Balance Accounting: Financial Record Management Guide

In modern business, balance accounting is key for good financial record management. Being precise with financial documents is vital. It helps with success and following rules. The collection of financial data shows how important careful financial tracking is.

Using tools like Hyland, Kofax, and SmartVault helps businesses manage finances better. Bad data quality can cost companies $12.9 million a year, says Gartner. This big number shows the need for better financial systems with strong accounting solutions.

Companies can truly show their financial state by using double-entry bookkeeping and accrual accounting. Having clear processes for checking accounts regularly helps. Making adjustments can make a company successful in the competitive finance world.

Key Takeaways

- Effective balance accounting is crucial for managing financial records well.

- Using new document management solutions can lower the cost of data mistakes.

- Well-organized financial documents show how healthy a business is financially.

- Strong accounting practices, like double-entry bookkeeping, make financial statements reliable.

- Checking finances regularly and adjusting entries helps show a true financial picture.

- Being open and following the rules is easier with the right accounting methods.

- Going through the accounting cycle carefully helps communicate a company's economic status.

Understanding Balance Accounting Principles

Effective financial management is key. It deeply relies on balance sheet reconciliation. This process is crucial for maintaining financial integrity. It ensures that each financial record truly reflects economic transactions.

What is Balance Accounting?

Balance accounting involves reviewing and checking the company’s financial data. This makes sure that financial statements show the company's real financial status. It includes a thorough process of matching each transaction with supporting documents.

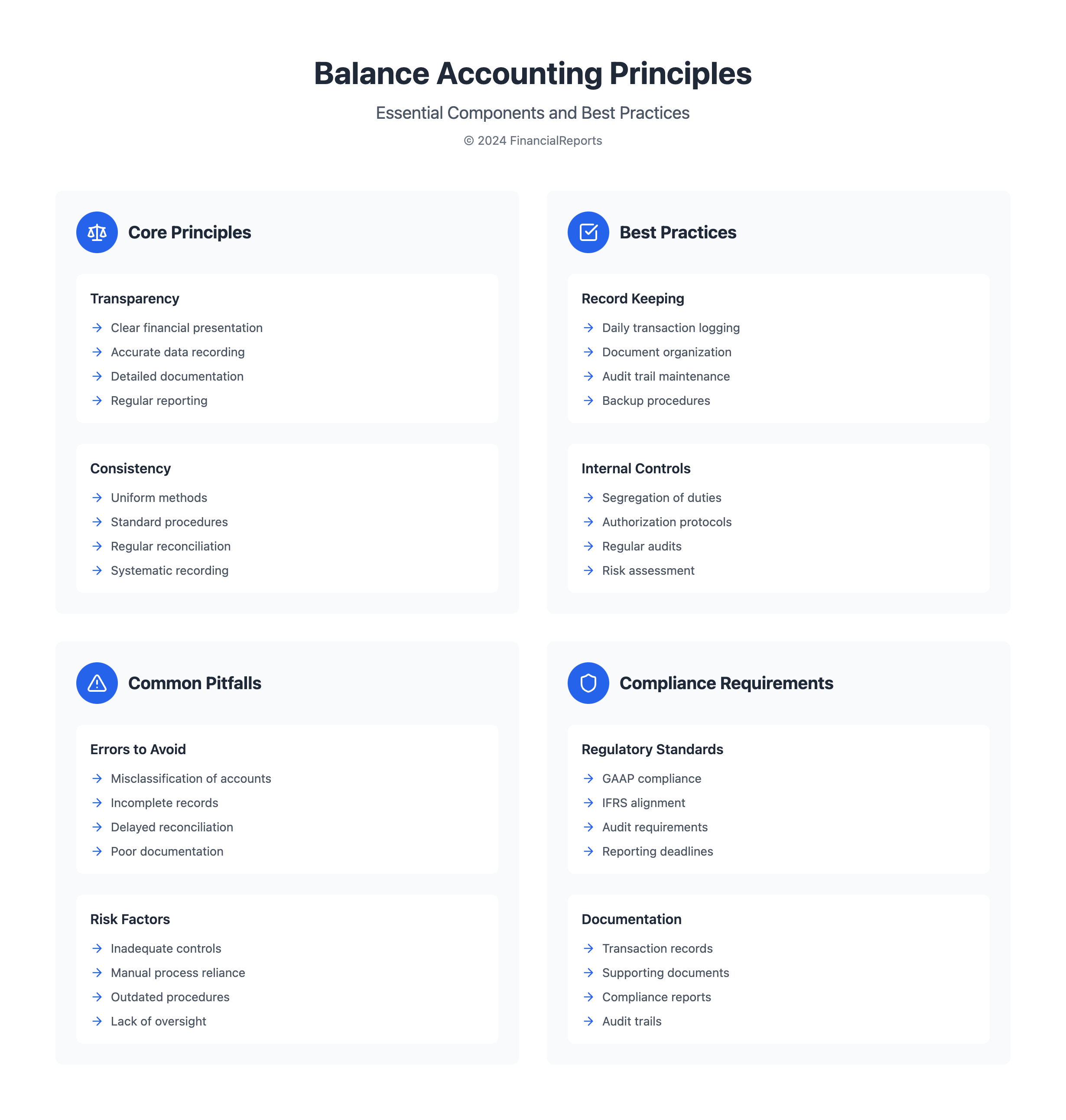

Key Principles of Balance Accounting

Balance accounting is founded on principles that support strict standards. These standards align with different financial rules, like the International Financial Reporting Standards (IFRS) and generally accepted accounting principles (GAAP). They make sure global and corporate reporting standards are met.

| Principle | Description | IFRS | GAAP |

|---|---|---|---|

| Transparency | Clear and accurate presentation of financial data. | Adopted in 168 jurisdictions, emphasizes fair value measurement. | Required for all publicly traded companies in the U.S., stresses detailed disclosures. |

| Comparability | Ability to compare financial statements across different periods and companies. | Standards-based; high adaptability across various jurisdictions. | Rules-based; consistency in application under uniform guidelines. |

| Consistency | Application of the same methods across periods. | Encourages consistent methodology but allows for flexibility based on context. | Demands strict adherence to prescribed methods, ensuring uniformity. |

| Completeness | All necessary information is included in financial reports. | Comprehensive disclosure to reflect economic reality. | Detailed records to capture all aspects of transactions. |

In the world of global transactions, balance sheet reconciliation is crucial. It balances regulatory needs with financial reporting practicalities. By adopting strong balance accounting principles, companies maintain financial integrity. They also stay competitive. Continuous updates to align with IFRS and GAAP ensure accurate, reliable financial reports.

Importance of Accurate Financial Records

Keeping perfect financial records is crucial for any business's longevity and progress. These records matter for more than just following rules. They are key in making management choices and planning for the future.

Benefits of Regular Record Keeping

Handling financial statements and tracking expenses regularly gives a true view of a company's money situation. It builds transparency and trust with everyone involved. Accurate records make tax return prep easier and help make business decisions that aim for the company's big-picture goals.

Statistics show that clear financial open books can lead to a 15 to 20% boost in how well operations run and market success.

Risks of Poor Accounting Practices

Bad financial reporting can greatly harm a business. It not only brings regulatory fines but can also ruin trust with stakeholders. This loss of faith can lead to money loss. Wrong financial info can mess up budgeting and planning, causing missed chances and waste.

| Impact | Financial Reporting Quality | Outcome |

|---|---|---|

| Stakeholder Confidence | High | Increased trust and investment |

| Regulatory Compliance | Accurate | Avoidance of fines and legal challenges |

| Operational Decision-making | Precise | Enhanced strategic planning and efficiency |

| Financial Health | Transparent | Better debt management and cash flow |

| Market Reputation | Trustworthy | Attracts potential investors and partners |

To dodge the downsides of weak financial habits, companies should invest in strong accounting tools and methods. This ensures the truth and dependability of financial info. It's critical for internal review, handling taxes, and staying competitive.

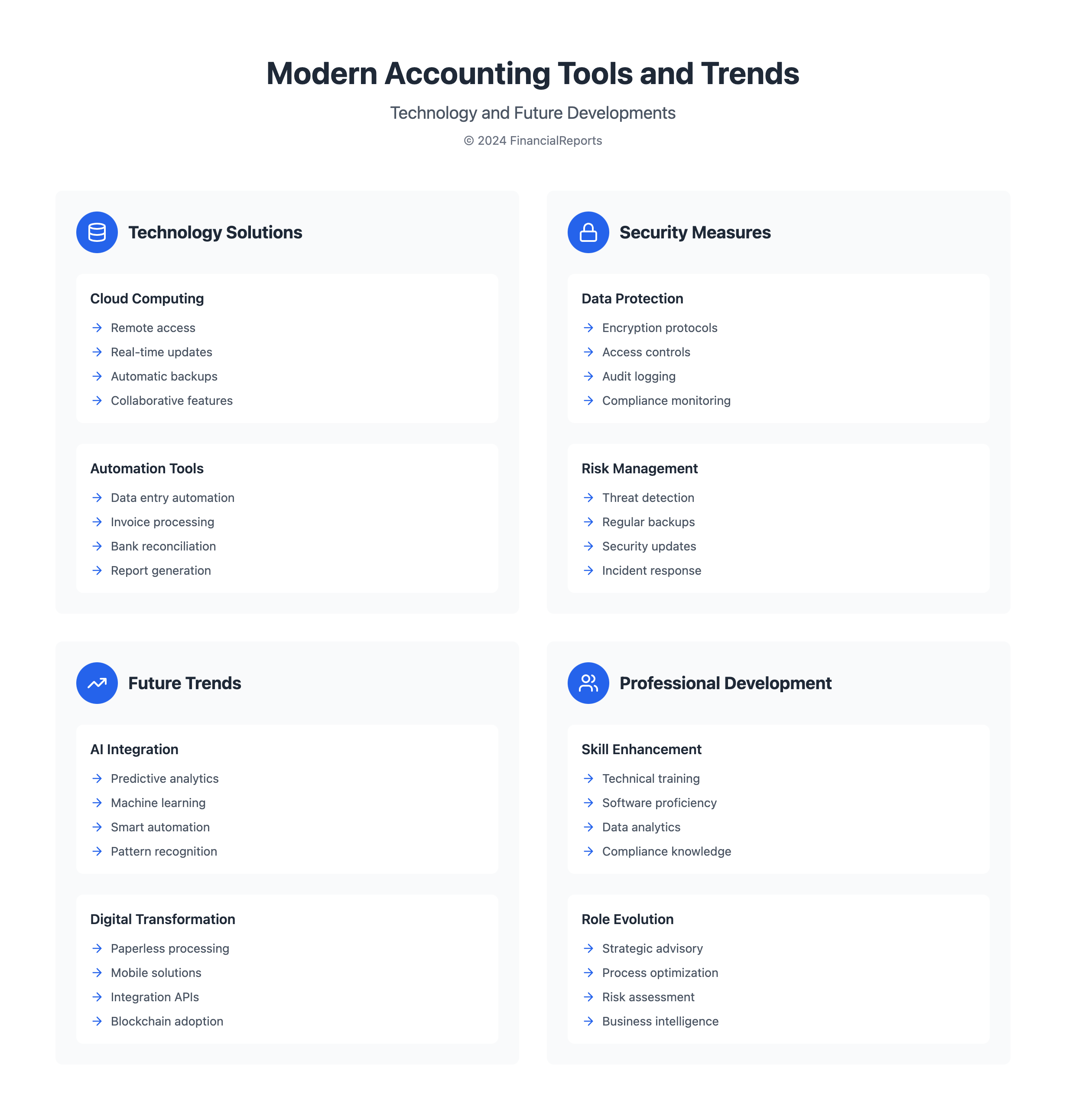

Essential Tools for Balance Accounting

In the competitive world of financial management, having the right tools is key. This is especially true for balance accounting. From small businesses to large corporations, companies need strong solutions. These include financial management software that improves the life cycle of documents. They also need automation to make processes more efficient and accurate.

Accounting Software Comparison

Choosing the right accounting software is crucial for handling financial records well. Modern software, with automation, makes complex tasks simpler and less prone to mistakes. For instance, financial managers often look for software that can automatically handle receivables. A PYMNTS study found that using automation for receivables led to a 23% better collection rate. This shows how vital automation is in finance.

Cloud vs. Desktop Solutions

The choice between cloud and desktop accounting is about accessibility, safety, and cost. Cloud solutions allow work from anywhere, which is essential today. They're also more scalable, meeting the needs of growing businesses. Companies like Hyland and SmartVault offer secure, flexible cloud tools.

| Feature | Cloud Solutions | Desktop Solutions |

|---|---|---|

| Accessibility | Remote access from any location | Limited to installation sites |

| Security | High-level encryption and automatic updates | Dependent on local IT security measures |

| Cost | Subscription-based, lower upfront cost | Higher initial investment but lower ongoing costs |

| Scalability | Easily scales with business growth | Requires additional licenses and hardware |

| Integration | Seamlessly integrates with other cloud services | Integration capabilities depend on software version |

Picking between cloud and desktop options depends on a company's needs. Factors include team flexibility, financial data volume, and access to information. Using financial document management software and automation improves efficiency. It also helps with strategic planning and decision-making.

How to Maintain Balance in Accounting

Maintaining balance in accounting is vital for accurate financial records. It involves subledger to general ledger reconciliation and strong internal controls. These steps ensure the truthfulness of financial reporting.

Regular Reconciliation Processes

Reconciliation is key to keeping accounts balanced. It means matching transactions in the subledger with the general ledger. This stops errors and keeps the financial data correct.

Internal Controls for Accuracy

Internal controls are crucial for identifying and preventing errors. They make sure financial reports are right and trustworthy. This lets people make smart financial choices.

Creating strong internal controls involves several steps. Setting materiality levels and dividing responsibilities reduces fraud risks. Regular audits check for compliance and effectiveness. These actions also ensure balance sheets are accurate. Understanding a company’s financial stance relies on them. Learn more about preparing balance sheets.

| Component | Role in Financial Stability | Common Issues |

|---|---|---|

| Reconciliation | Aligns subledger and general ledger data | Data mapping errors, manual entry discrepancies |

| Internal Controls | Prevents and detects inaccuracies in financial reporting | Inadequate fraud prevention measures, insufficient audit practices |

| Financial Reporting | Delivers comprehensive visibility into financial health | Unreliable financial data, non-compliance with reporting standards |

Accurate bookkeeping and effective controls do more than just comply with standards. They improve strategic financial insight. These measures protect a company's financial health, ensuring it is ready for future challenges and growth.

Common Balance Accounting Techniques

In finance, knowing balance financial definition and accounting techniques is key. Two main methods are double-entry accounting and choosing cash or accrual accounting. These methods are vital for following compliance standards and showing a company's true financial health.

Double-Entry Accounting

Double-entry accounting is a major part of finance. This method requires that every financial transaction results in equal and opposite entries in two accounts. It keeps the accounting equation (Assets = Liabilities + Owners' Equity) in balance. This balance is key for accurate and complete financial analysis.

- Every transaction includes a debit in one account and a credit in another.

- Ensures the accounting equation remains balanced after each transaction.

- Debits (left side) and credits (right side) must always equate, reinforcing the balance financial definition.

Cash vs. Accrual Accounting

The choice between cash and accrual accounting affects income and expense recording. Cash accounting, easier and more direct, only records transactions when cash is exchanged. On the other hand, accrual accounting records earnings and expenses when they occur, not just when cash moves. This method provides a more accurate view of financial status.

| Accounting Method | Definition | Impact on Compliance |

|---|---|---|

| Cash Accounting | Records transactions on cash exchange | Simplifies compliance but may not show true financial health |

| Accrual Accounting | Records transactions when earned or incurred | Aligns with compliance standards for a truthful financial depiction |

Accounting techniques keep the balance financial definition correct and ensure compliance. They are essential for clear and responsible financial reporting. For companies aiming for transparency and responsibility, adopting these methods is essential.

How to Prepare a Balance Sheet

Creating a balance sheet shows a company's financial position at a given time. It is key for analyzing finances and making important money decisions. We will explore what makes up a balance sheet and what mistakes to avoid.

Components of a Balance Sheet

The balance sheet is built on the basic equation: Assets = Liabilities + Owner's Equity. These parts are crucial to accurately show the company's financial status.

| Component | Description | Examples |

|---|---|---|

| Assets | Resources owned by the company that are expected to bring future economic benefits. | Cash, accounts receivable, inventory, equipment |

| Liabilities | Obligations the company owes, which it must settle in the future. | Accounts payable, long-term loans, mortgages payable |

| Owner's Equity | The residual interest in the assets of the entity after deducting liabilities. | Common stock, retained earnings, additional paid-in capital |

Common Balance Sheet Mistakes

Even experts can make balance accounting errors. Knowing these mistakes helps avoid wrong financial health assessments.

- Misclassification of Accounts: Sometimes assets or liabilities are wrongly listed. For example, a long-term debt may be marked as a short-term one.

- Inaccurate Valuation of Assets: Putting wrong values on assets can mess up a company's financial picture.

- Omission of Items: Leaving out certain assets or liabilities can wrongly represent the company's finances.

- Calculation Errors: Simple mistakes in math can upset the balance. Total assets must always match the sum of liabilities and shareholder equity.

To keep the balance sheet right, firms should regularly check and audit their reports. This helps catch balance accounting errors. Doing so ensures the document truthfully shows the company's financial position. Following these standards is vital for accurate financial reports and analysis.

Budgeting and Forecasting in Balance Accounting

Budgeting and forecasting are key in balance accounting. They help plan where to use resources within a year. Budgeting focuses on expected income, costs, and goals. On the other hand, forecasting uses past data to predict future economies. It helps with both short and long-term business plans. Together, they ensure resources are used best, helping companies grow and stabilize financially.

Setting Realistic Financial Goals

Using both forecasting and budgeting is vital for realistic financial goals. Through forecasting, companies can predict future outcomes from current activities and market trends. They set realistic targets, like improving growth or reducing debt. These goals are ambitious but based on solid data. This makes the goals more practical and accurate. It ensures they fit well with long-term plans and market conditions.

Tools for Effective Budgeting

For better budgeting, using advanced financial tools is crucial. Tools like HighRadius' solutions shorten the closing process. They give detailed monthly checklists and balance sheet forecasts. This improves the accuracy and speed of financial tasks. The use of budgeting and forecasting tools leads to well-informed and timely decisions.

| Forecasting Aspect | Details | Impact on Budgeting |

|---|---|---|

| Time Series Forecasting | Utilizes historical data to identify trends | Refines budget setting by aligning with identified trends |

| Causal Forecasting | Examines causal relationships among various business factors | Helps in adjusting budgets based on predicted changes in key variables |

| Equity Forecast | Projects future financial conditions by assessing assets and liabilities | Pivotal in strategic financial planning and long-term budget forecasts |

In summary, combining budgeting and forecasting greatly helps in finance management. It builds a strong framework for fiscal success. Using leading financial tools and deep data analysis, firms can ensure a financially secure future.

Financial Reporting and Compliance

The world of financial reporting and compliance has changed a lot. It demands clear and truthful financial information. It's key to follow rules like GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards). These aren't just rules but the foundation of a company's trustworthiness.

Understanding GAAP and IFRS

GAAP and IFRS are the main rules for financial reporting around the world. GAAP is used in the United States, while over 120 countries use IFRS. Using these standards makes sure financial reports are comparable and trusted everywhere, helping people make smart decisions.

The main differences between GAAP and IFRS include how they handle costs, depreciation, and income. IFRS gives broader guidelines good for many scenarios, while GAAP has specific rules.

Importance of Transparency in Reporting

Being clear in financial reports is crucial for keeping investors' trust. Past scandals, like Enron and WorldCom, showed us this. They led to the Sarbanes-Oxley Act of 2002, which made financial reporting clearer and aimed to stop fraud.

Following financial rules helps stop fraud and makes financial reports better. For example, the Sarbanes-Oxley Act's Title IX makes the penalties for financial crimes tougher. This ensures more careful and honest financial reporting.

Now, financial reports also cover sustainability through ESG (Environmental, Social, and Governance) standards. Companies must share their efforts and results in sustainability. This makes financial reporting fit with worldwide sustainability goals.

Finally, the need for strict financial rules and a strong compliance system is very clear. As finance gets more complex globally, GAAP and IFRS play essential roles. They help make financial reports credible and effective.

Case Studies: Successful Balance Accounting

Many firms show how key balance accounting is for financial success and business growth. From startups to big companies, keeping accurate financial records makes a big difference. This section shares stories that highlight how balance accounting boosts business growth and excellence.

Small Business Success Stories

For small companies, good financial record-keeping is crucial. Look at Genesis Systems. They use Adra to organize their accounting, making audits easier and improving compliance. Their story proves that effective balance accounting tools help small businesses grow strongly.

Lessons from Large Corporations

Big companies benefit from advanced balance accounting too. Toyota Financial Services reduced manual work with Adra Balancer. This gave them more accuracy and helped their business grow. Their success shows balance accounting is more than just meeting rules. It's a way to grow and stay healthy financially.

| Company | Tool | Impact on Business |

|---|---|---|

| Genesis Systems | Adra | Enhanced tracking and auditing, streamlined financial operations |

| Toyota Financial Services | Adra Balancer | Reduced manual reconciliations, increased accuracy and control |

| Keurig Dr Pepper | Trintech's Cadency | Optimized operational processes, educated on best practices |

| Heartland Payroll Solutions | Adra | Crucial support for the Accounting Department, improved compliance |

Innovative balance accounting solutions lead to wider business growth and financial success. By improving reconciliations, auditing, and documentation, companies get better. Adopting these technologies makes operations more efficient and helps plan for the future.

Future Trends in Balance Accounting

The world of balance accounting is quickly changing as we look ahead. Innovations in tech, like automation in accounting and AI in finance, are making big waves. These advances help professionals manage financial data better, improving efficiency and accuracy. For accountants, adapting to these changes means staying ahead in the competition. Also, getting better at using data analytics tools shows the industry is focusing more on data to make decisions.

Automation and AI in Accounting

Heading into 2024, artificial intelligence is becoming more common in finance. AI is now used for tasks like data entry and processing invoices, changing how accountants work. These AI systems speed up financial tasks, improve accuracy, and help spot issues in financial statements early. The World Economic Forum thinks that by 2025, automation will take over half of the complex tasks in accounting. This highlights a big shift towards roles that need both financial knowledge and tech skills.

The Rise of Remote Accounting Services

More people are using remote accounting thanks to cloud-based software. This allows for teamwork and flexible schedules from anywhere. At the same time, keeping financial data safe has become very important because of increased cyber threats. While tech makes processes smoother, the role of accountants is evolving too. Over 60% of accountants say their job now goes beyond just the numbers. They're getting more involved in advising, driven by new laws and the SEC's push for better ESG reporting. This change is a big chance and a push for accountants to learn more and adjust to the digital age.

FAQ

What is Balance Accounting?

Balance accounting keeps and checks financial records to show what a company does economically. It balances the books, follows standards, and uses tools to keep finances right.

What are the Key Principles of Balance Accounting?

Important principles are balancing books carefully and using double-entry accounting. They also include recording money moves correctly, following rules like GAAP and IFRS, and checking records to avoid mistakes and fraud.

What are the Benefits of Regular Record Keeping?

Keeping records well helps track money moves and supports tax work. It also aids in making financial reports and tracking costs. Plus, it's key for choosing the right business moves.

What are the Risks of Poor Accounting Practices?

Bad accounting can lead to big fines and wrong money reports. It can also make people trust you less and result in lost money. It might even break the law.

How do I Compare Accounting Software?

Compare software by looking at storage, tagging, safety, and how easy it is to use. Consider cloud vs. desktop options for better cooperation, safety, and rule-following.

What is the Difference Between Cloud and Desktop Solutions?

Cloud solutions let you get to your data anywhere and update on their own. They're better for working together and staying within rules. Desktop ones stay on one computer and need you to update them yourself.

Why are Regular Reconciliation Processes Important?

Regular checks make sure your money records are right. They ensure the money on your books matches what's actually moved. This helps find mistakes, stop fraud, and keep reports trustworthy.

Why are Internal Controls for Accuracy Important in Balance Accounting?

Internal controls help manage the checking process and other money tasks. They lower the chance of mistakes or fraud. They also make financial info reliable for better decisions.

What is the Difference Between Double-Entry and Cash vs. Accrual Accounting?

Double-entry means each money move has two book entries, keeping things balanced. Cash accounting notes money when it moves hands. Accrual accounting notes it when the deal is made, giving a fuller money picture.

What Common Mistakes Should I Avoid While Preparing a Balance Sheet?

Watch out for putting things in the wrong categories, valuing assets wrong, missing debts, and not fixing mix-ups. These problems can really mess up how your business looks financially.

How do Budgeting and Forecasting Integrate with Balance Accounting?

Budgeting and forecasting work with balance accounting to make money goals, guess future results, and plan resources. They use past money info to guess future conditions and check how well you're doing.

Why is it Critical to Understand GAAP and IFRS?

Knowing GAAP and IFRS is key because they set the rules for money reporting. They keep reports consistent and honest worldwide. This know-how makes sure you follow the law and keeps your reports looking good.

How Does Balance Accounting Differ for Small Businesses vs. Large Corporations?

The basic rules of balance accounting apply to all, but big companies face more challenges. Small businesses handle simpler systems and fewer deals, while big ones deal with complicated deals, more income types, lots of data, and tricky rules.

What Role Will Automation and AI Play in the Future of Balance Accounting?

Automation and AI will make accounting better by being accurate and making processes smoother. These tools lower mistakes, save money, and let accountants focus on important money analysis.

What is the Impact of Remote Accounting Services on Balance Accounting?

Remote accounting lets businesses handle their accounts flexibly and without location limits. This trend gives access to special expertise and adapts to changing money scenes while keeping accounting standards.