Boost Returns with the Buy Call, Sell Put Option Strategy

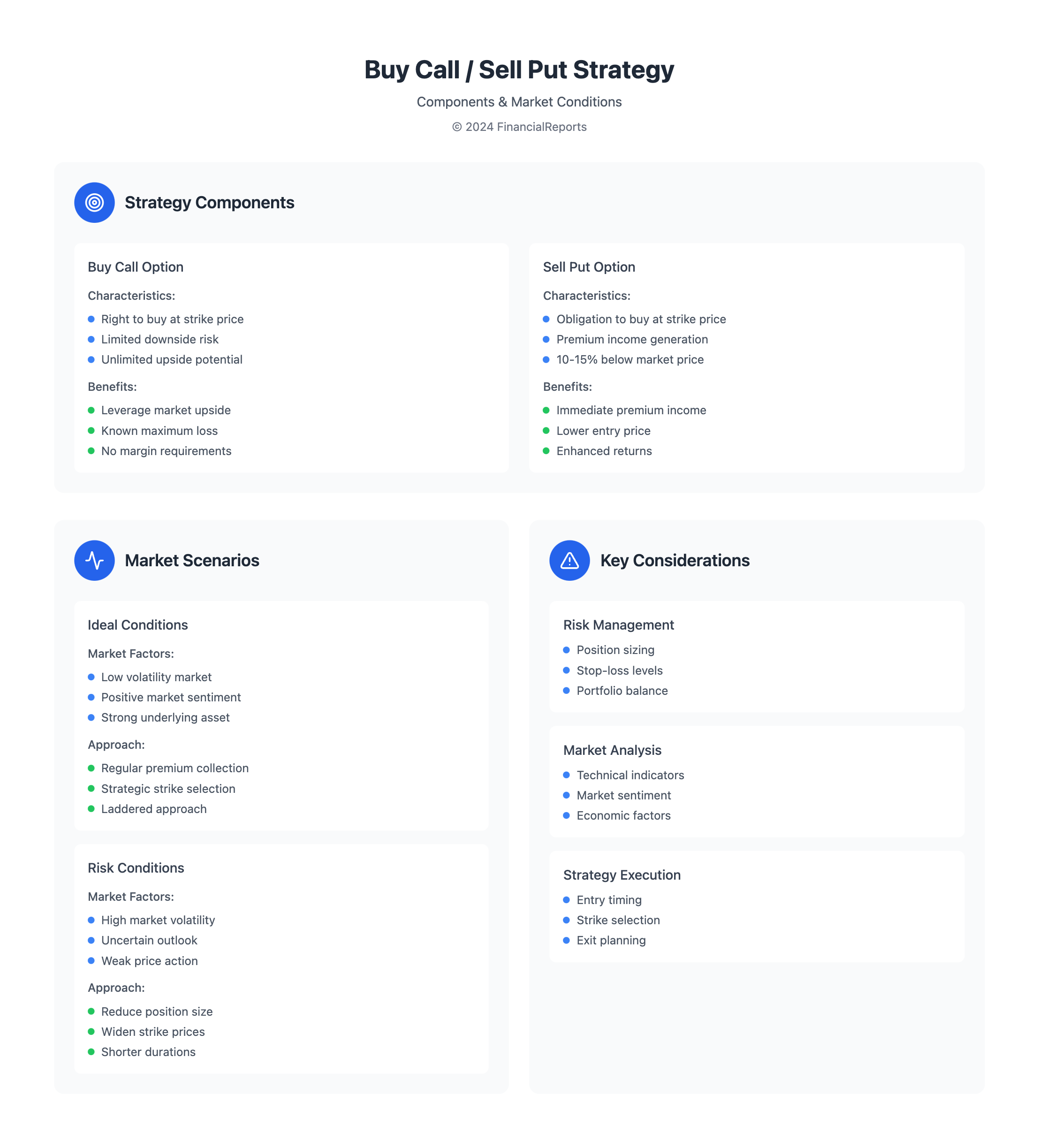

The buy call and sell put option strategy is a well-known method in options trading. It involves buying a call option and selling a put option on the same asset. This strategy can help increase returns in options trading. But, it needs a good understanding of the options market and the asset itself.

By using this strategy, investors can potentially boost their returns and manage risks in different market conditions. This approach is popular for its ability to generate premium income and buy stocks at lower prices.

Selling a $200 put option might earn $15 per share in premium. Buying a call option can limit losses to the call premium paid and offer unlimited gains. Success in this strategy depends on understanding its mechanics and adapting to market changes.

Introduction to the Buy Call and Sell Put Option Strategy

This strategy is versatile and works in various market conditions. It includes strong markets, bear markets, and sideways markets. By selling puts at strikes 10% to 15% below current prices, investors can manage risk and earn premium income.

In volatile markets, it's wise to ladder put strikes to reduce losses. This approach helps investors adapt to different market conditions, maximizing returns and managing risks effectively.

Key Takeaways

- The buy call and sell put option strategy can be used to boost returns in options trading.

- Understanding the options market and the underlying asset is key to success.

- The strategy involves buying a call option and selling a put option on the same underlying asset.

- Selling puts at strikes 10% to 15% below current market prices can be effective in strong markets.

- Adapting to different market conditions is essential for maximizing returns and managing risk.

- The buy call and sell put option strategy offers a choice between buying calls for lower risk tolerance and writing puts for traders with higher risk tolerance.

Understanding Options Trading Basics

Options trading lets you buy and sell contracts. These contracts give you the right to buy or sell an asset at a set price. To use the buy call and sell put option strategy well, you need to know the basics. This includes understanding call and put options.

At the heart of options trading are call and put options. A call option lets you buy an asset, while a put option lets you sell it. Knowing this helps you decide the direction of your trade and its possible outcomes.

What Are Call and Put Options?

Call and put options are the main types of options contracts. A call option lets you buy an asset at a set price, called the strike price. A put option lets you sell an asset at the strike price. It's key to know the difference between these options to make smart trading choices.

Key Terminology in Options Trading

Some important terms in options trading include:

- Strike price: the price at which you can buy or sell the asset

- Expiration date: the last day you can use the option

- Underlying asset: the security the option is based on

These terms are basic to options trading basics and are used a lot with call and put options. Understanding these helps traders navigate the complex world of options trading better and make informed choices.

The Mechanics of the Buy Call and Sell Put Strategy

The buy call and sell put strategy is a common way to trade options. It involves buying a call option and selling a put option on the same asset. This strategy lets the buyer buy the asset at a set price and the seller sell it at a set price. Knowing how options trading mechanics work is key to using this strategy well.

To use this strategy, traders must watch the asset's price and how volatile it is. Selling a put option can bring in extra income, as the seller gets a premium. But, it's important to have a plan to exit or hedge against losses. Deciding to sell a call option depends on expecting the asset's price to fall. Selling a put option depends on expecting the asset's price to rise.

How the Strategy Works

The buy call and sell put strategy works like this:

- Buying a call option to gain the right to buy the underlying asset at a specified price

- Selling a put option to obligate the seller to sell the underlying asset at a specified price

- Receiving a premium from the buyer of the put option

- Having an exit strategy or hedge in place to protect against possible losses

Entry and Exit Points

Choosing the right time to enter and exit is critical when using this strategy. It can help earn extra income, but understanding the buy call and sell put strategy and its risks is vital. By knowing the options trading mechanics and having a solid plan, traders can reach their investment goals.

Benefits of the Buy Call and Sell Put Strategy

The buy call and sell put strategy can help investors earn more. It combines two options to make a strategy that brings in income and protects against losses. This is very useful in markets that are hard to predict.

Some of the key benefits of this strategy include:

- Potential for enhanced returns: This strategy can help investors earn more than buying the asset alone.

- Risk mitigation: Selling a put option can lower risk in unpredictable markets. The premium from the sale can help cover losses.

- Flexibility: This strategy can be adjusted to fit what each investor wants. It offers different outcomes and risk levels.

This strategy is great for investors who want to make money and manage risk in unstable markets. It offers the chance for higher returns and helps reduce risk. Adding this to a diverse investment portfolio can be very beneficial.

| Strategy | Benefits | Risk Level |

|---|---|---|

| Buy Call and Sell Put | Enhanced returns, risk mitigation | Medium |

| Buy Call | Potential for high returns | High |

| Sell Put | Income generation, risk reduction | Medium |

When to Use the Buy Call, Sell Put Strategy

The buy call, sell put strategy is a common tactic in options trading. It helps investors make money and protect against losses. Knowing when and where to use this strategy is key to success.

Use this strategy when you think the stock will go up. You buy a call option and sell a put option. This way, you can profit if the stock price increases. The best time for this strategy is when the market is stable or rising, with low volatility and a positive outlook.

Ideal Market Conditions

The buy call, sell put strategy works best in certain conditions. These include:

- Low volatility: A stable market with minimal stock price changes.

- Positive market sentiment: A rising market with a good outlook for the stock.

- High demand for the underlying asset: A strong demand for the stock, which can increase its price.

Investor Profiles Best Suited for This Strategy

This strategy is for investors seeking high returns and willing to take some risk. They should know about options trading and be able to analyze market trends.

| Investor Profile | Risk Tolerance | Investment Goals |

|---|---|---|

| Aggressive Investor | High | High returns, willing to take on higher risk |

| Conservative Investor | Low | Lower returns, prioritizing capital preservation |

Understanding when and where to use the buy call, sell put strategy is vital. It helps investors make smart choices and increase their earnings. Always evaluate the market and the stock before starting, and keep an eye on changes.

Comparing This Strategy to Other Options Strategies

When looking at options trading strategies, it's key to weigh their benefits and risks. The buy call and sell put strategy can be compared to others like the covered call and naked put. Knowing how these strategies differ helps in picking the right one for your investment goals.

Key Differences

The buy call and sell put strategy involves buying a call and selling a put. The covered call is selling a call on an asset you own. The naked put is selling a put without owning the asset.

- The buy call and sell put strategy offers higher returns but comes with more risk.

- The naked put is riskier because you're selling a put without owning the asset.

- Comparing these strategies helps investors make better choices.

By comparing buy call and sell put strategy to others, investors can find the best fit for their goals and risk level. Each strategy has its own benefits and risks. It's important to carefully consider each before deciding.

Key Considerations Before Implementing the Strategy

Before diving into the buy call and sell put strategy, it's vital to look at market trends. Knowing the current market and the risks and rewards is key. The options trading world is complex. Being aware of the strategy's key points can help reduce risks.

Using risk management tools like stop-loss orders and setting the right position size can limit losses. It's also important to understand time decay. Options lose value over time. By grasping these concepts, investors can boost their success chances.

Some important things to think about when using the buy call and sell put strategy include:

- Market volatility and trends

- Risk management techniques

- Time decay and its impact on option value

- Position sizing and stop-loss orders

By carefully looking at these factors and using them in the strategy, investors can make better choices. This can lead to more success in the options trading market.

Crafting a Winning Strategy

To succeed in options trading, you need a solid strategy. Crafting a winning buy call and sell put strategy means setting realistic profit targets. It also involves spreading out your trades to manage risk.

Key points for crafting a winning buy call and sell put strategy include:

- Setting clear and achievable profit targets

- Diversifying within options trading to reduce risk

- Staying up-to-date with market trends and economic indicators

By following these tips and focusing on crafting a winning buy call and sell put strategy, traders can boost their success. Always aim for realistic profit targets and adjust to market changes.

| Strategy | Description |

|---|---|

| Buy Call and Sell Put | A strategy that involves buying a call option and selling a put option |

| Straddle | A strategy that involves buying a call option and a put option at the same strike price |

Tools and Resources for Traders

Traders need the right tools and resources for the buy call and sell put strategy. They should look for recommended platforms like online brokerages and trading software. These tools offer real-time market data, trading charts, and risk management features.

Traders also benefit from essential books and guides. Books like "Technical Analysis of the Financial Markets" by John J. Murphy and "Options as a Strategic Investment" by Lawrence G. McMillan are great. They help traders understand the strategy better and improve their skills.

Some top tools and resources for buy call and sell put strategy include:

- TradingView platform

- Investopedia

- Chartered Market Technician (CMT) Program

These resources give traders the knowledge and skills to succeed in the markets.

Real-World Examples

Real-world examples of the buy call and sell put strategy offer valuable insights. A case study of a successful use can show how to apply it in various market conditions. For example, in 2020's high volatility, traders profited from market swings using this strategy.

One notable example is the options trading on Tesla Inc. (NASDAQ: TSLA) on February 21, 2020. This showed the strategy's ability to yield significant gains. Traders who bought call options on Tesla made money as the stock rose. Those who sold put options earned from premiums. Here are some key points to keep in mind when using this strategy:

- Buying call options can offer unlimited upside, while selling put options can bring in income from premiums.

- Choosing the right strike prices and expiration dates for options contracts is critical.

- Understanding the risks is essential, and never risk more than you can afford to lose.

Studying real-world examples and case studies can deepen a trader's understanding of the buy call and sell put strategy. It helps in applying it effectively in trading practices.

Common Mistakes to Avoid

When using the buy call and sell put strategy, knowing common mistakes is key. One big error is overleverage, which can increase losses. Overleverage happens when traders use too much margin, risking big losses if the market goes against them.

Ignoring market sentiment is another big mistake. Traders should always check the current market conditions and trends before trading. Not diversifying and lacking discipline can also hurt portfolio growth. Buying options with too much margin and buying out-of-the-money (OTM) call options can lead to more losses than wins for new traders.

Here are some tips to avoid these mistakes:

- Start with a small number of contracts as a test amount

- Have an exit plan, including setting upside and downside exit points

- Ensure liquidity in options trading to prevent wide bid-ask spreads

- Understand technical indicators such as delta, gamma, vega, and theta

By knowing these common mistakes and how to avoid them, traders can boost their success and reduce losses. It's important to trade options with a solid strategy and discipline for long-term success.

| Mistake | Consequence | Prevention |

|---|---|---|

| Overleverage | Amplified losses | Use appropriate margin levels |

| Ignoring market sentiment | Poor investment decisions | Consider current market conditions and trends |

| Lack of diversification | Disrupted portfolio growth | Diversify options strategies |

Conclusion: Making Informed Decisions

The buy call and sell put strategy can boost your investment returns. But, it's key to know its risks and rewards well.

Final Thoughts on the Strategy

Success with this strategy comes from analyzing market trends and managing risks. Keep up with economic news and improve your trading skills. This way, you can reach your financial goals and handle market ups and downs.

Encouragement for Further Learning

Being a top options trader is a journey of learning and growing. Check out the resources and guides in this article. Stay curious and always look to learn more. With hard work and smart choices, you can make the most of the buy call and sell put strategy and succeed in options trading.

FAQ

What are call and put options?

Call options let the buyer buy the asset. Put options let the buyer sell the asset.

How does the buy call and sell put strategy work?

This strategy involves buying a call and selling a put on the same asset. It gives the buyer the right to buy and the seller the obligation to sell at set prices.

What are the benefits of the buy call and sell put strategy?

It can offer higher returns and reduce risks in volatile markets. This is because it can earn more than just buying the asset.

When is the buy call and sell put strategy best used?

It's best when the asset's value is expected to rise. It's for investors looking for high returns but ready to take some risk.

How does the buy call and sell put strategy compare to other options strategies?

It offers higher returns than the covered call but is riskier. It's safer than the naked put strategy, which is riskier because it involves selling a put without owning the asset.

What key considerations should be made before implementing the buy call and sell put strategy?

Traders should look at market trends, economic indicators, and risk management. This helps make informed decisions and avoid big losses.

What tools and resources are available for traders using the buy call and sell put strategy?

There are online brokerages and trading software for options trading. Books and guides also offer valuable tools and resources for the strategy.

Can you provide real-world examples of the buy call and sell put strategy being used successfully?

Yes, there are case studies of successful uses and lessons from failed attempts. These can offer insights and lessons for new traders.

What are some common mistakes to avoid when using the buy call and sell put strategy?

Avoid overleveraging and ignoring market sentiment. These mistakes can lead to big losses with this strategy.