An Inside Look at the Job of a Professional Trader

A professional trader buys and sells financial items like stocks and bonds. They work for themselves or a company. To understand what a trader does, we must look at their roles and duties.

Traders study market trends and make smart choices. They aim to make money by trading. Their job includes looking at data and creating trading plans.

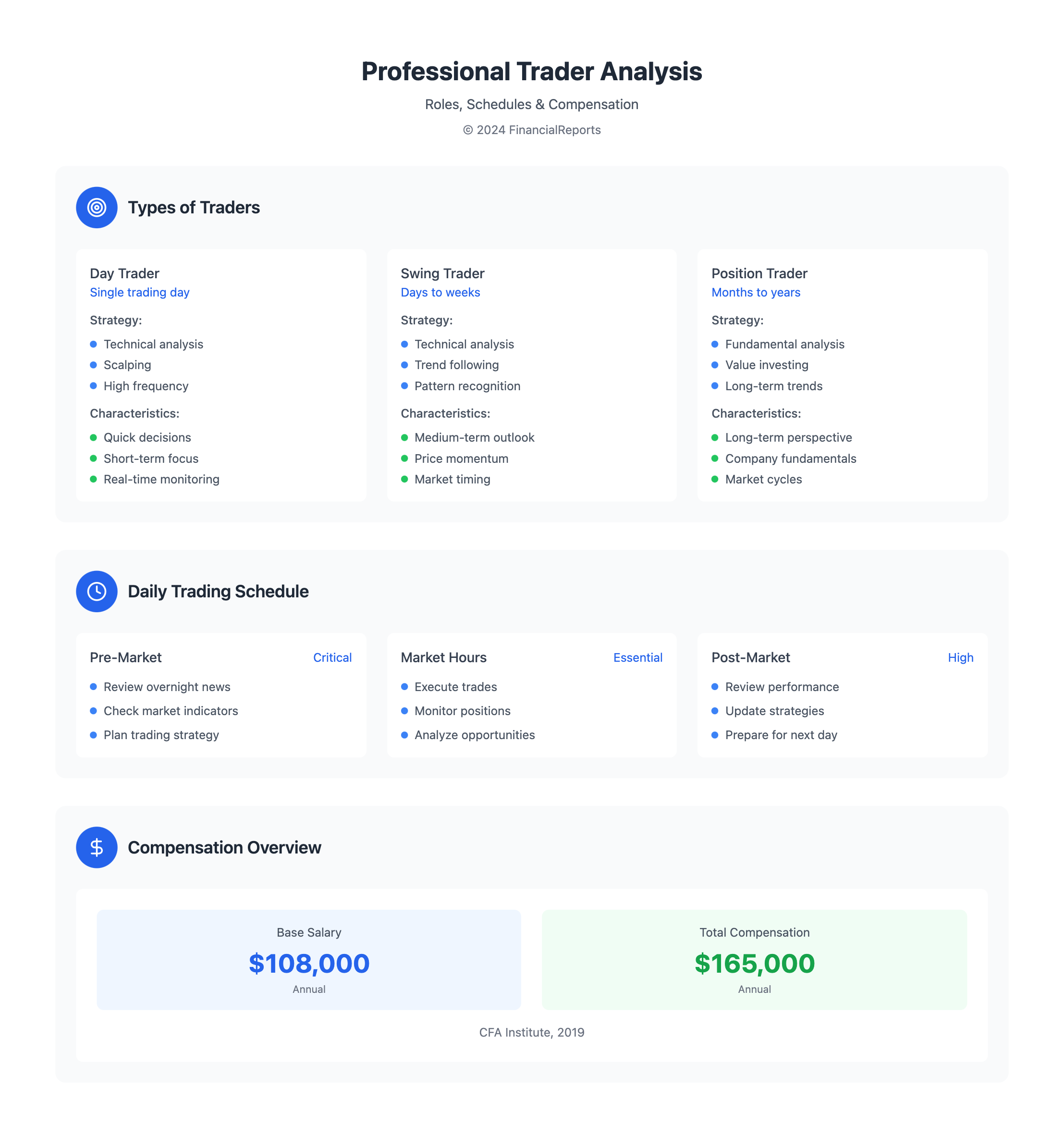

A 2019 study by the CFA Institute found that traders earn about US$165,000 on average. Their base salary is around US$108,000. Mike Bellafiore, a trader, says it's a job that needs technical skills, market knowledge, and self-control.

Key Takeaways

- Professional traders buy and sell financial instruments to maximize profits.

- To define trader, one must consider the various roles and responsibilities associated with this profession.

- What traders do is analyze market trends, make informed decisions, and execute trades.

- The trader meaning encompasses a range of activities, from researching market data to developing trading strategies.

- Trading professionals can earn a typical global total compensation of US$165,000, with a base salary of US$108,000.

- Technical skills, market knowledge, and emotional discipline are essential for success in trading.

Understanding the Role of a Trader

A financial trader buys and sells financial items like stocks and bonds. They aim to make profits while keeping losses low. They use various tools and strategies to do this.

Traders rely on platforms, software, and market data to make decisions. This helps them stay informed and make smart choices.

There are different types of traders. Day traders work for just one day. Swing traders hold positions for days or weeks. Position traders keep their investments for months or years.

Each trader has their own role and uses specific strategies. They all aim to achieve their goals through trading.

Traders have key responsibilities. They must analyze the market and make quick trades. They also manage risks to avoid big losses.

- Market analysis: Traders need to keep up with market trends and news.

- Trade execution: They must trade fast and efficiently to make the most profit.

- Risk management: They use strategies like stop-loss orders to control risks.

| Type of Trader | Timeframe | Strategy |

|---|---|---|

| Day Trader | Single trading day | Technical analysis, scalping |

| Swing Trader | Days, weeks, or months | Technical analysis, trend following |

| Position Trader | Long term | Fundamental analysis, value investing |

How Traders Analyze Markets

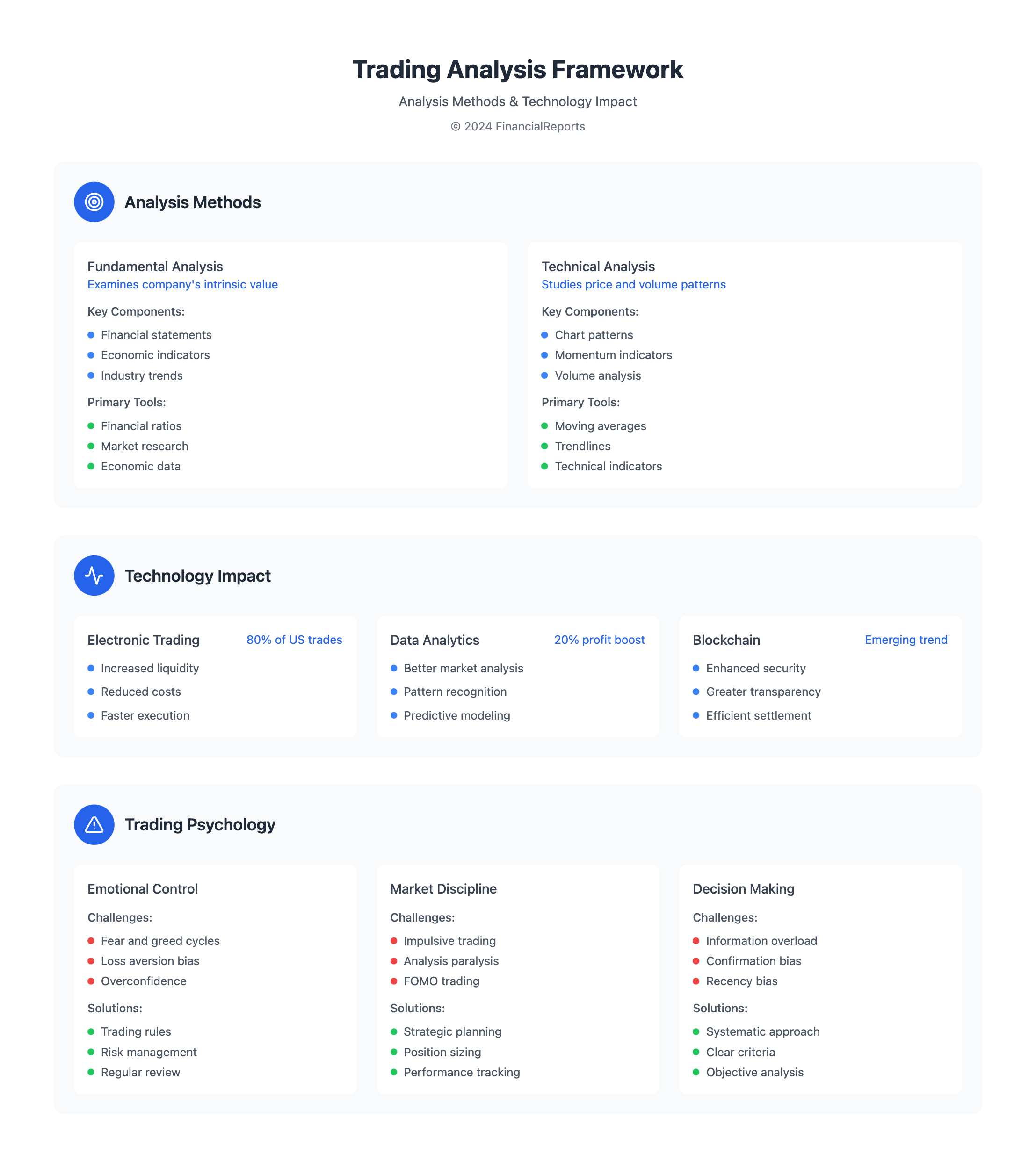

Traders use many ways to study markets, like looking at the economy, price trends, and how people feel about the market. They need to understand trends, spot patterns, and make smart choices based on data. A financial trader must quickly and accurately analyze lots of data, which is a big part of what traders do.

The trader meaning of technical analysis is about studying price movements to guess future prices. This method only looks at stock price and volume to find patterns. It's different from fundamental analysis, which looks at a company's true value.

Fundamental Analysis Techniques

Fundamental analysis looks at a company's real value, like the economy, industry, and financials. Bellafiore says it involves checking a company's financials, management, and industry trends to guess its future.

Technical Analysis Tools

Technical analysis uses many patterns and signals to predict the market. It includes tools like trendlines, moving averages, and momentum indicators. Here are some key tools:

- Trendlines and channels

- Moving averages and momentum indicators

- Chart patterns and volume analysis

By mixing these methods, traders can really understand market trends. Whether they use fundamental or technical analysis, the goal is to know the markets well and make smart choices based on data.

| Analysis Method | Description |

|---|---|

| Fundamental Analysis | Examines intrinsic value, considering factors like economy, industry, and management |

| Technical Analysis | Examines price movements and trends to forecast future price movements |

Developing a Trading Strategy

A good trading strategy is key to success in the markets. As a trader, knowing what tools you use and your investment goals is important. A strategy has three parts: planning, placing trades, and executing them. Most strategies use technicals or fundamentals, backed by data to check their accuracy.

Bellafiore's book "The PlayBook" says a clear strategy is vital. It should include a plan, risk management, and how to measure performance. It's about knowing your goals, how much risk you can take, and when you want to see results.

Key parts of a trading plan are:

- Risk management techniques

- Position sizing

- Trade execution

- Performance metrics

Backtesting is key to see how a trade has done in the past and might do in the future. Using past data helps test and improve strategies. By following best practices and making adjustments, traders can improve their performance and reach their goals.

| Strategy Type | Description |

|---|---|

| Technical | Relies on technical indicators to generate trading signals |

| Fundamental | Takes into account factors like revenue growth and profitability |

| Quantitative | Considers a large matrix of factors to arrive at a purchase or sale decision |

Tools of the Trade

A financial trader uses many tools and software to analyze markets and make trades. They aim to stay ahead by using these tools wisely. This includes trading platforms, technical analysis software, and risk management tools.

Some of the key tools used by traders include:

- Trading platforms, such as Charles Schwab's StreetSmart Edge, Fidelity's Active Trader Pro, and Interactive Brokers, which provide real-time streaming data and technical analysis tools

- Technical analysis software, like eSignal and MetaStock, which offer customizable charting functions and backtesting features

- Risk management tools, including stop losses, take profits, and position sizing, which help traders limit losses and safeguard their capital

Experts say that a trader's success depends on their use of technology. They must keep up with new tools and software. This helps them create a strategy that fits their risk level and goals.

As trading changes, it's key for traders to know about new tools and tech. By using these tools, traders can make better decisions and reach their investment goals.

The Trading Day: A Typical Schedule

A trader's day is packed with tasks, from getting ready before the market opens to analyzing after it closes. To understand what a trader does, we need to know their tools and how they manage their time.

Pre-Market Activities

Before the market opens, traders do a few things. They read important news from the night before and look at upcoming news. They also check their plans for the day.

During Market Hours

When the market is open, traders make their moves. They watch their open trades and look for new chances. They use different strategies to make money, like trading news or following trends.

Post-Market Analysis

After the market closes, traders look back at their day. They check if they followed their plans and how much money they made. They also write down their trades to learn from them.

Knowing a trader's daily routine helps us understand what they do. A good trader manages their time well, stays focused, and adjusts to market changes.

Risk Management in Trading

Risk management is key for traders. It means knowing how much risk you can handle and finding ways to cut down on losses. A trader must manage risk well to do well in the market.

One way to manage risk is through diversification. This means spreading out your investments across different types of assets. It helps lower the overall risk.

Stop-loss orders are also important. They help limit losses if a trade doesn't work out. By setting a stop-loss order, a trader can sell a security automatically when it hits a certain price. This helps protect investments.

Traders also need to know their risk tolerance. They must balance risks and rewards. Making smart decisions about when to take risks and when to play it safe is key. This way, traders can avoid big losses and make the most of their gains.

Some key risk management strategies include:

- Diversification across different asset classes

- Using stop-loss orders to limit losses

- Assessing risk tolerance and adjusting investment strategies

Psychology of Trading

Understanding the psychology of trading is key for traders. It helps them make better decisions. Bellafiore's book "The PlayBook" highlights the importance of emotional control in trading. Traders use more than just tools; they also rely on their self-awareness and emotional control.

Being a trader means more than just buying and selling. It's about managing your emotions and biases. The ability to make rational choices, even when it's hard, is what defines a trader. Traders often face challenges like:

- Fear and greed, which can lead to impulsive decisions

- Loss aversion, which can cause traders to prioritize avoiding losses over making gains

- Overconfidence, which can lead to excessive trading and poor performance

To stay focused and avoid these traps, traders need self-awareness and rules. They also use risk management strategies. By understanding and managing their emotions, traders can make better choices and succeed in the markets.

The Impact of Technology on Trading

Technology has changed the trading world a lot. It helps financial traders make better choices and work faster. Now, with electronic trading, big data, and blockchain, costs are down, and deals are smoother and safer.

Traders now look at market trends and find good deals thanks to tech. Tools like predictive analytics and machine learning help them guess better. Studies show these tools can boost profits by up to 20%.

Algorithmic trading has also changed the game, with 80% of US trades done by algorithms. This shows how vital it is to keep up with new tech to do well in trading. As a financial trader, knowing how tech changes the game is key.

| Technology | Impact on Trading |

|---|---|

| Electronic Trading Platforms | Increased liquidity, reduced transaction costs |

| Big Data Analytics | Enabled traders to analyze market trends and identify trading opportunities |

| Blockchain Technology | Provided secure and transparent transactions, increased efficiency |

Regulations and Compliance

As a trader, knowing the rules is key. Define trader as someone who buys and sells securities. They must understand complex markets and rules. Traders need to know about the SEC and FINRA, and laws like the Securities Exchange Act and the Dodd-Frank Act.

Traders use many tools and platforms. But they must follow rules to ensure fair play and protect consumers. Breaking these rules can lead to fines, penalties, and damage to their reputation. Staying compliant helps traders gain trust and stay ahead.

Some important rules for traders include:

- The Commodity Exchange Act (CEA), which regulates commodity futures and options markets in the U.S.

- MiFID II, a European Union regulation that enhances investor protection and promotes market transparency

- The Sarbanes-Oxley Act of 2002, which mandates strict governance and reporting requirements for public companies

By following these rules, traders keep their operations legal and markets fair. As "The PlayBook" by Bellafiore shows, traders must navigate these rules to avoid trouble.

The Future of Trading

As the trading world changes, financial traders need to be quick and flexible to succeed. Experts say the next decade will see more artificial intelligence (AI) and cryptocurrency in trading.

AI and machine learning will change how traders analyze markets and make decisions. These technologies can handle huge amounts of data, find patterns, and offer quick insights. This will help traders make better, faster choices.

The growth of cryptocurrency will also change the trading scene. As more people use digital assets, traders will need to learn about these new financial tools. Trading platforms for cryptocurrency and blockchain settlements could bring new chances and challenges.

To keep up, traders must learn new tech, improve their skills, and adjust their plans. Using AI, machine learning, and cryptocurrency can help traders stay ahead. This will prepare them for the exciting and changing world of trading.

FAQ

What is a trader?

A trader is someone who buys and sells financial items like stocks and bonds. They aim to make money from these transactions.

What are the different types of traders?

There are mainly three types of traders. Day traders, swing traders, and position traders each have their own ways of trading.

What are the key responsibilities of a trader?

Traders must analyze market trends and find good trading opportunities. They also execute trades and manage risks to make more money and lose less.

How do traders analyze the markets?

Traders use different methods to understand the market. These include looking at the market's fundamentals, technical analysis, and how people feel about the market.

What are the essential components of a trading strategy?

A good trading strategy has a clear plan and ways to manage risks. It also involves knowing how much to invest and how to adjust the strategy based on the market.

What tools and software do traders use?

Traders use many tools and software. These help them access data, make trades, and keep track of their performance.

What does a typical trading day look like?

A trader's day starts with analyzing the market before it opens. They then make trades during market hours. After the market closes, they review their performance and adjust their strategy.

How do traders manage risk?

Traders manage risk by knowing how much risk they can take. They diversify their investments and use tools like stop-loss orders to limit losses.

What psychological factors are important for traders?

Traders need to control their emotions and avoid common pitfalls. They must stay focused and make smart decisions, even when it's hard.

How is technology shaping the trading industry?

New technology is changing trading. It includes fast trading, automated strategies, and artificial intelligence. These tools help traders analyze and make trades more efficiently.

What are the key regulations and compliance considerations for traders?

Traders must follow strict rules and regulations. They need to understand these rules and comply with them to avoid penalties and protect their reputation.

What are some emerging trends and predictions for the future of trading?

The trading world is changing fast. New trends like cryptocurrency and artificial intelligence are emerging. These changes will likely shape the industry in the future.