Backtesting in Trading: Maximize Profits with This Essential Technique

For traders, knowing what backtesting in trading is key. It lets them check how strategies would have done in the past. This way, they can see if a strategy could have made money and how risky it might be.

Backtesting is a must-have for traders. It helps them make their strategies better, spot problems, and increase their success chances. By looking at past data, traders learn a lot about their strategies. This knowledge is vital for making their trading better.

Key Takeaways

- Backtesting involves using historical data to analyze the performance of a trading strategy.

- Understanding backtesting meaning and definition is key for traders to evaluate their strategies.

- Backtesting helps traders improve their strategies, find problems, and boost their success chances.

- Historical data in backtesting includes price changes, volume, and other market signs.

- Backtesting aims to increase the chance of making money by getting rid of strategies that don't work.

- Successful backtests don't promise future wins but make winning more likely.

What is Backtesting in Trading?

Backtesting is key in checking if a trading strategy works. It uses past market data to see if a strategy could make money. By define backtesting as a historical simulation, traders can see how a strategy did in the past. This helps them decide if it will work in the future.

To backtesting strategies, traders need to gather past data, apply the strategy, and look at the results. This shows the strategy's good and bad points. A good backtest makes traders feel sure about the strategy's success.

Key Aspects of Backtesting

- Assesses the viability of a trading strategy or pricing model using historical data

- Helps traders understand the strategy's risk-reward profile and identify its strengths and weaknesses

- Enables traders to make informed decisions about the strategy's future viability

Using backtesting strategies helps traders stay ahead. It's important to include all costs in backtesting. This gives a true picture of a strategy's profit. Backtesting lets traders test even complex ideas, sometimes needing programming help.

| Backtesting Metric | Description |

|---|---|

| Net Profit/Loss | Total profit or loss generated by the strategy |

| Return | Percentage return on investment |

| Risk-Adjusted Return | Return adjusted for risk taken |

The Objectives of Backtesting

Backtesting is key in checking how well a trading strategy works. It looks at past data to see if a strategy is good and where it can get better. Traders use backtesting to make their strategies better and get consistent results.

Backtesting helps traders look at important numbers like how much they could lose, how often they win, and their average gain. This info helps them understand the risks and rewards of their strategy. Some main benefits of backtesting are:

- Figuring out what works and what doesn't in a strategy

- Improving or creating new strategies

- Feeling more confident in trading with a tested strategy

- Keeping strategies sharp by always testing and tweaking them

Traders who use backtesting can make their strategies better and make choices based on data. This way, they can reduce risks and increase gains, leading to better trading results. Good backtesting needs accurate and clean past data and a deep understanding of the strategy being tested.

| Strategy | Backtesting Metrics | Risk-Reward Profile |

|---|---|---|

| Trend Following | Maximum Drawdown, Win-Loss Ratio | High Risk, High Reward |

| Mean Reversion | Average Return, Sharpe Ratio | Low Risk, Low Reward |

By testing strategies and looking at the results, traders can create a plan that fits their goals and how much risk they're willing to take. This helps them make smart choices and improve their trading skills.

Key Components of a Backtesting Framework

A strong backtesting framework is key for checking a trading strategy's worth. The backtesting trading meaning is about testing a strategy with past data to see how it might do. High-quality historical data is a must, being detailed, correct, and fitting the strategy.

The back tested meaning is about checking a strategy's past performance. When picking a backtesting framework, look at the data's quality and where it comes from. Also, consider the trading tools and time periods used.

Some important things to think about in a backtesting framework are:

- Data quality and sources

- Trading instruments and their characteristics

- Timeframes and their impact on strategy performance

A good backtesting framework helps traders check their strategies' worth. It lets them make smart choices about their trading. By focusing on a framework's key parts, traders can make sure their strategies are well-tested before they go live.

| Backtesting Framework | Data Quality | Trading Instruments | Timeframes |

|---|---|---|---|

| Backtrader | High-quality historical data | Supports multiple instruments | Flexible timeframes |

| QuantConnect | Comprehensive data sets | Includes stocks, options, and futures | Supports multiple timeframes |

Step-by-Step Guide to Backtesting

To grasp what backtesting in trading means, we need to break it down. It's about testing a trading strategy with past data to see how it might perform. This helps traders improve their plans, spot problems, and make better choices.

The first step is to set up the backtest. You need to define the strategy's rules, pick the past data, and decide on the time frame. For short-term strategies, a few weeks of data might be enough. But long-term plans might need years of data.

Key Components of Backtesting

- Historical Data Source: Get high-quality past price data from a trusted source.

- Timeframe Selection: Choose the time period for your strategy.

- Entry and Exit Rules: Set clear rules for when to start and end trades.

After setting up the backtest, you can run it and look at the results. You should check how well the strategy did, find any issues, and tweak it if needed. This is when the true value of backtesting shows, as it lets traders see if their plans work.

Analyzing Results

When you analyze the backtest results, you can see how effective the strategy is. Look at things like the win rate, risk-reward ratio, and biggest loss. Knowing about backtesting helps traders make smart choices and improve their strategies.

| Metric | Description |

|---|---|

| Win Rate | Percentage of winning trades versus losing trades. |

| Risk-Reward Ratio | Assess the average reward relative to the average risk for each trade. |

| Maximal Drawdown | The largest peak-to-trough decline in the portfolio during the backtest period. |

Common Backtesting Techniques

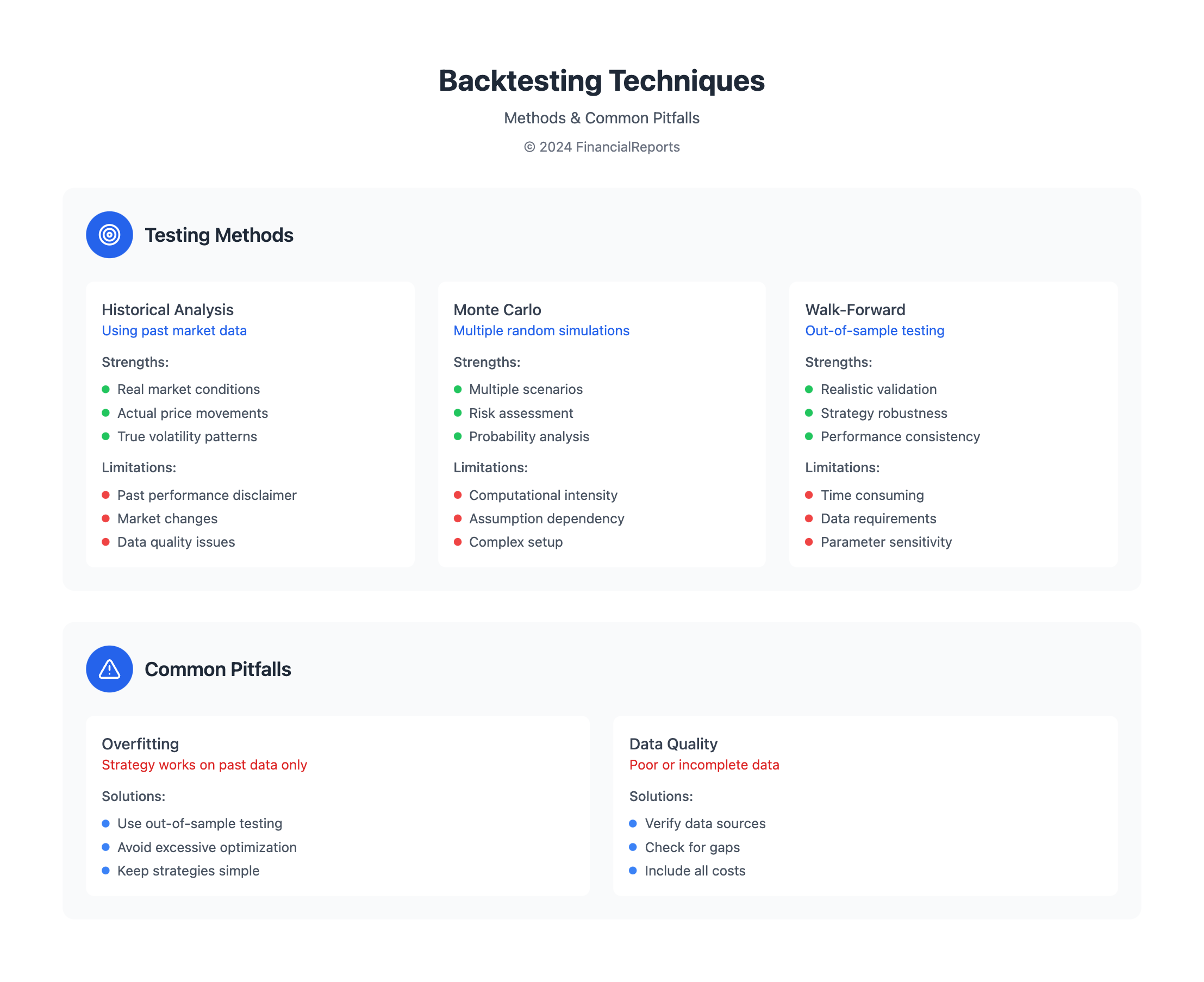

Backtesting strategies are key to checking how well a trading plan works. One main method is historical data analysis. This means using past data to see how the strategy would have done. Another way is Monte Carlo simulations, which run many tests to guess how well the strategy might do.

Walk-forward analysis is also used. It tests the strategy on data not used in the past. This helps see how it would do in real market conditions.

Some common backtesting techniques include:

- Historical data analysis: applying the strategy to historical data to evaluate its performance

- Monte Carlo simulations: running multiple simulations to estimate the strategy's backtest stock strategy and how it will perform in different market conditions. By using these techniques, traders can evaluate the effectiveness of their backtesting strategies and make informed decisions about their trading approach.

| Technique | Description |

|---|---|

| Historical Data Analysis | Applying the strategy to historical data to evaluate its performance |

| Monte Carlo Simulations | Running multiple simulations to estimate the strategy's backtest stock strategy and how it will perform in different market conditions. |

| Walk-Forward Analysis | Testing the strategy on out-of-sample data to evaluate its performance in real-time market conditions |

Tools and Software for Backtesting

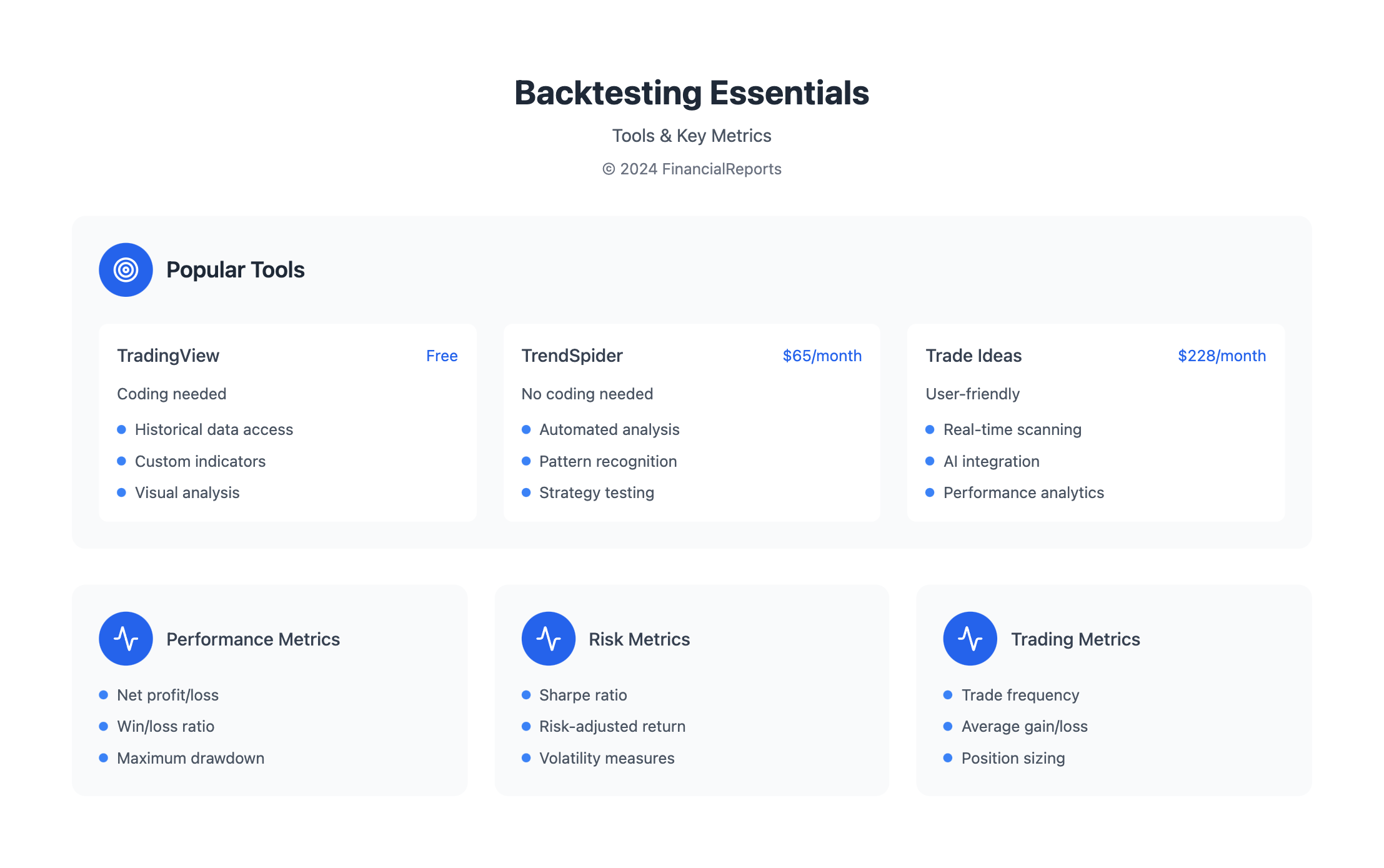

Backtesting trading means using past data to check how well a trading plan works. Many tools and software help with this. For example, TradingView offers a free backtesting platform that needs coding. TrendSpider has a backtesting tool for $65/month.

Trade Ideas and FinViz also have backtesting tools. Trade Ideas costs $228/month, and FinViz is $39.50/month. QuantConnect is free but needs coding. It's important to pick a tool that fits your strategy and coding skills.

When picking a backtesting tool, consider a few things:

Understanding backtesting and using the right tools helps traders improve their strategies. This leads to better investment choices and trading results.

Pitfalls to Avoid When Backtesting

Understanding backtesting in trading is key. It means testing a strategy with past data. But, it comes with challenges. One big issue is overfitting, where a strategy works well on old data but not now.

Another problem is ignoring how the market changes. Different times can affect how well a strategy works. To avoid these issues, traders should test their strategies in different market conditions. They should also consider costs and avoid looking for patterns that aren't there.

Common Mistakes to Avoid

To get accurate results, traders need to know these common mistakes. By avoiding them, they can make their strategies more effective. This is vital for making the most of backtesting to increase profits. By being careful and aware of these risks, traders can use backtesting to make better choices.

Interpreting Backtest Results

When looking at backtesting strategies, it's key to check various metrics. These include profit/loss ratio, drawdown, and Sharpe ratio. These numbers show how well a strategy does and how steady it is. For example, a high Sharpe ratio means a strategy offers more return for less risk, which is good for traders.

It's also important to see how a strategy does in different market times. This could be when the market is going up, down, or staying the same. This helps traders know if a strategy can really make money. By looking at these things, traders can make their strategies better and increase their chances of winning.

Some important metrics to look at when checking backtest results include:

By carefully looking at these metrics and seeing how a strategy does in different market times, traders can learn a lot. They can then make smart choices about their backtesting strategies.

| Metric | Description |

|---|---|

| Profit Factor | Shows the ratio of a strategy's total profit to its total loss. |

| Win Rate | Shows what percentage of trades or bets make a profit. |

Best Practices for Effective Backtesting

Backtesting is key for traders to check their strategies and make smart choices. The backtesting trading meaning is about testing a strategy with past data to see how it might do. Traders should keep updating their strategies and try different approaches. This means always checking how well the strategy works and changing it when needed.

Understanding the back tested meaning of a strategy is important. It means checking how it did with past data. This helps traders spot problems and make their strategies better. Some top tips for good backtesting include:

By following these tips, traders can make sure their backtesting is effective and precise. This leads to smarter trading choices. Remember, backtesting is a continuous process. Traders should always keep backtesting to keep up with new data and market trends.

Backtesting vs. Forward Testing

Understanding what is backtesting in trading is key. Backtesting uses past data to check a strategy's performance. Forward testing, or paper trading, tests strategies with live data in a demo account. Knowing the differences between these methods is vital for traders.

Backtesting meaning lies in its ability to analyze historical data. This helps traders spot patterns and possible profits. Yet, backtesting relies on old data, which might not match today's markets. Forward testing, by contrast, lets traders see how strategies work in real-time. Investopedia suggests combining both for a full strategy review.

Important metrics for backtesting include:

By looking at these, traders can fine-tune their strategies and lower risk. Both backtesting and forward testing are essential for crafting winning trading plans. Traders should use both to get the best outcomes.

| Backtesting | Forward Testing |

|---|---|

| Uses historical data | Uses live data |

| Quick results | Slower results |

| Cost-efficient | May require demo account |

The Future of Backtesting in Trading

The world of trading is always changing, and backtesting will play a key role in improving trading strategies. New technologies like artificial intelligence and machine learning will change how we test strategies. They will help traders analyze and improve their plans faster and more accurately.

Emerging Technologies

AI and ML will make backtesting smarter and more flexible. Automated tools can look through huge amounts of data, find patterns, and mimic real trading scenarios. This will help traders find new insights and make better choices with their backtested strategies.

Evolving Trading Strategies

Trading strategies are getting more complex, and we need better ways to test them. Traders will use advanced methods like walk-forward analysis to check if their strategies work over time. By always updating and improving their strategies, traders can keep up with new chances and stay successful.

FAQ

What is backtesting in trading?

Backtesting is a key method in trading. It lets traders check how their strategies would have done in the past. By simulating past trades, they see how a strategy might perform under different market conditions.

What is the definition of backtesting?

Backtesting is when you apply a trading strategy to past market data. It helps you understand if the strategy could be profitable and how risky it is.

What are the objectives of backtesting?

Backtesting aims to see if a strategy can make money. It also helps understand the strategy's risk and its strengths and weaknesses. This information helps improve the strategy.

What are the key components of a backtesting framework?

A good backtesting framework needs quality historical data and the right trading instruments. The time frame used also matters a lot, as it affects the results.

What are the steps involved in backtesting?

Backtesting starts with setting up the test. Then, you run the test and analyze the results. This helps evaluate the strategy's performance and make improvements.

What are some common backtesting techniques?

Traders use historical data analysis, Monte Carlo simulations, and walk-forward analysis. Each method offers unique insights into strategy performance.

What tools and software are available for backtesting?

Traders have many options. They can use trading platforms with built-in backtesting tools or write custom code. The choice depends on the strategy's complexity and the trader's skills.

What are some common pitfalls to avoid when backtesting?

Avoid overfitting strategies and ignoring market conditions. These mistakes can lead to poor performance in real markets.

How do you interpret backtest results?

To understand backtest results, look at metrics like profit/loss ratio and Sharpe ratio. Also, consider how the strategy performed in different market conditions.

What are the best practices for effective backtesting?

For effective backtesting, update strategies regularly and try different approaches. This helps identify and fix issues, leading to better performance.

How does backtesting differ from forward testing?

Backtesting uses past data, while forward testing uses real-time data. Knowing the differences is important, as each method has its own benefits and drawbacks.

What is the future of backtesting in trading?

The future of backtesting looks promising. New technologies like AI and cloud computing will make backtesting more efficient and accurate. This will help trading strategies evolve further