Calculate Marginal Profit Easily - A Step Guide

To understand a company's financial health, knowing how to calculate marginal profit is key. Marginal profit shows the profit from selling one more unit. This guide will show you how to do this, helping you make better business decisions.

Calculating marginal profit is a big part of financial analysis. It's important for making smart choices. The calculation uses total revenue and total variable costs. For example, a company with $6 million in revenue from 60,000 units at $100 each can figure out its marginal profit. This is done by looking at the cost per unit, which goes up each year from $25 to $31.

Introduction to Marginal Profit Calculation

Knowing how to calculate marginal profit is important for many. It helps companies find ways to improve and make more money. The goal is to keep making more until each new unit brings in more money than it costs.

Key Takeaways

- Marginal profit calculation is essential for financial analysis and decision-making.

- Learning how to calculate marginal profit helps companies optimize production levels and maximize profitability.

- Understanding marginal profit is key for spotting areas to improve and making smart choices.

- The marginal profit calculation is based on total revenue and total variable costs.

- Companies should keep making more until marginal revenue equals marginal cost, showing the profit peak.

- Mastering marginal profit calculation is vital for financial experts, investors, and clients.

What is Marginal Profit?

Marginal profit is key in business. It's the extra profit from selling one more unit. It's found by subtracting the cost of making one more unit from the revenue from selling it. This gives insights into a company's profit.

Definition of Marginal Profit

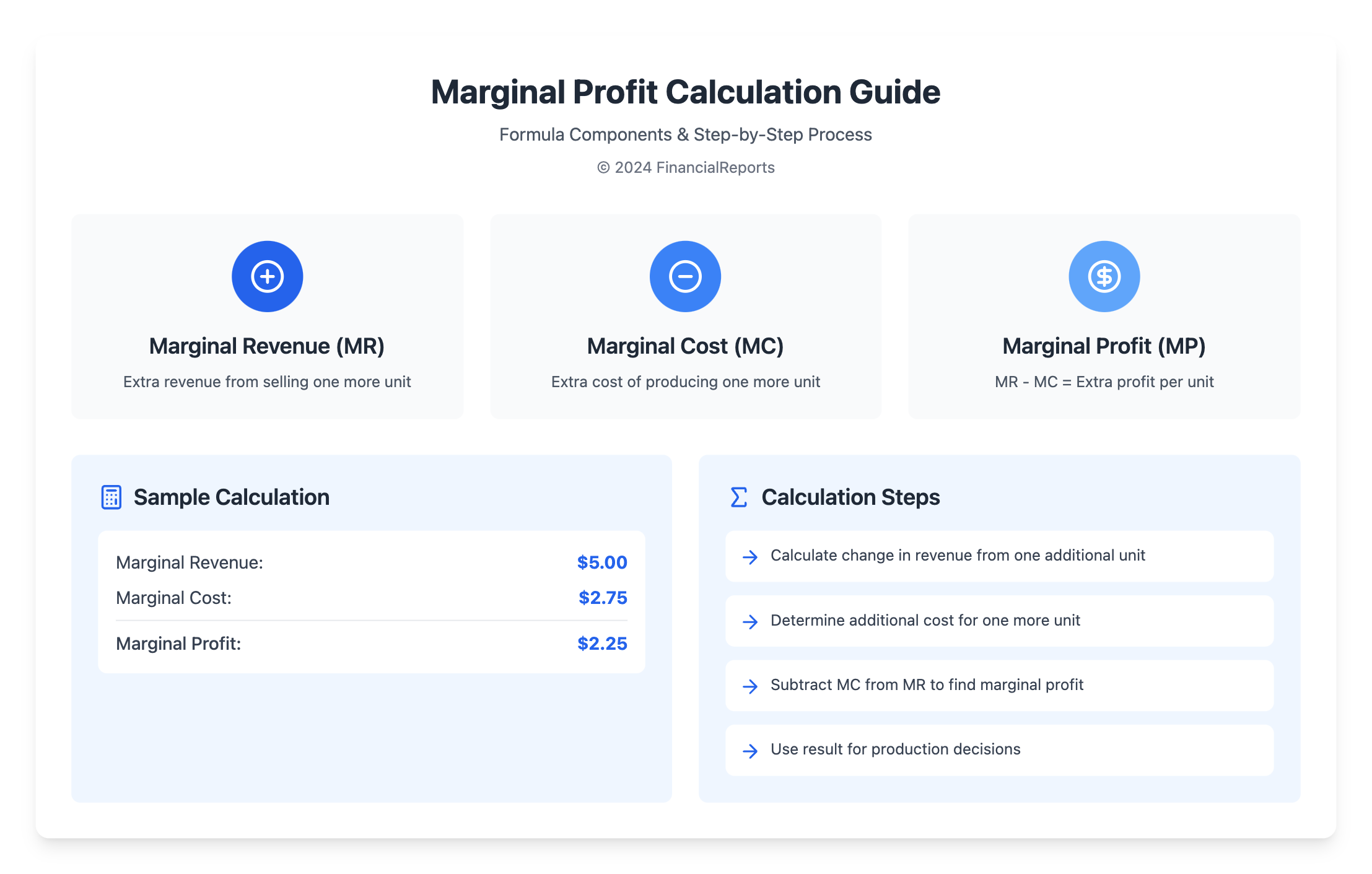

The formula for marginal profit is simple. It's Marginal Profit (MP) = Marginal Revenue (MR) - Marginal Cost (MC). This formula shows how revenue, costs, and profit are connected. It helps businesses decide on production and prices.

Importance in Business

Marginal profit is very important for businesses. It helps find the best production level for maximum profit. By looking at marginal profit, companies can spot areas to improve and set better prices.

Some important things to think about with marginal profit are:

- Calculating marginal revenue and marginal cost to find marginal profit

- Looking at how marginal profit changes with production levels

- Using marginal profit to set prices and improve operations

The Formula for Marginal Profit

To find marginal profit, you need to know the parts involved. The marginal profit ratio shows how profitable a product or service is. The formula is Marginal Profit = Marginal Revenue – Marginal Cost.

For example, if selling 100 widgets brings in $50 more and costs $15 more, the profit is $35. This helps businesses decide on production and pricing.

Understanding the Components

The formula has two main parts: marginal revenue and marginal cost. Marginal revenue is the extra money from selling one more item. Marginal cost is the extra cost of making one more item.

Step-by-Step Breakdown of the Formula

To find marginal profit, follow these steps:

- Find the marginal revenue by adding the extra money from selling one more item.

- Calculate the marginal cost by adding the extra cost of making one more item.

- Subtract the marginal cost from the marginal revenue to get the marginal profit.

Knowing the marginal profit ratio helps businesses make smart choices. They can decide on production, pricing, and how to use resources to increase profits.

How to Gather Necessary Data

To figure out marginal profit, businesses must gather data on revenue and costs for extra units. They need to understand the marginal profit function. This function is key in financial planning, helping find the best production and pricing levels.

Getting accurate revenue data is vital for marginal profit analysis. This means tracking sales and the revenue from each unit. Businesses also need to know variable costs, like labor and materials, for extra units. This helps them figure out marginal profit and make smart decisions on production and pricing.

Some important data to collect includes:

- Average revenue per unit

- Variable costs per unit

- Fixed costs

- Production capacity

By looking at these data points, businesses can understand their marginal profit. This helps them make informed choices to improve production and pricing strategies.

| Data Point | Description |

|---|---|

| Average Revenue per Unit | The average revenue generated per unit sold |

| Variable Costs per Unit | The costs that vary directly with the production of additional units |

| Fixed Costs | The costs that remain the same even if production increases or decreases |

| Production Capacity | The maximum number of units that can be produced within a given timeframe |

Calculating Marginal Profit: A Step-by-Step Guide

To find marginal profit, you need to know about marginal revenue and marginal cost. Marginal revenue is what you get from selling one more item. Marginal cost is what it costs to make one more item. You calculate marginal profit by dividing the change in revenue by the change in units sold.

For example, say a company sells 100 items at $10 each. If making one more item costs $5, then the marginal revenue is $10. The marginal profit is $5, found by subtracting the marginal cost from the marginal revenue.

Example Calculation

Consider a company making widgets. They sell 1000 units for $10,000. When they sell 1001 units, they make $10,010. The marginal revenue is $10, and the marginal cost is $5. So, the marginal profit is $5, found by subtracting the marginal cost from the marginal revenue.

Analyzing Results

By looking at marginal profit, companies can figure out the best prices and how much to make. A positive marginal profit means they're making money. A negative one means they're losing money. This helps them adjust their prices and production to make more money.

Factors Affecting Marginal Profit

Marginal profit is influenced by several factors. These include market demand, pricing strategies, and cost structures. Understanding these is key for businesses to boost their marginal profit. The marginal profit formula is vital for figuring out the profit from one more unit.

Market demand changes can affect marginal profit. For example, more demand means higher marginal revenue and profit. But, less demand means lower revenue and profit.

Pricing strategies also play a big role. Businesses can use different strategies to increase their profit. The costs of a business also matter. Changes in costs can affect marginal profit.

Some key factors that affect marginal profit include:

- Market demand: Changes in demand can impact marginal revenue and, subsequentl, marginal profit.

- Pricing strategy: Different pricing strategies can affect marginal revenue and marginal profit.

- Cost structure: Changes in costs can impact marginal cost and, subsequentl, marginal profit.

By understanding these factors and using the marginal profit formula, businesses can make better decisions. This helps them maximize their profit and optimize production levels.

| Factor | Impact on Marginal Profit |

|---|---|

| Market Demand | Increases marginal revenue, resulting in higher marginal profit |

| Pricing Strategy | Affects marginal revenue and marginal profit |

| Cost Structure | Impacts marginal cost and, subsequentl, marginal profit |

How to Use Marginal Profit for Decision-Making

Marginal profit analysis is key for businesses to make smart choices. They need to figure out the difference between marginal revenue and marginal cost. The marginal profit ratio shows how profitable extra units are.

Knowing how to find marginal profit helps companies check their product lines. They can spot where to make more money. This info lets them adjust production, prices, and use resources better. For instance, if a product's marginal profit ratio is high, they might make more of it.

Important things to think about when using marginal profit analysis include:

- Figuring out marginal revenue and marginal cost to find marginal profit

- Looking at the marginal profit ratio to see if extra units are profitable

- Checking product lines to find chances for growth and improvement

By using marginal profit analysis, businesses can make choices based on data. This helps them grow, make more money, and stay competitive.

Comparing Marginal Profit and Total Profit

Understanding the difference between marginal profit and total profit is key in financial analysis. The marginal profit definition is the extra profit from selling one more unit. Total profit, on the other hand, shows a company's overall profit. To calculate marginal profit, you need to look at the extra revenue and costs from one more unit.

Companies must grasp the link between marginal profit and total profit to make smart choices. Here are the main differences and what they mean:

- Marginal profit looks at the profit from one more unit, while total profit shows the company's overall profit.

- Knowing marginal profit helps businesses decide on production and pricing.

- Total profit gives a full picture of a company's financial health.

For instance, a company selling frozen raspberries at $5 per pack might make $127.50 profit. But if they lower the price to $2.75, the profit drops to $0. This shows how vital understanding marginal profit is for business strategy. For more on marginal profit and its uses, check out this resource for a detailed look and examples.

Tools for Calculating Marginal Profit

Businesses can use software and spreadsheets to find marginal profit. These tools make it easier to use the marginal profit formula. This helps companies decide how much to produce and set prices.

Popular tools for this job include financial management platforms and accounting software. They offer features like automatic calculations and reports. Spreadsheets like Microsoft Excel or Google Sheets also help by letting you create your own templates. Using these tools makes it simpler to work with the marginal profit formula and helps in making better decisions.

Software Solutions

- Financial management platforms

- Accounting software

- Spreadsheets with custom templates

By using these tools, businesses can run better and make more money. The marginal profit formula shows how profit changes with each extra unit sold. With the right tools, companies can use this formula easily and accurately.

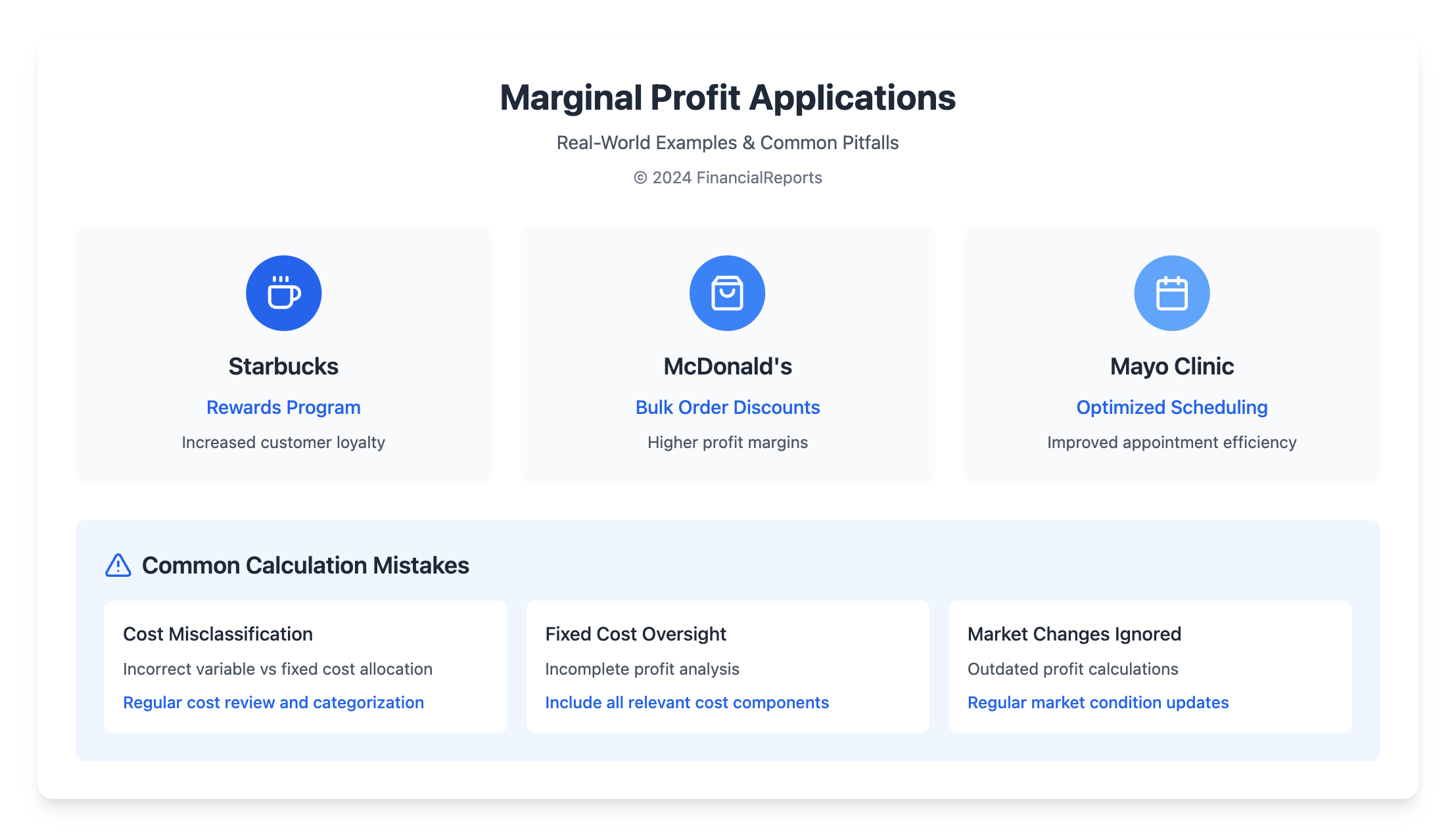

Common Mistakes in Marginal Profit Calculations

Calculating marginal profit requires avoiding common mistakes. Misinterpreting costs is a major error. It can greatly affect the outcome. Businesses must correctly identify and classify their costs, including variable and fixed costs.

Another mistake is ignoring fixed costs. Fixed costs, like rent and salaries, don't change even if production increases. It's important to understand fixed costs in marginal profit analysis. By avoiding these errors, businesses can accurately find their marginal profit and make better decisions.

Some common mistakes to watch out for include:

- Misclassifying costs as variable or fixed

- Overlooking the impact of fixed costs on marginal profit

- Failing to account for changes in market demand or pricing strategy

Being aware of these pitfalls helps businesses make accurate marginal profit calculations. This leads to informed decisions for growth and profitability. To learn how to find marginal profit and avoid mistakes, businesses can use financial software and consulting services. Mastering marginal profit calculations gives businesses a competitive edge and long-term success.

Marginal Profit and Pricing Strategies

Knowing how marginal profit and pricing strategies work is key for businesses to boost profits. The marginal profit ratio shows the best price for products. It's found by subtracting marginal cost from marginal revenue. To figure out marginal profit, businesses must understand marginal cost and revenue.

The marginal profit ratio guides pricing by showing how price, cost, and profit change with each sale. For example, if a business spends $3 and makes $5 on each item, it makes $2 profit. This means selling more items can increase profit by $2 each.

Setting Prices Based on Marginal Profit

Businesses can set the best prices using the marginal profit ratio. By looking at this ratio, they can find the price that maximizes profit. If the ratio is high, they might raise prices to make more money. If it's low, they might lower prices to sell more.

Impact on Sales Volume

The marginal profit ratio also affects how many items are sold. A high ratio might lead to fewer sales as prices go up. But a low ratio could mean more sales as prices drop. Businesses must balance these factors to stay profitable.

| Marginal Cost | Marginal Revenue | Marginal Profit |

|---|---|---|

| $3 | $5 | $2 |

Understanding the marginal profit ratio helps businesses set prices that boost profits. This ratio is vital for finding the right price and adjusting strategies to stay profitable.

Real-World Applications of Marginal Profit

Companies in many industries use marginal profit analysis to boost their profits. The marginal profit function is key in this effort. It shows the profit from selling one more unit of a product. This helps businesses decide if they should make more, less, or stop producing.

The formula for marginal profit is Marginal Profit (MP) = Marginal Revenue (MR) – Marginal Cost (MC). This formula is vital for spotting when profit starts to drop. For example, McDonald's uses it to get better deals on bulk orders. Mayo Clinic also uses it to schedule appointments more efficiently.

Here are some companies that have used marginal profit analysis well:

- Starbucks, which started a rewards program to keep customers coming back

- McDonald's, which got discounts on bulk orders to make more money

- Mayo Clinic, which improved its scheduling to make more from each appointment

By focusing on marginal profit, companies can make more money without selling more. This method also finds ways to save on costs, which is important in low-margin markets. It helps businesses set the right prices by finding the best production levels.

| Company | Marginal Profit Strategy | Result |

|---|---|---|

| Starbucks | Implemented a rewards program | Increased marginal profit through customer loyalty |

| McDonald's | Negotiated bulk discounts | Increased profit margins |

| Mayo Clinic | Optimized scheduling systems | Boosted marginal profit per appointment |

Conclusion: Mastering Marginal Profit Calculation

Understanding marginal profit analysis is key to better financial decisions and higher profits. The marginal profit formula helps businesses see how much more money they make from selling one more item. It also shows the extra costs involved.

Key Takeaways

This guide showed how important marginal profit is. It helps set the right prices, find new chances, and grow steadily. By knowing how to calculate marginal profit, companies can make smart choices about what to sell, how to use resources, and how to price things. This way, they can increase their profits.

Next Steps for Further Learning

To get better at calculating marginal profit, look for more learning resources. Check out books, articles, and online courses on finance, cost management, and making strategic decisions. Also, talk to experts, go to workshops, and keep up with new trends in business. With more knowledge and practice, you'll be ready to handle the challenges of today's business world and reach your financial targets.

FAQ

What is marginal profit?

Marginal profit is the extra profit a company makes from selling one more item. It's found by subtracting the cost of making one more item from the extra money made from selling it.

Why is understanding marginal profit important for businesses?

Knowing about marginal profit helps businesses decide how much to make and sell. It guides them in setting prices and choosing what products to offer.

How is the marginal profit formula calculated?

The formula for marginal profit is: Marginal Profit = Marginal Revenue - Marginal Cost. This shows how to figure out the profit from selling one more item.

What data is required to calculate marginal profit?

To find marginal profit, you need to know the money made and the costs that change. This includes sales, prices, and variable costs.

Can you provide a step-by-step guide on how to calculate marginal profit?

Yes, here's how to do it: First, find the marginal revenue. Then, find the marginal cost. Lastly, subtract the cost from the revenue to get the profit.

What factors can affect a company's marginal profit?

Several things can change a company's marginal profit. These include demand, prices, and costs. Knowing how these factors work together is key.

How can businesses use marginal profit analysis for decision-making?

Marginal profit analysis helps businesses choose what to make and sell. It also guides them in setting prices and using resources wisely.

What is the difference between marginal profit and total profit?

Marginal profit is about the extra profit from one more item. Total profit is the overall profit of a business. Both are important for making smart financial plans.

What tools are available for calculating marginal profit?

Businesses can use software or spreadsheets to find marginal profit. These tools make the process more accurate and easier.

What are some common mistakes to avoid when calculating marginal profit?

Avoid mistakes like misreading costs or ignoring fixed costs. Also, remember how prices affect sales. Accurate data and careful analysis are key.

How can marginal profit analysis influence pricing strategies?

Marginal profit analysis helps set the right prices. It balances making money and selling enough items. This analysis is very useful for pricing decisions.

Can you provide real-world examples of how companies have applied marginal profit analysis?

Yes, we'll look at companies that used marginal profit analysis well. We'll also see examples where it didn't work out.