Balance Sheet Format PDF: Free Template Download

Financial reporting is key for managing a business well. A correct balance sheet shows how a company stands financially. Our balance sheet PDF gives a complete template. It meets the needs of growing and big businesses. This balance sheet template makes presenting financial data professional and simple.

The balance sheet format PDF is designed for various financial details. It covers current and fixed assets, other assets, liabilities, and owner's equity. It's easy to use and modify. This lets financial experts outline assets and liabilities easily. They are vital for figuring out a company's net worth and health.

Key Takeaways

- Our balance sheet template improves financial report accuracy and quickness.

- It breaks down key financial parts for easy data work and checking.

- It helps get a full view of a company's financial state at any time.

- Using a template follows industry rules and makes financial papers consistent.

- The template helps in working efficiently by giving a reliable basis for financial judgement.

Understanding Balance Sheets and Their Importance

Balance sheets are key in business accounting. They show a company's financial health at a specific time. They allow a deep look into financial reporting practices. Thanks to them, stakeholders and investors can figure out a company's net worth.

Definition of a Balance Sheet

A balance sheet shows a company's assets, liabilities, and shareholders' equity. It's crucial for assessing the business's capital structure and financial standing. This makes it an essential tool for both internal and external evaluation.

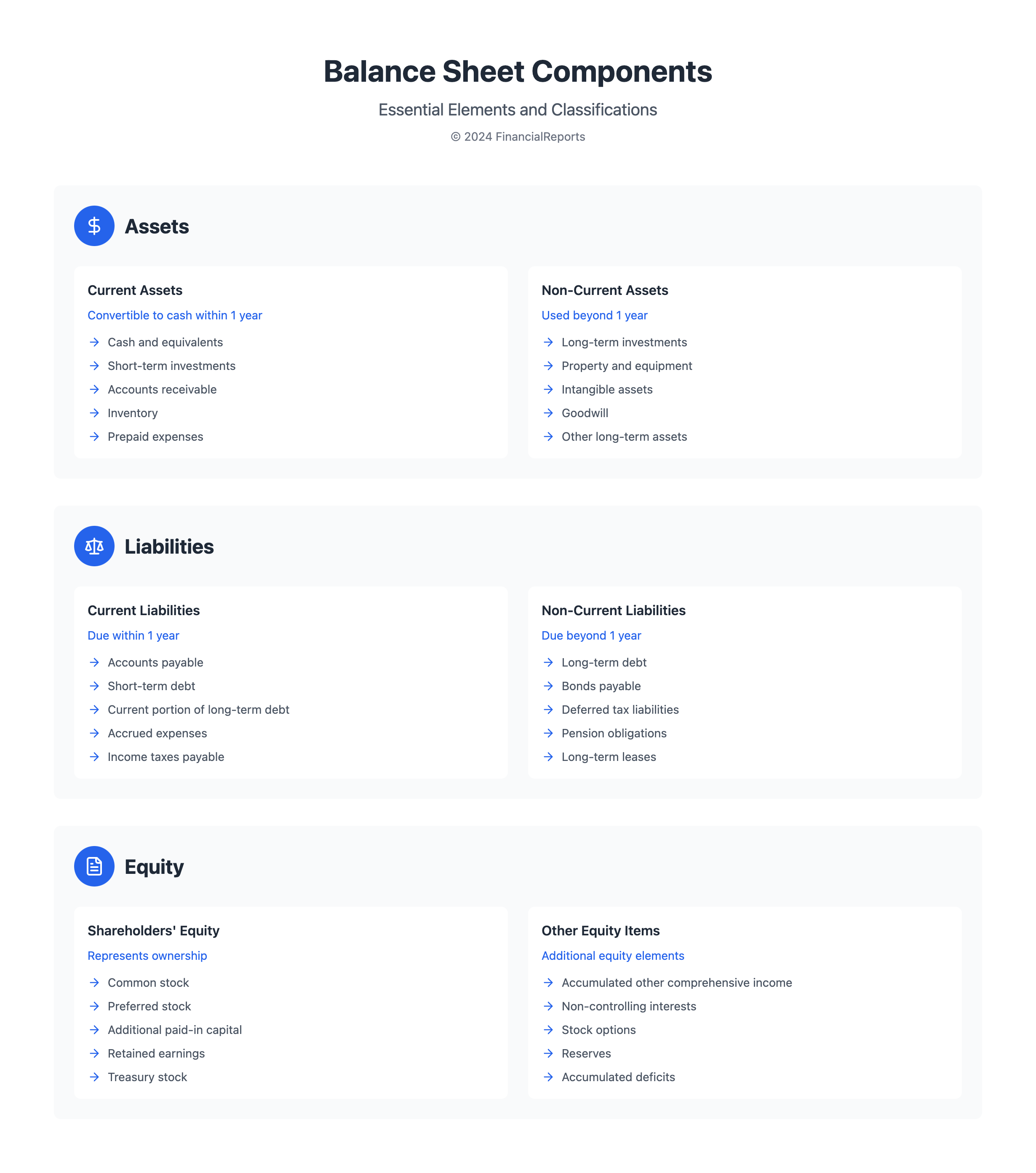

Components of a Balance Sheet

A balance sheet is split into two parts: assets on one side and liabilities and shareholders' equity on the other. Each part gives vital information:

- Assets: Include current and non-current items like cash, mutual funds, and brokerage accounts.

- Liabilities: Encompass both short and long-term debts such as mortgages, car loans, and credit card debt.

- Equity: Shows shareholders' equity, also known as Owner's Equity or Partner's Capital depending on the business type.

Purpose of Balance Sheets in Business

Balance sheets play a big role in financial reporting. Their main job is to compare a company’s assets against its liabilities. This helps calculate the company's net worth. Investors use this info to judge if a business is worth investing in. It also helps companies make smart decisions about where to use their resources, plan finances, and check performance.

To get a full financial picture, balance sheets should be reviewed with other financial statements. Together with the Statement of Cash Flows and the Statement of Retained Earnings, they offer a complete look at a company’s financial activities. Analyzing these documents together is crucial. It helps set business accounting tactics that meet company goals and regulations.

Key Elements of a Balance Sheet Format

Understanding a balance sheet's key pieces is crucial to gauge a company's financial health. It has three main parts: balance sheet assets, current liabilities, and owner's equity. Each part gives insights into the company's financial workings and its stability.

Assets: Current and Non-Current

It's vital to know which assets are current and which are non-current. Current assets, like cash and inventory, are used daily and turned into cash within a year. Meanwhile, non-current assets, such as real estate, offer long-term value.

Liabilities: Short-Term and Long-Term

Liabilities are split into current and non-current, showing short-term and long-term debts. Current liabilities are short-term debts like accounts payable, needing payment within a year. Non-current liabilities, like long-term debt, show longer commitments and are key for future planning.

Equity: Owner's Investment and Retained Earnings

Owner's equity shows the owner’s part of the company. It covers initial investments and retained earnings, which are profits put back into the business. This shows both the owner's value in the company and how reinvestment helps growth.

| Category | Components | Function |

|---|---|---|

| Current Assets | Cash, Inventory, Accounts Receivable | Support daily operational liquidity |

| Non-Current Assets | Real Estate, Equipment | Long-term value and operational support |

| Current Liabilities | Accounts Payable, Business Line of Credit | Financial obligations due within one year |

| Non-Current Liabilities | Long-term Debt | Financing for long-term projects and purchases |

| Owner's Equity | Initial Investments, Retained Earnings | Owner’s financial interest and reinvestment in the business |

The parts of a balance sheet—balance sheet assets, current liabilities, and owner's equity—are key for understanding a company's finances. Knowing these helps make smart decisions and manage finances strategically.

How to Create a Balance Sheet

A strong balance sheet is key in managing finances well. It helps maintain accurate accounts and supports smart choices in business. This guide will show you how to make a balance sheet. It covers each step, points out mistakes to avoid, and shares tips for error-free records.

Step-by-Step Guide

To start a balance sheet, list all assets, liabilities, and shareholders' equity. This shows the business's financial state at a certain time. Begin with current assets like cash and goods for sale. Then, move on to long-term assets such as land and machinery.

Next, note down the liabilities, split into short and long-term debts. The last part shows shareholders' equity. This part is important as it shows the value shareholders have in the company.

| Type | Description | Examples |

|---|---|---|

| Current Assets | Liquid assets due to be converted into cash within a year. | Cash, Accounts Receivable, Inventories |

| Non-current Assets | Assets that will provide benefits beyond one year. | Property, Plant & Equipment, Patents |

| Current Liabilities | Debts or obligations due within one year. | Accounts Payable, Salary Payable |

| Non-current Liabilities | Long-term financial obligations not due within the next year. | Long-term Debts, Bonds Payable |

| Shareholders’ Equity | The company's assets minus its liabilities, representing the net worth. | Capital, Retained Earnings |

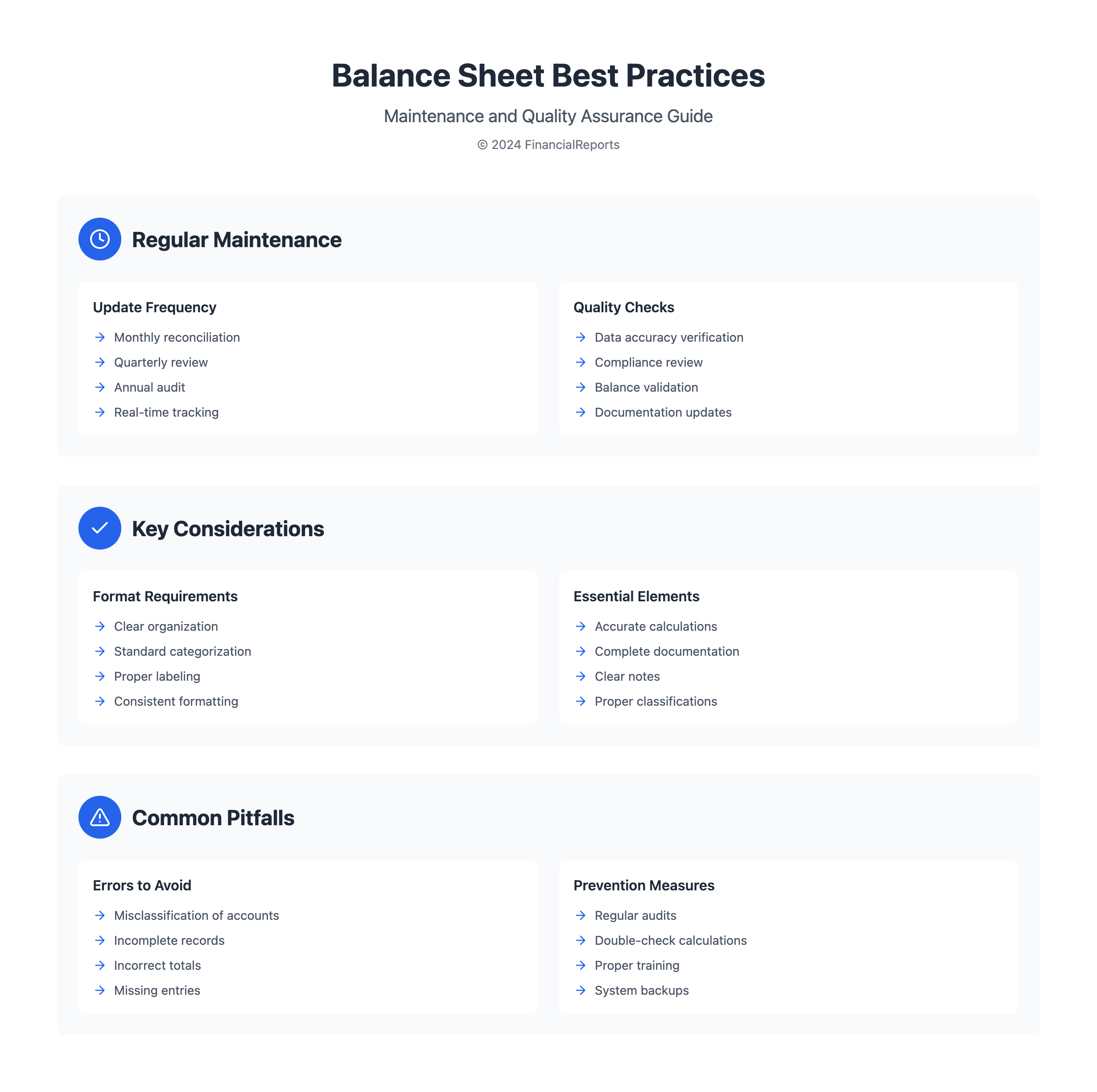

Common Mistakes to Avoid

When making balance sheets, it's easy to make errors. For example, assets and liabilities might be placed in the wrong categories. Accurate asset valuation is key. It's also essential to correctly list liabilities as current or non-current.

Best Practices for Accuracy

To keep financial records accurate, double-check all numbers. Regular audits help ensure data is correct. Using modern accounting software can make this easier and reduce errors. Training staff in the latest accounting rules also helps keep financial documents precise.

By following these steps, you can manage a balance sheet well. It's crucial for internal and external parties, like investors and regulators. They depend on accurate reports for making wise decisions.

Downloading Balance Sheet Templates

Professionals in different fields look for efficient ways to handle their financial reports. They often use balance sheet templates found in PDF financial documents. This part talks about how to use these templates well.

Benefits of Using PDF Templates

PDFs are known for staying the same on all devices. When you download a balance sheet in PDF, the format stays perfect. This makes your financial reports easy to read and consistent. Also, PDFs are safe from unwanted changes, keeping your financial info secure.

Where to Find Free Templates

Many online sites let businesses download balance sheet templates for free. These templates are a great help for companies wanting a solid financial plan. You can find them in various formats, like Google Docs and MS Excel, and adjust them for your business.

Comparing Different Template Formats

Finding the best template format helps you customize your financial reports. It shows your specific industry needs. Below is a detailed comparison of format compatibility and sizes:

| Template Type | File Formats | Size |

|---|---|---|

| Pro Forma Balance Sheet | Doc, Docx, PDF | 33.8KB |

| Sample Balance Sheet | Xlsx, Xls, PDF | 21.5KB |

| Projected Balance Sheet | Numbers, Pages, PDF | 27.6KB |

| Common Size Balance Sheet | Google Sheets, PDF | 450KB |

| Partnership Balance Sheet | MS Excel, PDF | 18KB |

These options make it easy for different companies to find what works best. Picking the right size and format is key. It helps in making precise financial documents for business analysis and planning.

Customizing Your Balance Sheet Format

To make your finance tools work better for you, it's key to customize. Add balance sheet customization, brand your financial documents, and use templates that fit your industry. This makes your finances clear and professional while showcasing your unique financial position.

Modifying PDF Templates

Start by changing a PDF template to suit your needs. Adjust account titles to better match what your business does. This lets you tweak templates for a true picture of your financial health.

Adding Company Branding

Adding your brand to balance sheets is crucial. It makes every financial report clearly yours. Logos and colors ensure your documents stand out, building trust and recognition.

Tailoring for Specific Industries

Using templates designed for your industry helps follow rules and fits your sector's needs. Customizing for your industry isn't just smart; it's strategic. It makes your business analysis and investor appeal stronger.

| Feature | Benefits |

|---|---|

| Customized Financial Titles | Enhanced relevancy and clarity for specific business operations |

| Branded Financial Documents | Increased brand recognition and trust |

| Industry-Specific Templates | Assured compliance with sector regulations and standards |

Importance of Regular Balance Sheet Updates

Keeping financial records accurate with regular balance sheet updates is vital for any company. This truthfulness is key for both the company's team and investors. The latter rely on fresh data for smart choices.

Frequency of Updates

Most firms update their balance sheets every quarter. This matches fiscal report needs. Yet, sectors with fast-paced dealings may do it monthly. It helps in keeping finances right on track.

Impact on Financial Health

Updating balance sheets often shows a company’s current financial status clearly. It's a peek into assets, debts, and equity. This clarity aids everyone in seeing how well strategies are working.

Tools for Tracking Changes

Modern accounting software is crucial for record accuracy. It automates data entry with each transaction. Thus, it keeps the balance sheet instantly up-to-date.

| Year | Forex Reserves in Asia (USD trillion) | % of GDP | Central Bank Balances in Advanced Economies (USD trillion) |

|---|---|---|---|

| 2006 | 2 | 45% | 8 |

| Current | 5+ | >45% | 8+ |

The table shows Asia's forex reserves growing since 2006. It also looks at advanced economies' central bank balances. These stats underline how key balance sheet updates are. They help judge economic health and guide decisions.

Analyzing Your Balance Sheet

An effective balance sheet analysis involves using key financial metrics. It looks at the business's health and stability. Financial analysis with balance sheets identifies strengths and concerns. This aids in making smart choices.

Key Financial Ratios to Consider

Financial analysis often includes balance sheet ratios. These ratios show a company's financial leverage and ability to pay debts. Here are important ratios analysts use:

- Current Ratio: Current assets divided by current liabilities, a measure of liquidity.

- Debt to Equity Ratio: Total liabilities divided by shareholder equity, indicating debt financing levels.

- Acid-Test Ratio (Quick Ratio): A stricter liquidity measure, calculated without inventory against liabilities.

For a full financial picture, combine balance sheet ratios with income statements and cash flows.

Identifying Trends Over Time

Trend identification involves tracking financial metrics through time. This can highlight growth or issues. For example, changes in assets or liabilities over five years can indicate strategies or liquidity problems.

Making Informed Business Decisions

Making informed decisions requires analyzing balance sheets and financial documents. This lets decision-makers understand financial stability and the impact of their strategies.

| Year | Current Ratio | Debt to Equity Ratio | Acid-Test Ratio |

|---|---|---|---|

| 2020 | 1.5 | 0.6 | 1.1 |

| 2021 | 1.7 | 0.5 | 1.3 |

| 2022 | 1.8 | 0.4 | 1.2 |

The table shows financial improvement over years. The Current and Acid-Test Ratios went up while Debt to Equity Ratio went down. This means better financial health and less debt reliance.

Tools and Software for Balance Sheets

Picking the right tools for balance sheets is key for a business's money health. The market today has many accounting programs that help with financial records. The top software makes it easy to create balance sheets and works well with other money tools.

Popular Accounting Software

FreshBooks is a top choice because of its great features and easy use. It helps manage balance sheets in detail, covering all needed areas for correct finance reports.

Features to Look for in a Tool

Look for software that automates, is easy to use, and tracks finances in real time. These things help keep financial statements correct and updated. The software should also work with payroll and invoicing for a full finance view.

Integrating Balance Sheets with Other Financial Reports

Linking balance sheets with other reports is crucial for a full finance overview. Good software should easily connect with income statements and cash flow reports. This makes it simpler for businesses to plan and make smart decisions with a full view of their finances.

| Feature | Description | Impact on Financial Management |

|---|---|---|

| Automation | Makes repeating tasks easy and accurate. | Makes reporting more efficient and reduces mistakes. |

| Real-Time Tracking | Keeps finance data up-to-date instantly. | Helps in making quick, informed decisions. |

| Integration Capabilities | Connects with other finance reports like income statements. | Leads to better finance analysis and reports. |

Using strong accounting software and balance sheet tools is a must for businesses today. These tools boost how well a business runs and help with planning and following finance rules.

Real-World Examples of Balance Sheets

Looking at real-world balance sheet examples gives deep insights into successful financial tactics. Across various industries, these examples show effective strategies. They highlight the importance of sharp financial management.

Case Studies from Successful Companies

Top companies use smart financial strategies to keep their balance sheets strong. They pay close attention to financial details. This is shown in an analysis of Section 65 of SubTopic 40 in the Accounting Standards Codification.

They log assets at bought costs, following industry strategies. This careful reporting helps in planning and staying competitive.

Lessons Learned from Poorly Managed Sheets

Badly managed balance sheets can lead to big financial issues. A study shows mistakes like overvaluing assets or not reporting enough liabilities. These mistakes can misshow a company’s financial health.

It highlights the importance of following financial rules and having regular audits.

How Different Industries Approach Balance Sheets

Different industries manage balance sheets in unique ways. Tech firms might focus on intellectual property. Meanwhile, manufacturing companies report a lot on inventory and equipment.

For example, some rules specifically cover how to report manufacturing equipment. This ensures companies are clear and follow the rules closely.

- Technology Sector: Heavy emphasis on R&D and intellectual assets. Lessons from Section 65 of SubTopic 10 spotlight the dynamic approach needed for valuing intangible assets.

- Manufacturing: Focus on inventory and production equipment. Insights from Section 65 of SubTopic 20 demonstrate the necessity of regular depreciation updates and real-time asset valuation.

- Real Estate: Investment properties are central, requiring periodic revaluation to reflect market conditions, as advised by Section 50 of SubTopic 10.

A good balance sheet management requires careful record-keeping and following financial standards. It also needs to match with the company’s specific industry demands.

Frequently Asked Questions About Balance Sheets

For financial professionals, learning about balance sheets is crucial. We answer balance sheet FAQs. Our goal is to boost your financial skills and shed light on comparing it to income statements.

What is the Difference Between a Balance Sheet and an Income Statement?

A balance sheet and an income statement are different yet essential. A balance sheet shows a company's finances at one point in time. It follows the formula Assets = Liabilities + Owners' Equity. This sheet includes things like cash and patents.

On the other hand, an income statement shows money made and spent over time. It helps see if a company is doing well financially. This is vital for those looking to invest in the company.

How Often Should a Business Prepare a Balance Sheet?

How often to prepare a balance sheet depends on the business size and type. But doing it at least once a year is recommended. Many find it best to check it quarterly or monthly.

This regular check helps spot and fix money issues quickly. It helps in keeping the company financially healthy. Frequent checks are key to understanding how much debt a company has compared to what it owns.

Can a Balance Sheet be Used for Personal Finances?

Yes, balance sheets can help manage personal finances too. They help track what you own and owe. This method shows your overall financial situation clearly.

By using a balance sheet for yourself, you can make smarter money choices. It's a step towards better wealth management and planning for the future.

FAQ

What is a Balance Sheet?

A balance sheet is a financial overview of a company at a specific time. It lists assets, liabilities, and owner's equity.

What are the Key Components of a Balance Sheet?

Balance sheets have three main parts. Assets come in two types: current and non-current. Liabilities are short-term or long-term. Equity includes owner’s investment and earnings saved over time.

Why are Balance Sheets Essential in Business Accounting?

They show a company's financial stability and value. This information helps owners, investors, and lenders make smart choices.

How Can I Categorize Assets and Liabilities on a Balance Sheet?

Assets are divided into current, like cash, and non-current, such as property. Liabilities are grouped into short-term, like bills to pay, and long-term, for example, loans.

What Common Mistakes Should I Avoid When Creating a Balance Sheet?

Don't mix up assets and liabilities or value assets incorrectly. Always aim for accuracy to show your business's true financial state.

Where Can I Find Free Balance Sheet Templates?

Free templates are available online. Check financial sites, business portals, and accounting software for formats that suit your business.

How Often Should a Balance Sheet be Updated?

Update your balance sheet often. This could be monthly, quarterly, or yearly. Stay current to support wise decisions.

What Key Financial Ratios Should I Analyze on My Balance Sheet?

Focus on liquidity ratios like current ratio, solvency ratios such as debt-to-equity, and profitability ratios. They shed light on financial health and prospects.

What Features Should I Look for in Accounting Software for Balance Sheets?

Choose software that automates and updates in real time. It should integrate easily and offer detailed reports for managing balance sheets well.

How Can I Use a Balance Sheet for Personal Financial Management?

A personal balance sheet tracks your assets, liabilities, and net worth. This aids in making knowledgeable personal finance and investment decisions.

What is the Difference Between a Balance Sheet and an Income Statement?

A balance sheet shows financial status at one point. An income statement looks at financial activity over time, including income and expenses.

How do Different Industries Approach Balance Sheet Construction?

Industries have specific balance sheet requirements. These depend on standards, rules, and practices. Customize your balance sheet to suit these industry needs.