Auto Investments: Driving Your Financial Future

Auto investments make saving easy and regular. They let you move money into an investment account automatically. This can happen through a 401(k) at work or a brokerage account. It helps you invest a set amount from your paycheck or bank account into your investment account.

By using auto investments, you can grow your money over time. This approach helps you achieve financial stability. It's a smart way to invest regularly without much effort.

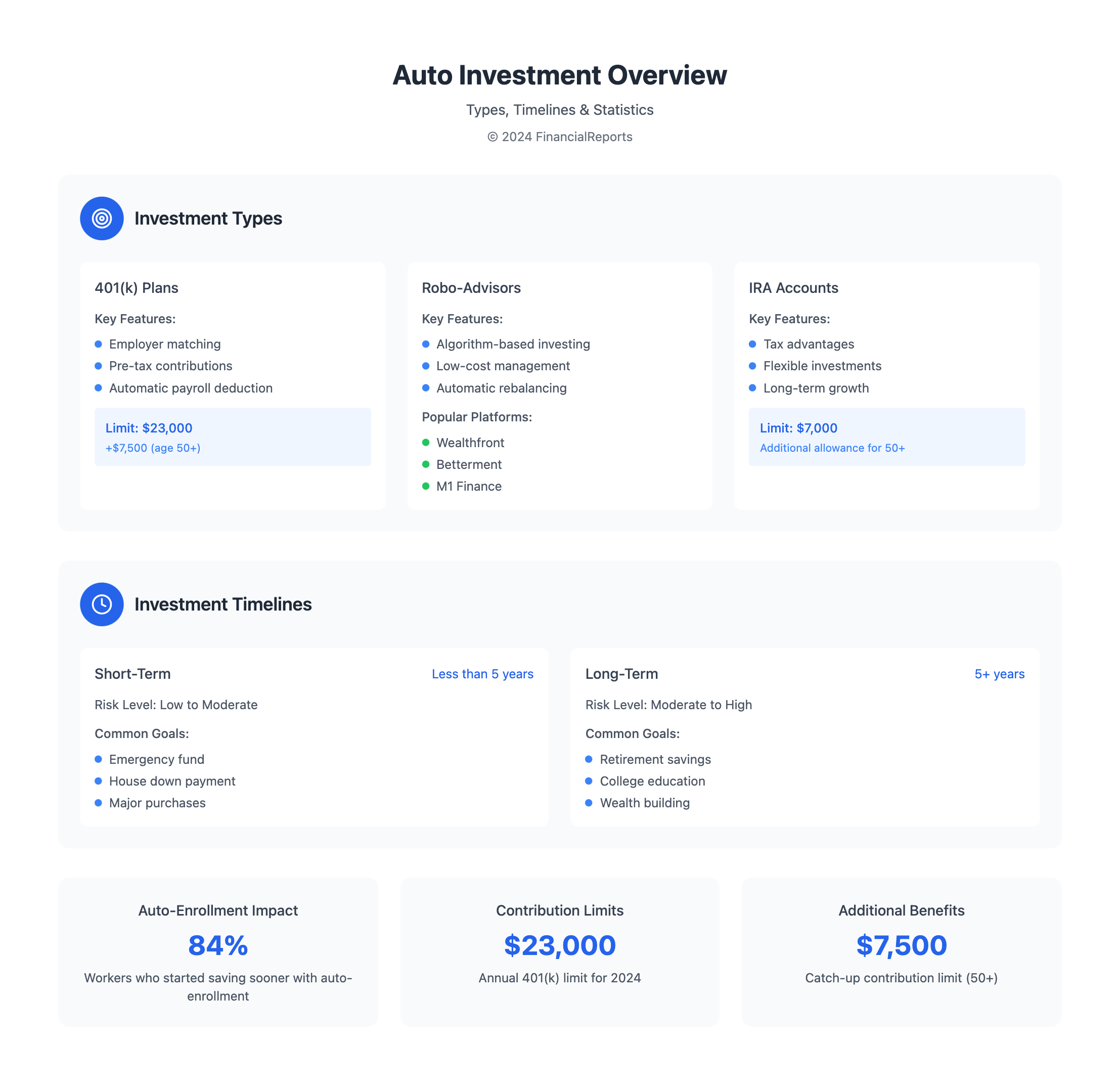

A 2021 poll by Principal Financial Group found something interesting. It said 84% of workers who were automatically enrolled in their workplace retirement plan started saving sooner. This shows how auto investments can help you grow your money and save for the future easily.

Robo-advisors like Wealthfront and Betterment make it simple to start and manage auto investments. They help you save for retirement or other big goals. With their help, you can invest automatically and watch your money grow.

Key Takeaways

- Auto investments provide a convenient and disciplined approach to investing

- Automatic transfers can be set up through a workplace retirement plan or brokerage account

- Auto investments can promote long-term growth and financial stability

- 84% of workers who were automatically enrolled in their workplace retirement plan started saving for retirement sooner

- Robo-advisors like Wealthfront and Betterment can help individuals set up and manage their auto investments

- Auto investments can be used to save for retirement, education, or other financial goals through an automatic buy

- Auto investments can help individuals make consistent investments, reducing the risk of not investing saved money

Understanding Auto Investments

Auto investments, also known as automatic investing, involve setting up a plan to move money from a bank to an investment account regularly. This method is common in employer-sponsored plans, like 401k plans. Here, employers might match a part of what their employees put in.

There are different types of auto investments. Robo-advisors use automated strategies for long-term goals and keep costs low. Dividend reinvestment plans let investors use their dividends to buy more shares.

Auto-investing has many benefits. It makes investing consistent and saves time. It also helps reduce emotional decisions and averages out the cost of investments. To see if auto-investing works for you, think about your cash flow, how long you plan to invest, your goals, and any fees.

Many platforms offer auto-investing options. For example, AMP Managed Funds and AMP KiwiSaver Scheme often don't charge extra for this service.

The Rise of Automated Investment Platforms

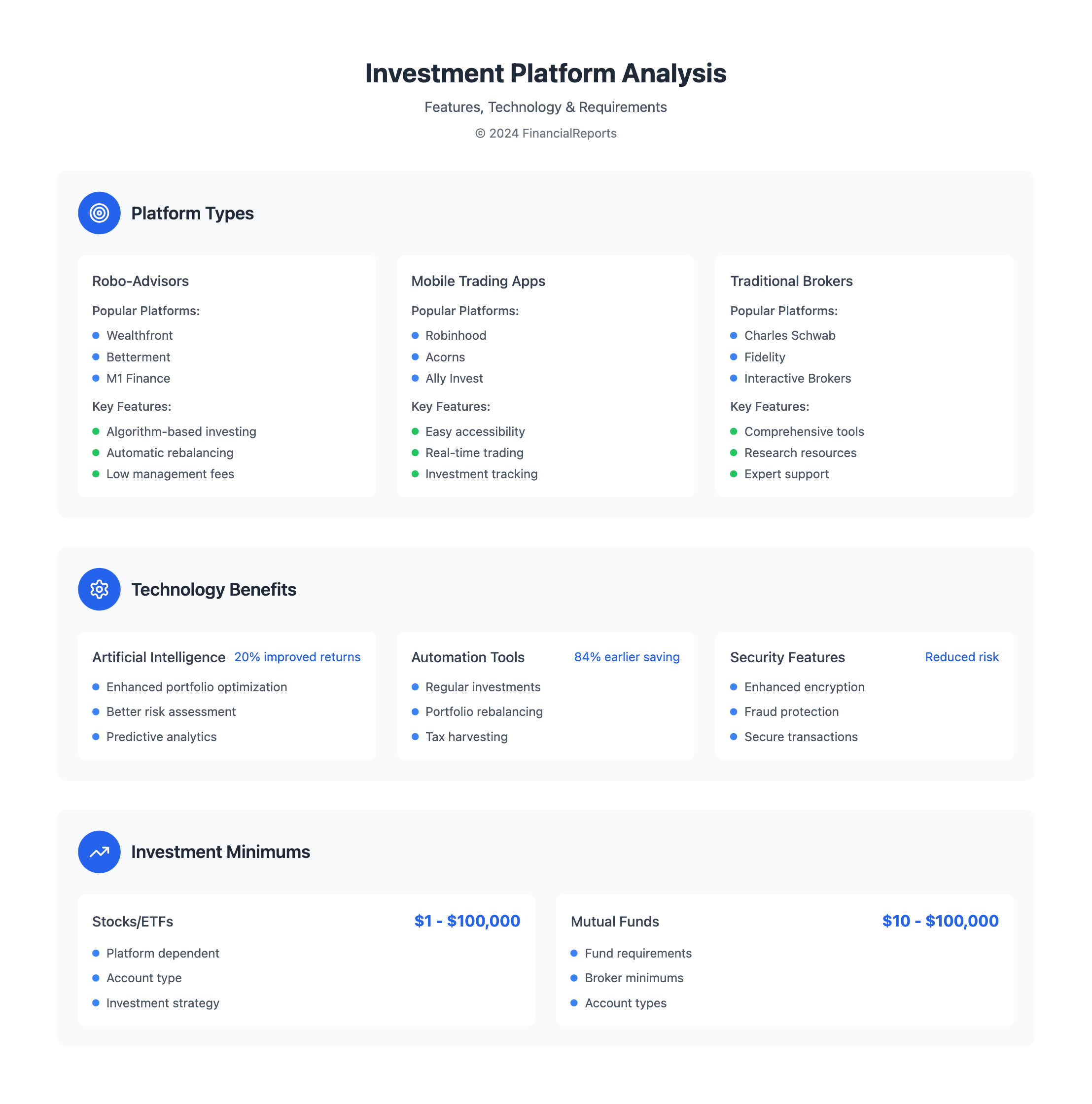

Automated investment platforms have changed how we invest in the stock market. They use algorithms and machine learning to offer low-cost options and diverse portfolios. Companies like Wealthfront, Betterment, and M1 Finance lead the way, providing auto investments and automatic buy options.

Key Players in the Market

These companies make investing in the stock market easy, requiring little effort or knowledge. The benefits include:

- Lower fees than traditional financial advisors

- Diverse portfolios to reduce risk

- Automatic buying and selling to boost returns

- Constant monitoring of your portfolio and market trends

How Automated Platforms Work

These platforms use algorithms to pick investments based on your risk level and goals. They also help with taxes, like tax-loss harvesting, to cut down on capital gains taxes. Thanks to automated platforms, investing has become more affordable and accessible. This makes it simpler to reach financial goals through automatic buying and selling.

Assessing Your Investment Goals

Understanding your investment goals is key when it comes to automatic investing. You need to decide if you're aiming for short-term or long-term goals. Short-term goals are for things you need in less than five years, like a down payment on a house. Long-term goals, like retirement, are for five years or more.

To figure out your investment goals, think about a few things:

- Time horizon: When do you need the money?

- Risk tolerance: How much risk are you willing to take?

- Financial situation: What is your current income and expenses?

After you know your investment goals, you can start planning your recurring investment strategy. This means setting up a plan to invest a fixed amount regularly. This approach can help you manage the ups and downs of the market better.

| Investment Goal | Time Horizon | Risk Tolerance |

|---|---|---|

| Short-term | Less than 5 years | Low to moderate |

| Long-term | 5 or more years | Moderate to high |

By understanding your goals and risk level, you can make a plan that fits you. This plan will help you reach your goals through automatic investing and recurring investment strategies.

How to Choose the Right Auto Investment Strategy

Choosing the right auto investment strategy is key to reaching your financial goals. There are many options, so think about your goals, how much risk you can handle, and when you need the money. An automatic buy strategy can be smart, as it lets you invest a set amount regularly, no matter what the market does.

Asset allocation is important in auto investments. It means spreading your money across different types of investments to reduce risk. For instance, Ally Invest's Robo Portfolios offer various choices, like a market-focused one with a 0.3% annual advisory fee. Plus, you only need $100 to start an Ally Invest Robo Portfolio, making it easy for investors to get started.

When picking an auto investment strategy, consider a few things:

- Investment goals: What do you want to achieve with your investments?

- Risk tolerance: How much risk are you okay with?

- Time horizon: When do you need the money?

By thinking about these and picking the right strategy, you can make smart choices. This helps you work towards your financial goals.

Building Your Auto Investment Portfolio

Building an auto investment portfolio means spreading out your money across different types of investments. This includes stocks, bonds, and real estate. It helps lower risk and can lead to better growth over time. Using automatic investing and regular investment plans can make reaching your goals easier. They make the process automatic and help you avoid spending too much.

Some key benefits of automatic investing include:

- Reduced risk through diversification

- Increased chance for long-term growth

- Automation helps avoid spending too much and keeps you calm during market ups and downs

Studies show that automating your savings and investments can be very effective. You can set up regular transfers to save and invest automatically. For instance, the limit for 401(k) contributions is $23,000 a year. If you're 50 or older, you can add another $7,500. By using these limits and automating your investments, you can create a diverse portfolio. This helps you reach your investment goals.

| Investment Type | Annual Contribution Limit |

|---|---|

| 401(k) plans | $23,000 |

| Roth and traditional IRAs | $7,000 |

The Role of Technology in Auto Investments

Technology has changed how we invest in the stock market. It makes investing easier and more accessible. Now, investors can make automatic buy decisions with just a few clicks.

Online platforms and mobile apps have improved the investment process. They offer personalized investment recommendations and help manage portfolios.

The use of AI and machine learning has been key in auto investments. These technologies help investors make data-driven decisions. This reduces the risk of human error and emotional bias.

As a result, auto investments are becoming more popular. They are a good choice for those looking to invest in the stock market.

The Impact of AI and Machine Learning

AI and machine learning help investors make better decisions. They use complex algorithms to analyze market trends and predict future performance. This leads to more sophisticated auto investment strategies.

These strategies can be tailored to meet individual investors' needs and goals.

Mobile Apps and Their Benefits

Mobile apps let investors access their portfolios and make automatic buy decisions anywhere. Apps like Robinhood and Acorns are popular for this. They offer features and tools to help investors make informed decisions.

The benefits of mobile apps include convenience, flexibility, and accessibility. They make it easier for individuals to invest and reach their financial goals.

Tax Implications of Auto Investments

When you invest automatically, it's key to think about taxes. This helps you keep more of your money and grow your investments. Knowing how taxes work with auto investments helps you choose the best strategy for your money.

Capital gains tax is a big part of this. It's a tax on the profit from selling investments. The tax rate depends on the investment type and how long you held it. For instance, long-term gains from investments held over a year are taxed less than short-term gains.

Understanding Tax-Advantaged Accounts

Tax-advantaged accounts like 401(k) and IRA offer great benefits. They let you put aside money before taxes, which lowers your taxable income. This means you pay less in taxes now. The money in these accounts grows without immediate tax, until you withdraw it.

Here are some key benefits of tax-advantaged accounts:

- Reduced taxable income

- Tax-deferred growth

- Lower tax liability

By understanding auto investment taxes and using tax-advantaged accounts, you can make your investment strategy better. This helps you reach your long-term financial goals.

| Account Type | Contribution Limit | Tax Benefits |

|---|---|---|

| 401(k) | $23,000 (2024) | Pre-tax contributions, tax-deferred growth |

| IRA | $6,000 (2024) | Pre-tax contributions, tax-deferred growth |

Monitoring and Adjusting Your Auto Investments

Regularly checking and adjusting your investments is key. It helps keep your portfolio in line with your goals and risk level. For example, dollar-cost averaging can lessen the risk of market timing. It involves investing the same amount regularly, which helps smooth out market ups and downs.

An automatic buy strategy is also helpful for auto investments. It sets up a plan to invest a fixed amount at regular times, no matter the market. This method helps you stay on course with your investment goals, even when the market is unpredictable.

Regular Portfolio Review Practices

To keep your portfolio in check, regular reviews are a must. Here's how to do it:

- Check how your portfolio is doing

- Adjust your investments as needed

- Make sure your goals and risk level are up to date

When to Rebalance Your Portfolio

Rebalancing means adjusting your investments to match your target mix. You can do this regularly, like every quarter or year, or when needed. For instance, if your portfolio leans too much in one area, it's time to rebalance.

| Investment Type | Minimum Investment Requirement |

|---|---|

| Stocks and ETFs | $1 to $100,000 |

| Mutual Funds | $10 to $100,000 |

Common Mistakes to Avoid with Auto Investments

When you invest automatically, knowing common mistakes is key. One big error is emotional investing. This means making choices based on feelings, not facts. It can lead to quick decisions, like buying or selling based on short-term market changes.

Another mistake is ignoring fees and expenses. High fees can cut into your returns, hurting your portfolio's performance. It's important to know the costs of your investments. Choose options that fit your financial goals and risk level. By avoiding these mistakes, you can grow your wealth and reach your financial goals.

Some important strategies include:

- Diversifying your portfolio to spread risk and prevent poor-performing investments from impacting your entire portfolio

- Rebalancing your investments periodically to ensure they remain aligned with your desired asset allocation

- Staying informed about your investments' performance, economic trends, and market developments to make informed decisions

By knowing these mistakes and managing your investments wisely, you can make sure your automatic and recurring investment strategies help you reach your financial goals.

Future Trends in Auto Investments

The world of auto investments is set to change a lot in the next few years. New tech like blockchain and artificial intelligence will make transactions safer and clearer. They will also give investors advice and help manage their money better. This means auto investments will be easier and open to more people.

More people are using automatic buy strategies. These let investors put money into a mix of assets without doing much work. This is because many want easy ways to make money and save costs. The global market for self-driving cars is already big, at $207.38 billion, and it's expected to grow a lot more.

Auto investments offer many benefits, including:

- They make things more efficient and cut costs.

- They help spread out risks and manage them better.

- They can lead to higher returns by using data to make choices.

As auto investments keep growing, we'll see even more new tech. Things like machine learning and natural language processing will help make better investment choices. With auto investments and automatic buy strategies, people will have more chances to reach their financial goals and secure their future.

Getting Started with Auto Investments

Starting with automatic investing is now easier than ever. Online platforms and mobile apps make it simple to set up regular investments. Just follow a few easy steps.

When picking a platform, think about your goals, how much risk you can take, and when you plan to retire. Many platforms offer different investment options. You can choose from index funds to actively managed mutual funds to fit your needs.

Beginners should start with small amounts and add more over time. Automatic investing helps you grow your wealth steadily. It also keeps you from making emotional decisions based on market changes. Always consider getting professional advice to make sure your plan matches your long-term goals.

FAQ

What are auto investments?

Auto investments let you set up automatic transfers to an investment account. This can be through a 401(k) or a brokerage account. It's convenient, helps you stay disciplined, and can grow your money over time.

What are the different types of auto investments?

There are several types of auto investments. These include robo-advisors, dividend reinvestment plans, and recurring transfers. Robo-advisors pick investments based on your risk and goals. Dividend reinvestment plans let you automatically reinvest dividends. Recurring transfers move money from your bank to your investment account regularly.

How have automated investment platforms changed the investment landscape?

Automated investment platforms have made investing easier. Companies like Wealthfront, Betterment, and M1 Finance offer low-cost options. They use algorithms to match your risk and goals with investments.

What factors should I consider when choosing an auto investment strategy?

When picking an auto investment strategy, think about your goals, risk tolerance, and time frame. Passive strategies focus on a diversified portfolio. Active strategies aim to beat the market. Consider your goals, risk, and time frame.

How can I build a well-diversified auto investment portfolio?

Building a diversified portfolio starts with asset allocation and diversification. Asset allocation spreads your money across different types of investments. Diversification reduces risk by spreading across different areas.

How has technology impacted the auto investment industry?

Technology has transformed investing with mobile apps and online platforms. Apps like Robinhood and Acorns make investing simple. AI and machine learning offer personalized advice and portfolio management.

What are the tax implications of auto investments?

Understanding taxes on auto investments is key to saving money. Capital gains tax applies to profit from selling investments. Tax-advantaged accounts like 401(k) and IRA offer benefits for retirement savings.

How can I monitor and adjust my auto investment portfolio?

Regularly review and rebalance your portfolio to keep it aligned with your goals. A review assesses performance and makes adjustments. Rebalancing involves buying or selling to match your target allocation.

What are some common mistakes to avoid with auto investments?

Avoid emotional investing and overlook fees and expenses. Emotional investing is making decisions based on feelings. Fees and expenses can reduce your returns.

What are the future trends in auto investments?

Future trends include blockchain and artificial intelligence. Blockchain will enhance security and transparency. AI will offer personalized advice and portfolio management.

How can I get started with auto investments?

Starting with auto investments is easy with online platforms and mobile apps. Choose a platform based on your goals, risk, and time frame. Tips for beginners include starting small, being consistent, and seeking advice.