Become a Savvy Stock Trader with Our Expert Lessons

Today's financial markets are complex, making it key to learn stock trading well. You need expert guidance and a solid online trading course. The New York Institute of Finance says a good course can teach you to trade stocks and options wisely.

Our lessons give traders the tools and strategies for success. We focus on technical terms to teach stock selection, asset allocation, and sector analysis. This builds a strong base for trading with confidence. Join our online course to boost your trading skills and reach your financial goals.

Key Takeaways

- Stock trading lessons are vital for market success.

- A good online course teaches you to trade stocks and options well.

- Our lessons cover stock selection, asset allocation, and sector analysis.

- Learn to trade shares with our online course and get better at it.

- Our lessons equip traders with the tools and strategies for market success.

- We focus on technical terms to help you trade confidently.

Understanding the Basics of Stock Trading

Stock trading is complex and needs a deep market understanding. For beginners, stock trading classes near me or trading classes near me are great. A good trading education helps in making smart investment choices.

First, learn the basics of stock trading. This includes different stock types, trading strategies, and risk management. The Stock Market Savvy program teaches these concepts. Learning from pros and keeping up with trends helps traders make better choices.

What is Stock Trading?

Stock trading is about buying and selling stocks, which show you own a piece of a company. The aim is to buy low and sell high to make a profit. With online trading, starting is easy, but knowing the market is key.

Key Terminology Every Trader Should Know

Important terms include bull market, bear market, and stock market correction. A bull market sees stock prices go up, while a bear market sees them go down. A correction is a 10% drop in the market. Knowing these terms helps traders make smart moves.

For more learning, check out online courses and trading education programs. By grasping the basics, traders can succeed and reach their investment goals.

Setting Up Your Trading Account

To start trading, you need to set up a trading account with a good brokerage. This means picking the right brokerage, understanding account types, and knowing what to look for when opening an account. An online stock trading course can help a lot with this.

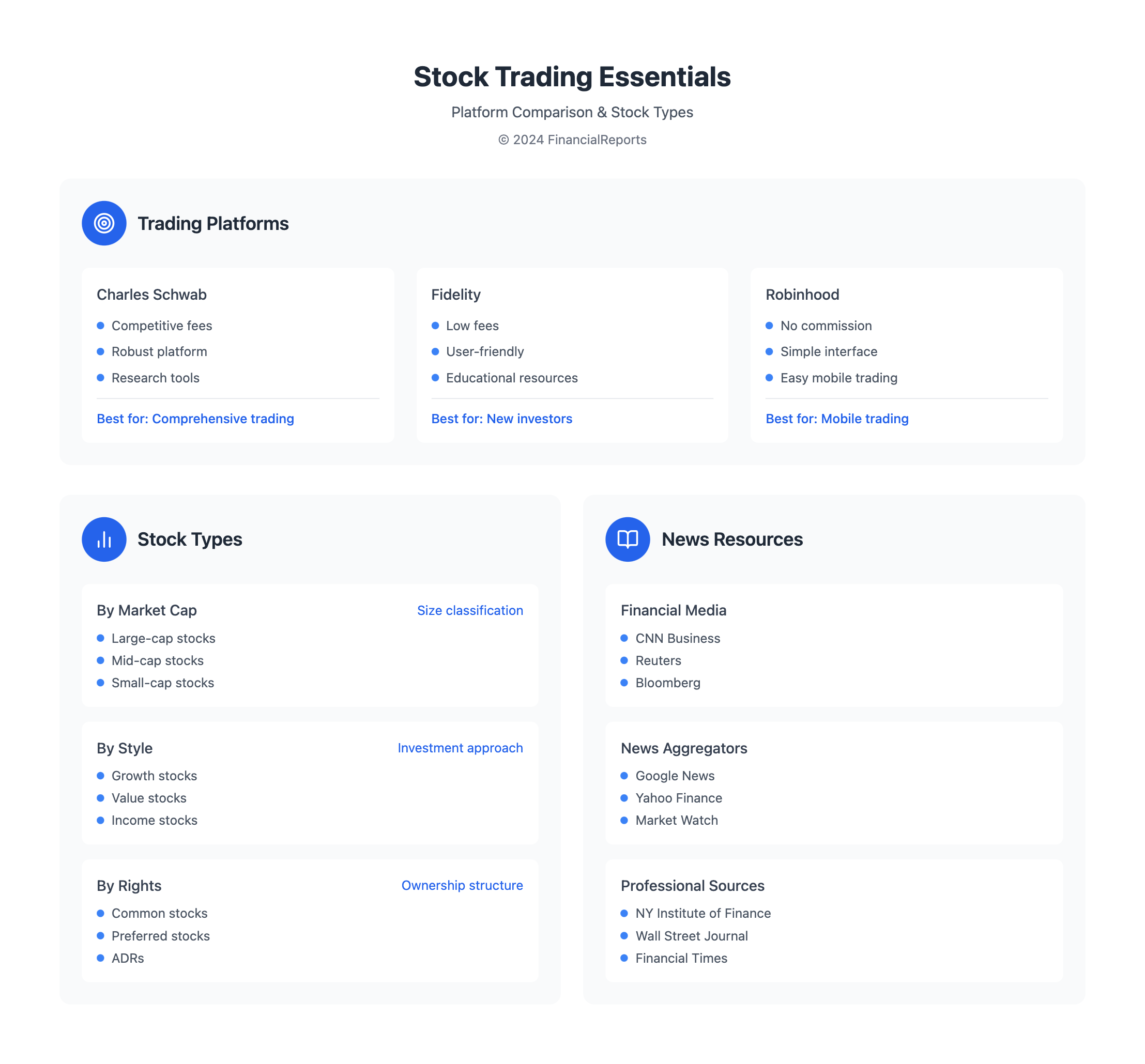

A stock market school teaches trading lessons online. These lessons cover the basics, like choosing a brokerage, funding your account, and using a trading platform. Popular brokerages include Charles Schwab, Fidelity, and Robinhood.

When picking a brokerage, think about these things:

- Fees and commissions

- Trading platform and tools

- Customer support and education

- Account types and options

By taking an online stock trading course and learning from a stock market school, you can learn how to set up a trading account. You'll be ready to trade with confidence. With the right trading lessons online, you can understand trading and make smart investment choices.

| Brokerage | Fees and Commissions | Trading Platform and Tools |

|---|---|---|

| Charles Schwab | Competitive fees and commissions | Robust trading platform and tools |

| Fidelity | Low fees and commissions | User-friendly trading platform and tools |

| Robinhood | No fees and commissions | Simple and intuitive trading platform and tools |

Types of Stocks and Their Characteristics

Knowing the different types of stocks is key for traders. A good stock trading school can teach you well. The stock market has many categories, like ownership and size. Online classes help traders understand these and make smart choices.

A good training program will teach you about common and preferred stocks. Common stocks give you a piece of the company and voting rights. Preferred stocks offer steady income and stability. Stocks have unique traits, such as size and investment style.

- Market capitalization: large-cap, mid-cap, and small-cap

- Investment style: growth stocks and value stocks

- Economic sensitivity: cyclical and non-cyclical stocks

Knowing these traits helps traders pick the right strategy. A solid stock trading school program is essential. Online classes offer flexibility. With the right training, traders can reach their goals.

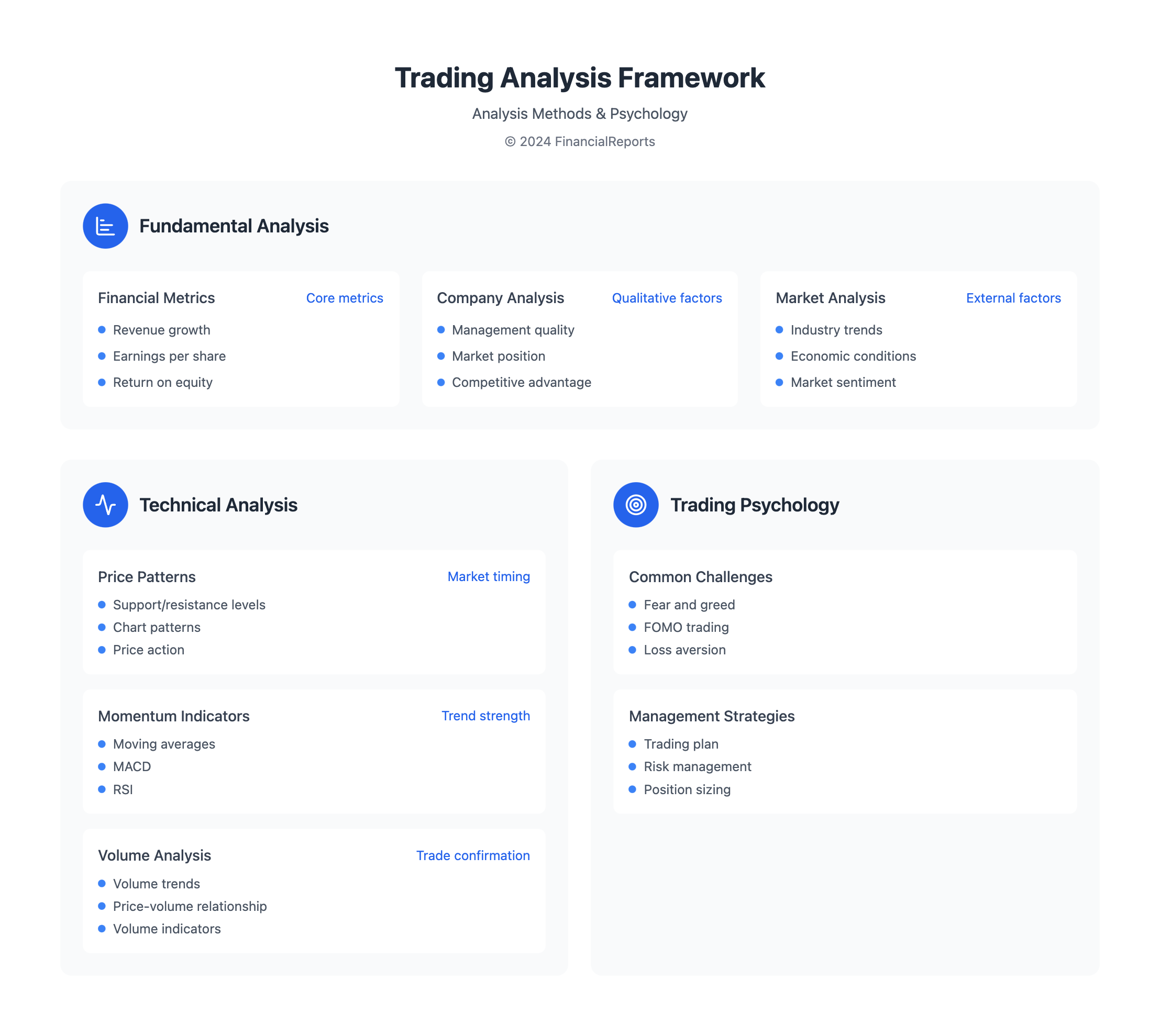

Fundamental Analysis: Assessing Stock Value

To learn share trading and make smart investment choices, understanding fundamental analysis is key. It looks at a company's financial health, management, and how it stands against competitors. By taking an online trading course or attending stock trading classes, investors can learn to evaluate stocks well.

Key Financial Metrics to Analyze

Some important financial metrics to check include:

- Revenue and earnings growth

- Return on equity (ROE) and debt-to-equity (D/E) ratio

- Price-to-earnings (P/E) ratio and earnings per share (EPS)

These metrics give insights into a company's financial health and market position.

Importance of Earnings Reports

Earnings reports are vital in fundamental analysis. They give a detailed look at a company's financial performance. By studying earnings reports, investors can find trends, identify issues, and make better investment choices.

The New York Institute of Finance offers a professional certificate program. It covers fundamental analysis and stock value assessment. This program helps investors gain the skills and knowledge needed to succeed in the market.

Technical Analysis: Reading Charts and Trends

Technical analysis is key to understanding charts and trends. It helps in making smart investment choices. You learn about technical indicators, support and resistance levels, and how to use this info. For those seeking trading education, many resources are out there, like trading classes and stock market schools.

Technical traders use line, bar, and candlestick charts. Support levels are like a floor for stock prices, showing when prices might turn up. Resistance levels are like a ceiling, showing when prices might turn down. They look for patterns like triangles and flags to decide when to buy or sell.

To get good at technical analysis, you need to use many indicators. This includes volume, moving averages, and chart patterns. It helps in making better decisions and avoiding false signals. For better trading skills, there are many resources, including classes and online schools.

| Technical Indicator | Description |

|---|---|

| Simple Moving Averages | Average stock price over a specified period |

| MACD | Measure of stock price momentum |

| RSI | Measure of stock price strength |

Understanding technical analysis and using the right tools can help traders make better choices. Whether you're looking for classes near you or online, there are many options to help you reach your trading goals.

Developing a Trading Strategy

Creating a trading strategy is key for traders. It means knowing about different strategies like day trading and swing trading. A good plan helps traders make smart choices and reach their money goals. With the right online courses and training, traders can craft a strategy that fits them.

To make a strategy, traders must pick what market to trade in. This could be stocks, options, futures, forex, or commodities. They also need to decide on a time frame, whether it's day trading, swing trading, or investing. Backtesting is important to see how a strategy worked before and might work again. The New York Institute of Finance offers a program that teaches strategy development and risk management.

Some important things to think about when making a strategy include:

- Testing a strategy with different indicators and time frames to see how it performs

- Not relying on strategies that always work, as this is not possible

- Looking for strategies that make a profit within a certain time frame

- Adjusting strategies to fit current market conditions

By following these tips and using the right online courses, traders can make a strategy that helps them reach their financial goals.

| Trading Strategy | Description |

|---|---|

| Day Trading | Buying and selling stocks within a single trading day |

| Swing Trading | Buying and selling stocks over a shorter period, typically 3-5 days |

Emotions and Psychology in Trading

Emotions are key in trading, and knowing how to handle them is vital. A stock trading school teaches the importance of emotions and psychology. Learning to control emotions helps traders make smart choices and reach their financial targets.

Traders often fall into traps like fear and greed, leading to bad decisions. Fear can make traders leave trades too soon, while greed can cause them to trade too much. Online share trading classes help by teaching how to stay disciplined and manage feelings.

To learn share trading well, traders must grasp the role of psychology. This means spotting biases like negativity and gambler's fallacy. It also means creating a trading plan that considers emotional factors. This way, traders can better their trading psychology and make wiser investment choices.

Some key strategies for managing emotions in trading include:

- Building a trading plan and sticking to it

- Filtering out market noise and focusing on logical decision-making

- Conducting thorough research before making investment decisions

By understanding and controlling emotions, traders can boost their trading success and meet their financial goals. Whether through a stock trading school or online share trading classes, mastering emotions and psychology is key to success.

Staying Informed: Market News and Trends

To stay ahead in the stock market, knowing the latest news and trends is key. Trading education is vital here. A top stock market school will teach you to analyze trends and make smart investment choices. An online trading course helps you understand stock trading and keep up with market news.

Many sources provide market news and trends. You can find it on CNN, BBC, The New York Times, Reuters, and The Globe and Mail. Google News and AP News also gather news from various places. Plus, podcasts and services like Google Alerts and Feedly offer insights and updates on the market.

Places like the New York Institute of Finance offer professional programs. These include learning about market news and trends. These programs can boost your trading education and give you an edge in the stock market. By staying informed and learning, you can make better investment choices and reach your financial goals.

| Source | Description |

|---|---|

| CNN | 24/7 news coverage |

| Google News | News aggregator platform |

| New York Institute of Finance | Professional certificate programs |

Continuing Your Education in Stock Trading

Starting your journey as a stock trader is just the beginning. Even the most experienced traders know that learning never stops. Our stock trading lessons give you a solid base, but true mastery comes from a lifelong dedication to learning.

Looking into online stock trading courses and joining trading communities keeps you current. You'll learn about new trends, strategies, and best practices. Books, top websites, and forums offer insights and chances to learn from pros.

Spending time on your trading training boosts your decision-making skills. It also helps you develop discipline and emotional control for the fast-changing markets. Stay curious and let your love for stock trading lead you to success.

FAQ

What is stock trading and how does it work?

Stock trading is about buying and selling shares of companies on the stock market. Traders try to make money by buying low and selling high. Knowing the basics is key to doing well in the markets.

How do I set up a trading account?

To start, pick a good brokerage and understand your account types. Think about fees, platform features, and support. Our lessons will help you set up your account and begin trading.

What are the different types of stocks and their characteristics?

There are common and preferred stocks, each with its own traits. Common stocks give voting rights and dividends. Preferred stocks have set dividends but no voting rights. Knowing these differences helps in building a strong portfolio.

How do I perform fundamental analysis to assess stock value?

Fundamental analysis looks at a company's financials and trends. It helps find a stock's true value. Our lessons will teach you to analyze financial data and understand earnings reports.

What is technical analysis and how can it help me make trading decisions?

Technical analysis uses charts to spot patterns and trends. It helps in timing trades. Our lessons will cover the basics of technical indicators and how to use them.

How do I develop a successful trading strategy?

A good strategy involves understanding different trading styles and managing risk. Our lessons will guide you in creating a plan, setting goals, and using analysis to make smart decisions.

How do emotions and psychology affect my trading performance?

Emotions like fear and greed can impact trading. Understanding and managing them is key. Our lessons will help you avoid common traps and stay disciplined.

How can I stay informed about market news and trends?

Staying informed is vital. Use reliable news sources and understand market sentiment. Our lessons will show you how to find and use market information for your strategies.

What resources are available for continuing my stock trading education?

Continuous learning is important for traders. Our lessons will suggest books, online resources, and communities to help you grow your skills.