances from gross revenue, you find net revenue. This is important for seeing a company's financial health and making smart choices.

Breakdown of Revenue Components

To accurately calculate net revenue, you need to know the different parts. Here are the main ones:

- Gross Revenue: Total sales earnings

- Returns: Costs of returned products or services

- Discounts: Price cuts given to customers

- Sales Allowances: Deductions for sales-related costs

By using the net revenue formula and understanding these parts, financial experts can get net revenue right. This is key for businesses to check their financial health and make smart choices. To learn more about net revenue, it's important to know the formula and its parts.

| Component | Description |

|---|---|

| Gross Revenue | Total amount earned from sales |

| Returns | Costs associated with returned products or services |

| Discounts | Reductions in price offered to customers |

| Sales Allowances | Amounts deducted from revenue due to sales-related costs |

Understanding Gross Revenue vs. Net Revenue

To understand a company's financial health, knowing net revenue and its equation is key. Gross revenue and net revenue are often mixed up. Gross revenue is the total earned without any deductions. Net revenue, on the other hand, subtracts returns and discounts.

The main difference between gross and net revenue is in how they're calculated and what they mean. Gross revenue is the sum of all sales. Net revenue is what's left after subtracting returns, discounts, and other costs. For instance, if a company has $100,000 in gross revenue and $10,000 in deductions, its net revenue is $90,000.

Key Differences Between Gross and Net Revenue

Here are the main differences between gross and net revenue:

- Gross revenue is the total sales before expenses are subtracted.

- Net revenue is the total sales after expenses are subtracted.

- Gross revenue shows sales growth, while net revenue gives a clearer view by accounting for deductions.

It's vital for businesses to understand the difference between gross and net revenue. This knowledge helps in making smart financial decisions. By knowing how to find net revenue and using the net revenue equation, companies can manage expenses better and boost profitability.

| Revenue Type | Calculation | Example |

|---|---|---|

| Gross Revenue | Total Sales | $100,000 |

| Net Revenue | Total Sales - Returns - Discounts | $90,000 |

Adjustments to Calculate Net Revenue

To find net revenue, businesses need to look at discounts, returns, and refunds. These are key for financial experts. They help figure out the net revenue formula. To calculate net revenue, you subtract these from gross revenue.

Important adjustments include:

- Discounts: given to customers as promotions

- Returns: products sent back by customers

- Refunds: money given back to customers

These adjustments are vital in the net revenue formula. They show the real money a business makes after costs. By making these adjustments, businesses can get their net revenue right. This is important for knowing how profitable they are and making smart money choices.

For example, if a business makes $1,000 but gives back $150 in refunds, their net revenue is $850. This shows why adjustments are important. They give a clearer picture of a business's financial health.

| Revenue Type | Gross Revenue | Adjustments | Net Revenue |

|---|---|---|---|

| Example | $1,000 | $150 (refunds) | $850 |

By knowing and using these adjustments, businesses can get their net revenue right. This helps them understand their finances better. It also helps them grow and succeed, showing how important the net revenue formula is.

Step-by-Step Guide to Calculating Net Revenue

To find net revenue, you need to know the net revenue equation. First, collect all revenue data. Then, identify and count any adjustments. Use the net revenue formula: (Quantity Sold * Unit Price) - Discounts - Allowances - Returns.

The first step is to gather financial data. This includes sales data like quantity sold and unit price. Also, collect any discounts, allowances, or returns. It's important to have accurate and complete data to avoid mistakes.

Gathering Financial Data and Applying the Formula

After collecting all data, apply the net revenue equation. Subtract discounts, allowances, and returns from the total revenue. For instance, if total revenue is $100,000, and there are $10,000 in discounts, $5,000 in allowances, and $5,000 in returns, the net revenue is $80,000.

Knowing how to find net revenue and using the net revenue equation is key. It helps businesses make smart decisions and check their financial health. By following these steps and using the formula, companies can accurately calculate their net revenue.

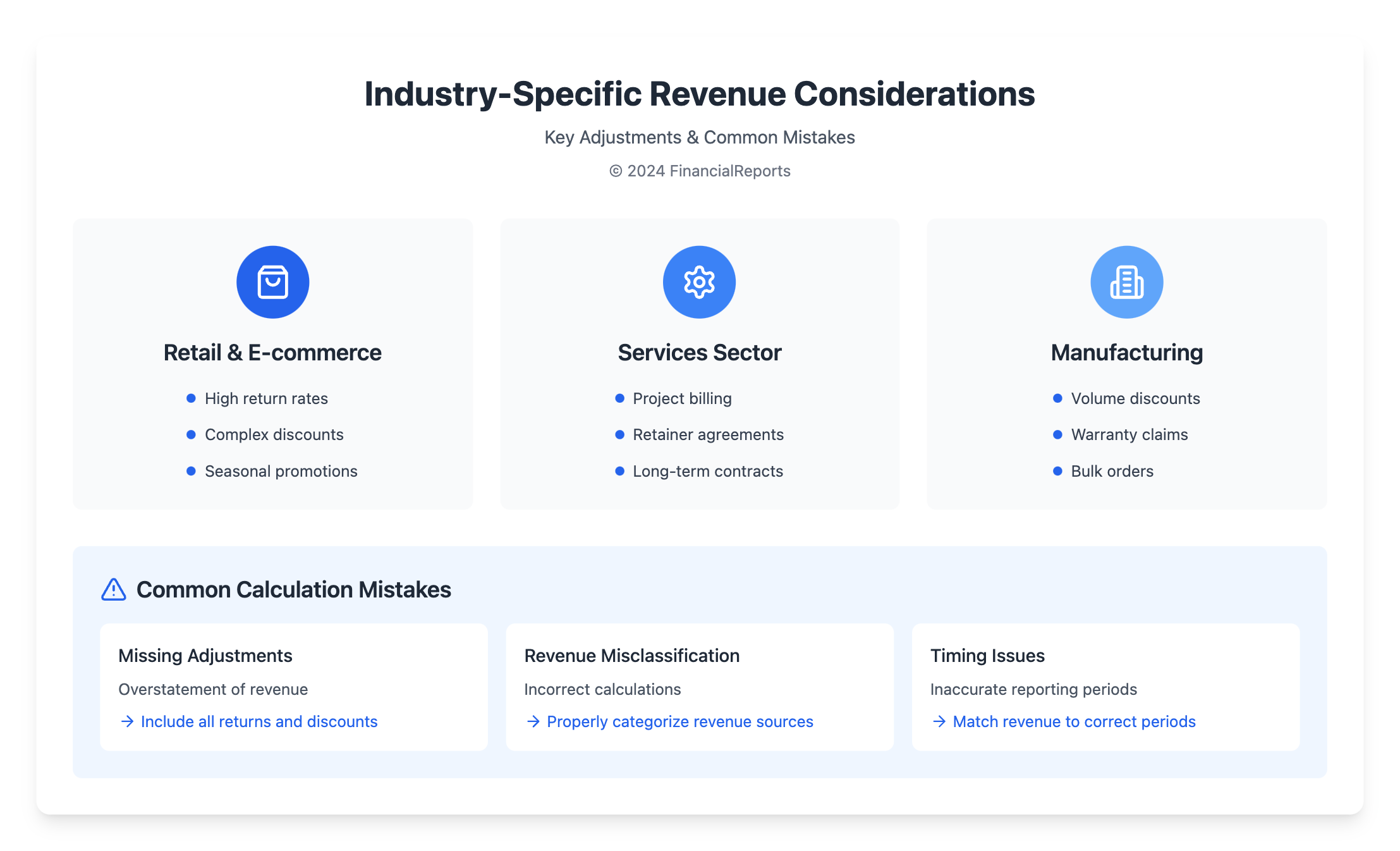

Common Mistakes in Calculating Net Revenue

Learning how to calculate net revenue is key. But, it's also important to know the common mistakes that can lead to wrong results. One big error is forgetting to include returns, discounts, and allowances. These can greatly change the net revenue formula, which is Net Revenue = Gross Revenue - Returns - Discounts - Allowances.

Another mistake is mixing up different types of revenue. This can cause wrong calculations. To avoid these errors, it's vital to know the net revenue formula well. Also, make sure to include all deductions. This way, businesses can get their net revenue right and make smart choices.

Some common mistakes to watch out for include:

- Failure to account for all returns and discounts

- Incorrectly categorizing revenue sources

- Not regularly reviewing and updating financial data

By knowing these common mistakes and avoiding them, businesses can get their net revenue right. This helps them make smart choices to grow and be more profitable.

| Mistake | Impact on Net Revenue |

|---|---|

| Overlooking necessary deductions | Inaccurate net revenue calculations |

| Misclassifying revenue streams | Incorrect net revenue calculations |

Tools and Software for Calculating Net Revenue

Businesses can use many tools and software to find net revenue. This makes the process easier and more accurate. Knowing how to find net revenue is key, and the right tools can make it simpler.

Accounting software like QuickBooks, Xero, and Sage are popular. They help with tracking expenses, sending invoices, and reporting finances. These tools make managing finances better and help understand net revenue.

Spreadsheets like Google Sheets or Microsoft Excel are also great for manual calculations. They offer flexibility and can meet unique financial needs.

When picking a tool or software, consider scalability, integration, and accounting standards. The right choice ensures accurate and efficient net revenue calculations. This helps make better financial decisions.

| Software Solution | Features | Benefits |

|---|---|---|

| QuickBooks | Automated expense tracking, invoicing, financial reporting | Streamlined financial management, improved accuracy |

| Xero | Automated expense tracking, invoicing, financial reporting | Streamlined financial management, improved accuracy |

| Sage | Automated expense tracking, invoicing, financial reporting | Streamlined financial management, improved accuracy |

Industry-Specific Considerations

When figuring out net revenue, it's key to think about the special things that happen in different fields. For example, stores and online shops often have a lot of returns. This can really change how you figure out net revenue. You need to adjust the net revenue formula to handle these returns and other special things like selling in many places and having complex discounts.

In the services world, things get a bit more complicated. You might have to deal with billing for specific projects or agreements that last a while. To get net revenue right in these areas, you need to really understand the net revenue formula and how it works. By looking at these special things, financial experts can make sure their net revenue numbers are right. This helps them make smart choices for their business.

Some important things to think about when figuring out net revenue for different industries include:

- Return rates and refund policies in retail and e-commerce

- Project-based billing and retainer agreements in the services sector

- Multi-channel sales and complex discount structures in various industries

By keeping these special factors in mind and using the right net revenue formula, businesses can really understand their money situation. This helps them make choices based on facts to grow and make more money.

| Industry | Unique Factors | Net Revenue Calculation Considerations |

|---|---|---|

| Retail and E-commerce | High return rates, multi-channel sales, complex discount structures | Adjust net revenue formula to account for returns, discounts, and sales from multiple channels |

| Services Sector | Project-based billing, retainer agreements, long-term contracts | Apply net revenue formula to project-based billing, consider retainer agreements and contract terms |

The Role of Net Revenue in Financial Health

Net revenue is key to a company's financial health. To grasp its importance, knowing how to find net revenue and use the net revenue equation is vital. The net revenue equation is Net Revenue = Gross Revenue - Returns, Allowances, and Discounts. This figure directly affects profits and guides business strategies.

Several elements influence net revenue. Returns are items customers send back. Allowances are price cuts for damaged goods. Discounts are sales boosts or early payment rewards. By examining these, businesses can spot and fix weak spots in their pricing.

Impact on Profitability

Net revenue's effect on profits is huge. It shows a company's income after sales costs. By comparing gross and net revenue, businesses can better plan resources, pricing, and costs. For example, a retail business might see how to cut costs and boost profits with a $100,000 gross revenue and $85,000 net revenue.

Influence on Business Decisions

Net revenue trends shape business choices, from resource use to strategic planning. By studying net revenue, companies can spot revenue boosts and cost cuts. This data guides pricing, marketing, and growth plans. For instance, a SaaS company might tweak its pricing to retain more customers with a $200,000 gross revenue and $180,000 net revenue.

| Business Type | Gross Revenue | Net Revenue |

|---|---|---|

| Retail | $100,000 | $85,000 |

| SaaS | $200,000 | $180,000 |

Understanding net revenue's role in financial health helps businesses grow and boost profits. By using the net revenue equation and studying trends, companies can enhance their financial standing and meet their objectives.

Reporting Net Revenue to Stakeholders

It's vital to report net revenue accurately and openly to keep stakeholders' trust. Financial experts need to know how to calculate net revenue using the net revenue formula. This means subtracting all expenses from total income, taking into account discounts, returns, and refunds.

When sharing net revenue info, clarity is key. Companies can use financial statements, management reports, and investor presentations to do this. For instance, Microsoft Corporation, with a revenue of $245.1 billion for the fiscal year ending June 30, 2023, must give detailed net revenue breakdowns to its stakeholders.

Best Practices for Presentation

Here are some tips for presenting net revenue data well:

- Use simple and clear language

- Give detailed info on revenue and expenses

- Point out important trends and insights

Importance of Transparency in Reporting

Being open in reporting is key to gaining stakeholders' trust. This means sharing regular updates on net revenue and explaining any changes made to the calculations. By following these tips and using the net revenue formula to calculate net revenue, financial experts can make sure their reports are clear, open, and useful.

How to Use Net Revenue for Business Growth

To grow your business, knowing how to find net revenue is key. Analyzing net revenue trends helps set goals and spot areas to improve. For example, you can calculate revenue growth by comparing current and past values. This helps in making smart choices about investments and pricing.

Net revenue data guides strategic decisions, like adding new products or markets. By using what you're good at and finding new ways to earn, you can grow more. For instance, a subscription service can track its Monthly Recurring Revenue (MRR) to see how it's doing. To learn more about growing revenue, check out revenue growth resources.

Improving your growth rate involves several strategies:

- Offering special discounts to previous customers

- Creating subscription options for recurring revenue

- Implementing email campaigns for customer retention

- Utilizing strategic cross-selling

- Providing introductory discounts to attract new customers

By using these strategies and tracking your net revenue, you can grow your business. This leads to higher profits and better decision-making.

| Revenue Type | Calculation | Example |

|---|---|---|

| Gross Revenue | Total Revenue | $1,000 |

| Net Revenue | Total Revenue - Total Expenses | $800 |

Understanding net revenue and its equation opens doors to your business's full growth. It leads to long-term success.

Conclusion: Mastering Net Revenue Calculation

Calculating net revenue accurately is key for financial experts and business leaders. It helps them understand their true profits and how well their operations are running. By knowing the net revenue formula and accounting for all deductions, companies can see their real financial health.

Being good at net revenue calculation helps businesses make smart choices. They can set realistic goals and share their financial status clearly with others. By checking their gross revenue, discounts, returns, and other changes, companies can find ways to get better, set better prices, and grow steadily.

Net revenue is more than just numbers. It's a tool for managing finances well and aiming for success in the long run. Keep a close eye on your net revenue, use the right tools, and stay up-to-date with new accounting rules and best practices.

FAQ

What is the definition of net revenue?

Net revenue is the money a company makes after subtracting returns, discounts, and other adjustments from its total sales. It shows the real income a business gets from its sales and services.

Why is net revenue an important metric for businesses?

Net revenue is key for businesses because it shows their true financial health. It helps check if they're making money, set prices, and decide how to use resources.

What is the formula for calculating net revenue?

To find net revenue, use this formula: Net Revenue = Gross Revenue - Returns - Discounts - Allowances

How does net revenue differ from gross revenue?

Gross revenue is the money a business makes before any deductions. Net revenue is what's left after subtracting returns, discounts, and other adjustments.

What types of adjustments are included in the net revenue calculation?

Adjustments for net revenue include returns, discounts, rebates, and sales allowances. These reduce the gross revenue to get the net revenue.

What are the steps to accurately calculate net revenue?

To find net revenue, first, collect all financial data. Then, use the net revenue formula to subtract adjustments from gross revenue. Make sure to apply the formula the same way every time.

What are some common mistakes to avoid when calculating net revenue?

Avoid missing deductions like promotional discounts and misclassifying revenue. It's important to include all adjustments and apply the formula consistently for accurate net revenue.

What tools and software are available for calculating net revenue?

Accounting software like QuickBooks, Xero, and SAP can automate net revenue calculations. Spreadsheets with templates and formulas can also help with manual calculations.

How does net revenue calculation differ across industries?

Net revenue calculation varies by industry due to different revenue recognition, return policies, and discounts. For example, retail and e-commerce often have more returns, while services may have long-term contracts.

How can net revenue data be used to drive business growth?

Net revenue data helps set goals, analyze trends, and make business decisions. It informs pricing, market expansion, and resource allocation. Using net revenue insights can improve financial health and drive growth.