What Are the Formulas for a Balance Sheet in Excel?

Understanding how to make a strong balance sheet in Excel is key for anyone in finance. It shows a company's financial position at a certain time, highlighting assets, liabilities, and shareholders' equity. The formula that ties these together is Assets = Liabilities + Shareholders’ Equity. It's the core of double-entry accounting, helping to make accurate financial statements in Excel.

Using Excel formulas for balance sheet calculations allows for quick totaling of assets and liabilities. It mixes current with non-current assets and adds up all liabilities, both short-term and long-term. To figure out shareholders' equity, you add paid-in capital to retained earnings. Looking at companies like Apple Inc. shows how these formulas work in real life. A good balance sheet in Excel is about precise data and using Excel's tools for business.

Key Takeaways

- Assets, split into current or non-current, are what a company can turn into cash.

- Liabilities are what the company owes, both now and later.

- Shareholders' Equity is what's left for the owners after debts.

- Excel's advanced features can show financial changes with graphs.

- Zebra BI and Excel together make dynamic financial presentations for Powerpoint.

- Keeping a close eye on assets, liabilities, and equity is crucial for accurate finance reporting.

- Financial analysis should meet data visualization for clear decision-making and talking to stakeholders.

Understanding the Balance Sheet Structure

The balance sheet is key for showing a company's financial health at a snapshot. It's vital for detailed financial analysis. It shows what a company owns, owes, and the value for its shareholders. Let’s explore the big parts: assets, liabilities, and equity.

Assets, Liabilities, and Equity Explained

Assets can be anything from cash to buildings. They're divided into current and non-current based on how quickly they can be turned into cash. You've got Cash, Accounts Receivable, Inventory, and even long-term things like Buildings.

Liabilities show what the company must pay soon or later on. Current liabilities are due within a year like accounts payable. Non-current liabilities are things like loans that take longer to pay off. This shows a company's immediate and future financial duties.

Equity means what’s left for shareholders after debts are paid. It shows a company's worth and financial strength. It’s found by taking assets and subtracting liabilities.

The Accounting Equation

The balance sheet is based on a simple formula: Assets = Liabilities + Shareholders' Equity. This keeps the balance sheet in check, showing everything is accounted for. It highlights a company's health and ties into deeper financial analysis. It gives a clear picture of where the company stands financially.

| Category | Details | Impact |

|---|---|---|

| Current Assets | Includes cash, marketable securities, accounts receivable, inventory, and prepaid expenses. | Used to fund day-to-day operations and pay short-term obligations. |

| Non-Current Assets | Encompasses long-term investments, property, plant and equipment (PP&E), intangible assets, and goodwill. | Provides benefits over a long period and forms the backbone of the company’s long-term financial strategy. |

| Current Liabilities | Covers short-term financial obligations such as accounts payable, taxes owed, and short-term loans. | Indicates the company’s short-term financial health and liquidity status. |

| Non-Current Liabilities | Includes long-term financial commitments like bonds payable, long-term loans, and deferred tax liabilities. | Represents the company's long-term fiscal responsibilities and financing strategies. |

| Shareholders' Equity | Calculated as Total Assets minus Total Liabilities. Represents the company's net worth. | Indicative of the residual value to shareholders if company assets were utilized to extinguish liabilities. |

Stakeholders can make smart decisions using the balance sheet. It helps understand a company’s operation, liquidity, solvency, and financial leverage. This shows how the accounting equation is key for full financial analysis.

Key Components of a Balance Sheet

Understanding a balance sheet's core elements is key for checking a company's financial solvency. It also helps in making smart stakeholder investment choices. A balance sheet is a financial statement. It shows a company's financial state at a certain time. It lists assets, liabilities, and owner’s equity.

Current Assets vs. Non-Current Assets

Assets are important for a balance sheet. They are resources a company owns that are expected to bring future economic benefits. Assets are split into current and non-current, based on how fast they can be turned into cash. Current assets like cash, accounts receivable, and inventory can be liquidated within a year. Non-current assets include land and patents. They provide long-term value that supports a company's strategic goals.

Current Liabilities vs. Long-Term Liabilities

Liabilities are also critical for understanding financial solvency. They are divided into current and long-term. Current liabilities are debts due within a year including wages and taxes. Long-term liabilities are due after a year like bonds payable. Managing these ensures company stability and builds investor trust.

Owner's Equity Breakdown

Owner's equity is crucial too. It shows the investment by owners and shareholders in the company. It's found by subtracting total liabilities from total assets. This shows the company's net worth or actual value to stakeholders.

| Component | Description | Examples |

|---|---|---|

| Current Assets | Assets convertible to cash within one year | Cash, accounts receivable, inventory |

| Non-Current Assets | Assets providing long-term economic benefits | Land, buildings, equipment |

| Current Liabilities | Obligations due within the coming year | Accounts payable, wages, short-term loans |

| Long-Term Liabilities | Obligations due beyond one year | Long-term bonds, long-term leases, deferred tax liabilities |

| Owner's Equity | Residual interest in the assets of the company after subtracting liabilities | Capital stock, retained earnings, accumulated other comprehensive income |

This breakdown not only makes things clearer for investors but also paves the way for financial strength and business toughness.

Setting Up Your Excel Balance Sheet Template

Starting with an Excel balance sheet template means picking the right layout. This choice depends on how complex and big your financial data is. For startups, a simple format works best. But established businesses might need something more detailed. The goal is always the same: to keep an eye on financial progress and take charge of financial results.

Choosing the Right Layout for Your Needs

The first step is to make sure your Excel balance sheet template has clear labels. You'll want columns for "Previous Year", "Accounting Year", and other important times. This setup makes it easy to watch and compare finances over different periods. It helps you make smart choices based on solid financial info.

Essential Formatting Tips

Good formatting can make a balance sheet much easier to use and read. Here are key tips:

- Formatting headers: Bold the row headers to make sections like assets, liabilities, and equity stand out.

- Currency formatting: Use currency formatting for clear and consistent money values.

- Use of borders: Borders help divide the data visually, so it's simpler to get through.

- Dynamic charts and graphs: Adding charts turns hard data into easy-to-understand visuals. They show financial growth and trends in a clear way.

Setting up your Excel balance sheet template carefully is key. It gives you a powerful way to organize financial data. Not only does it help with regular checks, but it also gives important info for planning and strategy. This strengthens your business's financial base in a tough market.

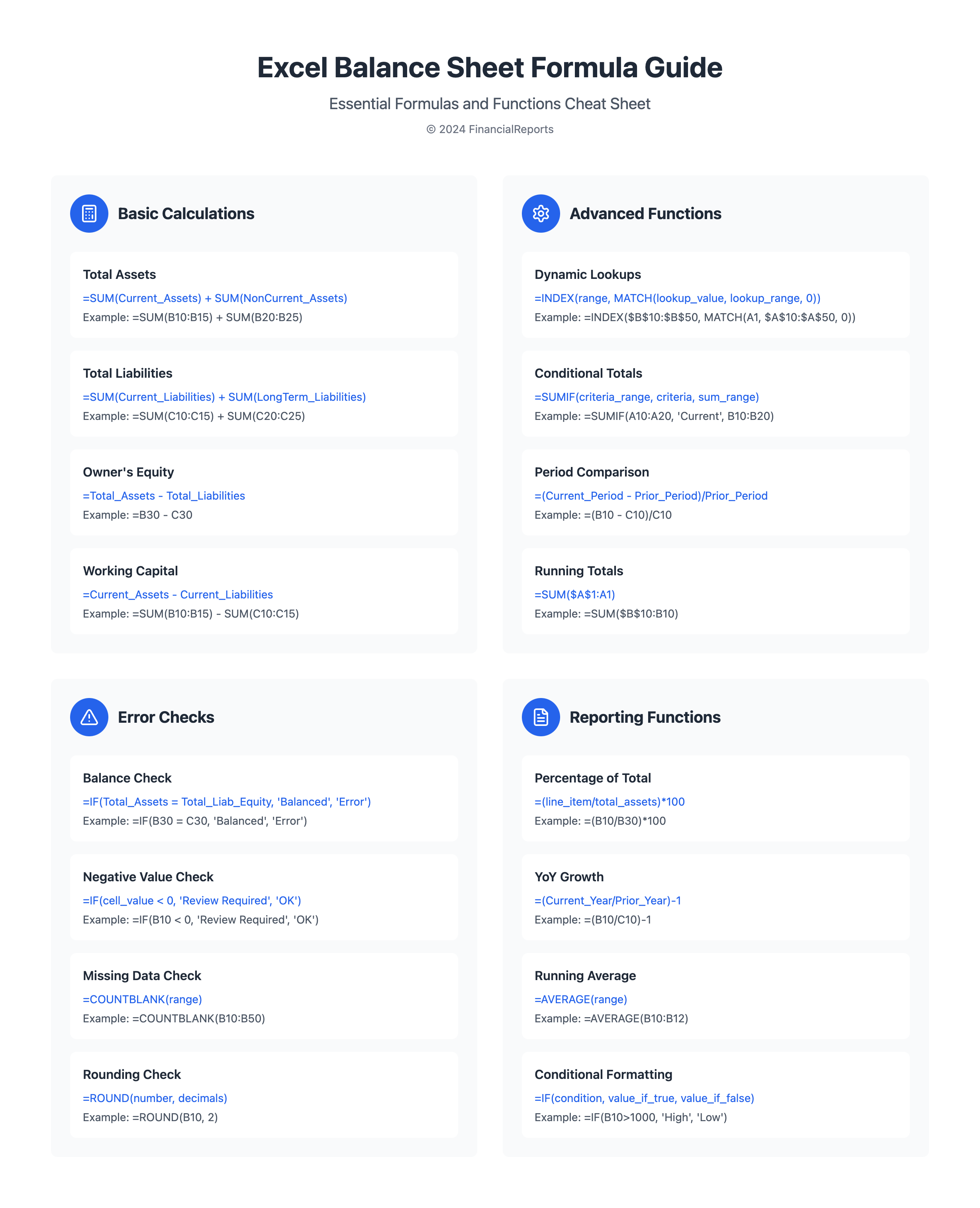

Common Balance Sheet Formulas

Understanding balance sheet analysis means knowing how to find total assets, liabilities, and equity. These elements show a business's financial state. Knowing how to calculate them lets financial experts check a company's stability and value.

Calculating Total Assets

Calculating total assets means adding up current and non-current assets. It's a key part of financial analysis. This includes adding up things the business owns. These things can be turned into cash or used in the business. Assets can be cash, accounts receivable, inventory, and long investments.

Determining Total Liabilities

Understanding financial liabilities involves summing up debts that need to be paid soon and later. This helps know the financial responsibilities of a company. It affects how well the company can pay its debts. Liabilities include things like short-term loans, accounts payable, and long-term debts like bonds.

Owner's Equity Calculation

The equity calculation is vital for the balance sheet. It shows what shareholders would get if all assets were sold and debts paid. This amount includes money from owners, profits kept in the business, and other reserves. It shows the money put into the business by owners or through profits, showing their share.

Good balance sheet analysis tells about more than business performance. It lets people see a company's financial health and risks. This makes it a key tool for businesses and investors.

Linking Accounts to Create Dynamic Formulas

To keep your balance sheet updated and accurate in Excel, using dynamic formulas is key. These formulas let financial pros connect different accounts and data. This way, the balance sheet shows current financial states.

How to Use Cell References

It's important to use cell references well for dynamic Excel formulas. This makes your balance sheet update in real time. You can use named ranges to make formulas easier to handle. Make sure names start with a letter, underscore (_), or backslash (\).

To manage these names, use the Excel Name Manager. You can open it with CTRL + F3. This tool makes it easy to manage your named ranges.

Creating Formulas for Balance Updates

For updating balances in real time, Excel's INDEX and MATCH functions are handy. You can pull specific data dynamically with them. For example, using =INDEX($A$15:I23,MATCH($D48,$A$15:$A$23,0),MATCH(E$47,$A$5:$R$5,0)) fetches revenue figures for specific years.

Also, the INDIRECT function combined with SUM, as in =SUM(INDIRECT(E42&E44):INDIRECT(E43&E44)), allows dynamic summation. This means updates in your balance sheet happen automatically when data changes. It aligns with the goal of accessing real-time data easily.

Using Excel Functions for Accuracy

In making financial statements, being accurate is key. Excel has some functions that are super important for this. Functions like SUM, IF, and VLOOKUP are crucial. They help analyze data right and show a company's real financial health.

SUM Function for Totals

The SUM function is a must-have in Excel. It adds numbers for you. This is really handy for adding up all the stuff like assets and debts on a balance sheet. It makes adding easy, cuts mistakes, and saves time. Using SUM means you get the totals right which is very important for financial reports.

IF and VLOOKUP Functions for Data Retrieval

Excel’s IF function lets you compare things and decide what to do in your sheets. It's good for things like changing how something looks based on what the values are. VLOOKUP is great for finding info in big data sets. It’s super helpful for putting specific details into a balance sheet fast without having to look through lots of info by hand.

For instance, VLOOKUP lets you quickly put info on a balance sheet from different records. This makes sure every detail is right on the money. Using IF is good when you need to check things like if assets are current or not.

Knowing how to use these Excel functions makes putting together financial statements better and more accurate. This matters a lot for analysts, accountants, and business owners. They depend on these statements to make smart money choices and to share info with others. Check out more on making a balance sheet in Excel here.

Recommended Excel Practice Tips

In financial reporting, keeping a current, accurate balance sheet is critical. Excel practices help make balance sheets reliable. This trustworthiness is improved when Excel's auditing tools are used. It lifts investor confidence and meets regulatory standards.

Regularly Updating Your Balance Sheet

For effective financial management, update your balance sheets often. This captures the latest financial activities. Use advanced Excel formulas to automate and minimize errors.

Utilizing Excel's Audit Features

Excel’s audit features are key for precise financial statements. Tools like tracing, error checking, and formula auditing help fix errors fast.

Custom Excel formulas are vital for accurate balance sheets:

- INDEX MATCH offers more accuracy than VLOOKUP.

- Mixing IF with AND/OR allows detailed analysis.

- OFFSET and SUM or AVERAGE enable dynamic calculations.

| Company | Total Assets | Total Liabilities | Total Shareholder’s Equity |

|---|---|---|---|

| Example | 183,500 | 41,000 | 142,500 |

| Apple Inc. | 37,53,19,000 | 24,12,72,000 | 13,40,47,000 |

| 6,49,61,000 | 57,67,000 | 5,91,94,000 |

Using these Excel practices for balance sheets ensures compliance and trust. They prepare professionals for the changing finance landscape with precision.

Common Errors to Avoid

Keeping a balance sheet accurate and financial statements reliable requires avoiding certain errors. Among the biggest issues are misclassifying assets and liabilities. Also, inaccuracies in calculations can greatly affect financial reports.

Misclassifying Assets and Liabilities

Misclassifying assets and liabilities can give a wrong picture of a company's state. This mistake can mess up working capital evaluations and financial ratios. For example, mixing up non-current assets with current ones may overstate a company's short-term finances. This misleads stakeholders on the company's liquidity and its ability to fund operations.

Calculation Errors and Their Impact

- Excel might only store up to 15 numbers, causing small but important errors in financial statements.

- Using the ROUND function helps limit errors from tiny decimals affecting big financial decisions.

- Following best practices in modeling prevents calculation mistakes. Ensure formulas are consistent and financial entries are correct.

- Comparing balances with a "Balance Sheet check 2" method aids in spotting and understanding errors between periods.

- It's crucial to check for missed rows in summed ranges to prevent incorrect financial data.

Excel problems, like inactive toolbar options or formula issues, often happen from simple oversights. These include the NumLock or Scroll Lock being on by mistake or using arrow keys wrongly. Staying aware and doing regular checks for these issues are key to ensure financial statement reliability.

In closing, being meticulous with data and formulas and having checks in place are vital. They ensure the accuracy of financial reports. This carefulness helps avoid big mistakes from common financial errors.

Conclusion and Next Steps

Understanding how to make a balance sheet in Excel is crucial. It's essential to analyze your financial statements regularly. This helps to manage your balance sheet better. Regular checks show the real financial health of a restaurant. They help stakeholders make decisions based on data.

Regular Review of Your Balance Sheet

Updating financial records regularly is very important. Just like using Excel functions like AVERAGE or SUM, reviews are key. They show your current financial status and help plan for the future. With this method, your business moves forward using solid financial data.

Resources for Further Learning

If you want to stay ahead in finance and Excel, keep learning. Check out online resources, forums, and courses at altametrics.com. They will help you grow your skills in financial analysis. These tools also help in making better financial stories from your data, bringing new insights into your business.

FAQ

What are the formulas for a balance sheet in Excel?

For a balance sheet in Excel, you use the SUM function to find total assets, liabilities, and owner's equity. You use "=" to make sure assets equal liabilities plus owner's equity. This helps your balance sheet stay accurate. Cell referencing lets these totals update on their own.

How do I understand the balance sheet structure?

The balance sheet has three main parts: assets, liabilities, and equity. Assets are what the company owns. Liabilities are its debts. Equity is the owner's share. It's all based on the formula: Assets = Liabilities + Equity.

What are the key components of a balance sheet?

A balance sheet's key parts are current and non-current assets, like cash and buildings. Liabilities are divided into short and long-term debts. Owner's equity shows what's left for owners after paying off debts.

How can I set up my Excel balance sheet template?

Choose a template that fits your business to set up your balance sheet in Excel. Label periods on columns, and list assets, debts, and equity line by line. Use formats like currency signs and bold headers to make it clear and professional.

What are common balance sheet formulas?

Important balance sheet formulas include SUM to add up figures. You use basic adds or SUM to get quick, correct totals for assets, liabilities, and equity.

How do I link accounts to create dynamic formulas in Excel?

Link balance sheet accounts using Excel's cell references. It makes your formulas update automatically with new data. This keeps the financial status current.

How can I use Excel functions to ensure accuracy?

Use SUM, IF, and VLOOKUP in Excel for correct balance sheet figures. These functions help with accurate calculations.

What are recommended Excel practice tips for my balance sheet?

Keep your balance sheet updated with the latest numbers. Use Excel's audit tools to catch and fix mistakes. Regular checks keep your financial reports reliable.

What are common errors to avoid when creating a balance sheet in Excel?

Be careful not to mix up assets with liabilities. Make sure to separate current from non-current items correctly. This avoids big mistakes in financial analysis. Watch your formulas closely to prevent calculation errors.

What are the next steps after mastering balance sheet creation in Excel?

Keep learning advanced Excel and best practices in finance after mastering balance sheets. Use tutorials, courses, and forums on financial analysis to improve further.