Master the Art of Quant Trading: Strategies for Success in Finance

Quantitative trading, or quant trading, is a field that needs a strong grasp of math, probability, and statistics. As a quant trader, you must analyze complex data, spot patterns, and create strategies to make money from market trends. This field is both prestigious and well-paying, with salaries ranging from $98,000 to $259,500 a year.

To do well in quant trading, you need a solid math or physics background. Knowing programming languages like R, Python, or MATLAB is also key. With the right skills, quant traders can use fast computers to make trades and earn big salaries and bonuses.

Key Takeaways

- Quantitative trading requires a deep understanding of mathematics, probability, and statistical hypothesis testing.

- Quant traders must be able to analyze complex data sets and identify patterns to develop strategies.

- Average base salaries for quant traders range from $98,000 to $259,500 per year.

- A solid background in mathematics, physics, or a numerate undergraduate degree is essential for success in quant trading.

- Knowledge of programming languages such as R, Python, or MATLAB is critical for quantitative traders.

- Quantitative trading involves identifying a trading strategy, conducting backtesting, implementing trades, and applying risk management techniques.

- Quant traders can leverage high-speed computers to implement trades and negotiate substantial salaries and bonuses.

What is Quant Trading?

Quantitative trading, or quant trading, uses math and stats to make trading choices. It tries to avoid emotional decisions and boost efficiency by using computers. A quantitative trader needs to know a lot about math, stats, and coding.

To break into quant, you must have technical skills. This includes knowing programming languages like Python, C++, or Java. You also need to understand statistical concepts, like regression and time-series analysis. This field can be very rewarding, with salaries from $125,000 to over $500,000 a year.

Some important ideas in quant trading are:

- Algorithmic trading: computers make trades based on set rules

- High-frequency trading: fast trades to grab market chances

- Statistical arbitrage: finding market mistakes with stats

Quant trading started in the 1970s. New tech has made it easier to get into. But, it needs a solid technical base and a good grasp of market trends to succeed.

The Role of Data in Quant Trading

Quantitative trading heavily relies on data analysis. Aspiring traders must know the different data types used. They need to be skilled in using programming languages like R, Python, or MatLab to implement models. This is key in headline quant trading, where quick, data-driven decisions are made.

To develop a winning quant trading strategy, a strong data analysis foundation is essential. It's important to understand various data types, such as market data and economic indicators. By using these data sources, traders can make smart choices and outperform others. For those aiming to become quantitative traders, honing data analysis skills is critical.

Some important data analysis techniques in quant trading include:

- Time series analysis

- Statistical learning

- Predictive modeling

These methods help traders spot patterns and trends in data. This allows them to craft effective trading strategies. By combining these techniques with programming skills and knowledge of data sources, traders can build strong models that yield results.

| Data Type | Description |

|---|---|

| Market Data | Includes stock prices, trading volumes, and other market-related information |

| Economic Indicators | Includes data on GDP, inflation, and other economic metrics |

| Alternative Data Sources | Includes data from social media, sensors, and other non-traditional sources |

Essential Tools for Quant Traders

Quantitative traders use many tools and technologies to create and run their trading plans. To grasp what quant traders do, knowing the key tools and software is important. For those new to quantitative trading, learning programming languages like C++, R, Python, and MATLAB is key.

Some of the main tools used by quant traders include:

- Trading platforms and software, such as QuantConnect and StrategyQuant

- Programming languages, like Python and R, for data analysis and strategy development

- Libraries and frameworks, such as Pandas and NumPy, for efficient data processing

These tools help quant traders create and run complex trading strategies. They also analyze big datasets and make smart investment choices. Whether you're starting out in quantitative trading or looking to get better, knowing these tools is essential for success.

Developing a Quant Trading Strategy

A quant trader uses math to find good trades and manage risks. They need to know finance, math, and coding to do this. This helps them make smart choices with data.

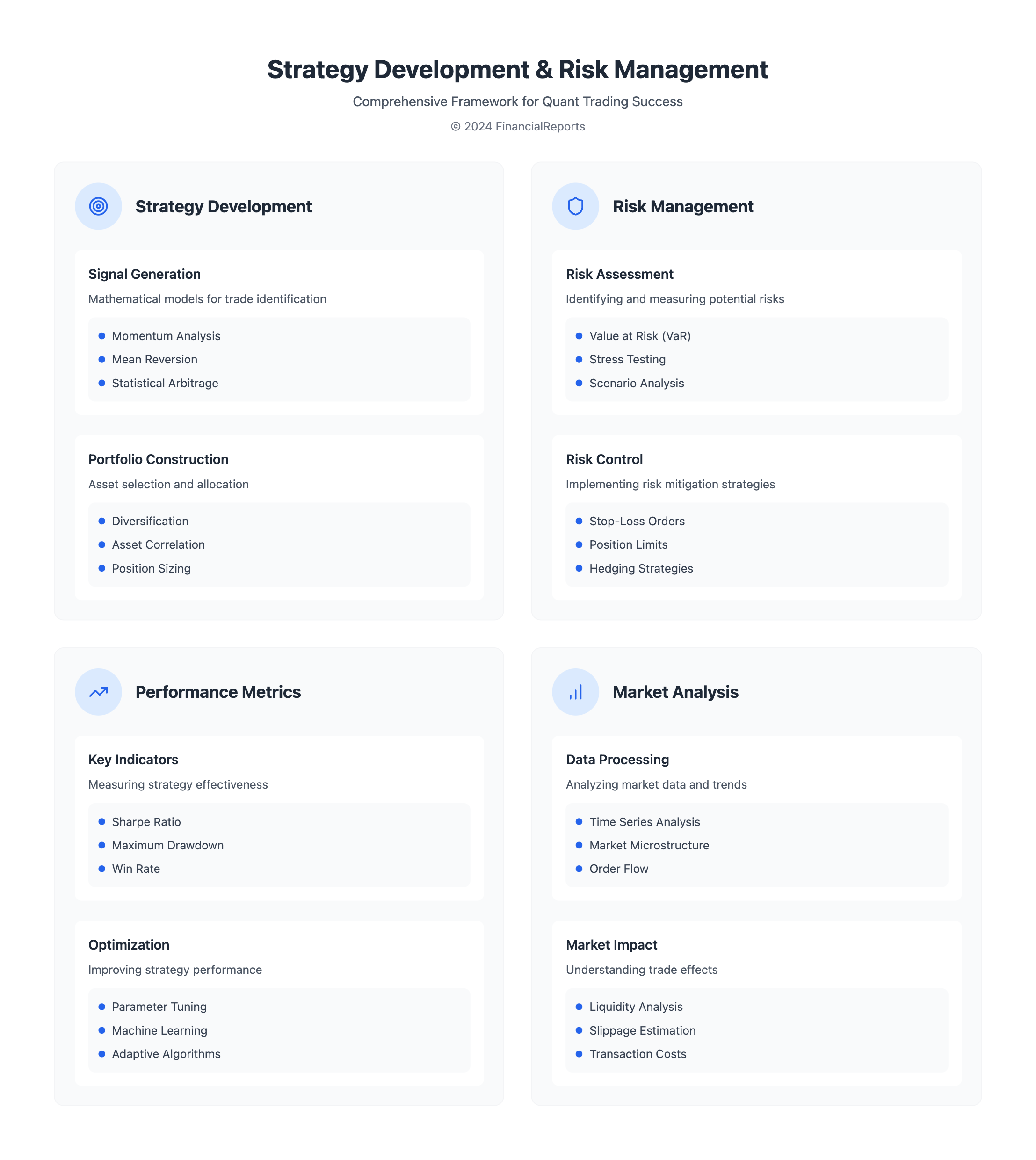

To make a good quant trading plan, you need to focus on a few things. These include:

- Signal generation: finding trades with math models

- Portfolio construction: picking the right assets for your portfolio

- Risk management: strategies to keep risks low and returns high

Backtesting is key. It lets the trader test the plan with old data. This way, they can make it better before using it in real markets. Knowing what a quant trader does and the parts of a good plan can help you make your own strategy. This can increase your chances of doing well in the markets.

Risk Management in Quant Trading

Effective risk management is key in quant trading. It helps avoid big losses and keeps trading strategies going strong. Quant trading uses complex algorithms and math models for investment decisions. So, a solid risk management plan is a must.

This plan includes checking how strategies change, understanding how traders react to market stress, and figuring out the value-at-risk (VaR). VaR shows the possible loss of a portfolio.

In quant trading, managing risk means spotting, checking, and controlling risks. There are many ways to do this:

- Position sizing limits the effect of one trade on the whole portfolio

- Diversification spreads investments to reduce risks from specific markets

- Hedging uses financial tools to protect against losses

- Stop-loss orders set limits to prevent big losses

Value at Risk (VaR) is a big deal in quant trading. It measures the risk in a portfolio and shows the biggest possible loss at a certain confidence level. VaR uses past returns to estimate losses. It helps match trading strategies with how much risk a trader can handle.

By using these risk management methods, quant traders can cut down on losses and increase gains. This leads to success in the competitive world of quant trading.

| Risk Management Technique | Description |

|---|---|

| Position Sizing | Limiting the amount of capital at risk in any given position |

| Diversification | Spreading investments across different sectors or asset classes |

| Hedging | Offsetting possible losses using derivatives, insurance, or other financial instruments |

Quant Trading Models and Techniques

As a quantitative trader, knowing different models and techniques is key. Quant trading uses math to study price and volume changes. To break into quant, you need skills in programming, data analysis, and stats.

Popular strategies include momentum investing and trend following. Mean reversion and statistical arbitrage are also used. These help both individual and institutional investors. A quantitative trader can use tools like oscillators to create trading systems.

A good trading system has strategy, backtesting, execution, and risk management. Quant trading helps by automating trades and making decisions more rational. But, it needs to adapt to market changes and can fail to keep up.

- Statistical arbitrage: finds market mispricings by analyzing securities.

- Machine learning applications: create advanced strategies by analyzing big data.

- Momentum investing: invests in securities with recent high returns.

To succeed in quantitative trading, keep up with market trends and best practices. Follow industry leaders, go to conferences, and join online forums.

The Importance of Coding Skills

Coding skills are key for success in headline quant trading. They help traders create and use complex algorithms and strategies. To become a quantitative trader, you need to know programming languages like C++, R, Python, and MATLAB.

These languages are vital for analyzing data, implementing strategies, and testing them. They are essential for any trader who wants to succeed in quant trading.

Some important programming languages in quant trading are:

- C++: Used for high-performance trading applications

- R: Utilized for statistical analysis and data visualization

- Python: Employed for strategy development and backtesting

- MATLAB: Used for data analysis and algorithm development

To improve coding skills, aspiring quantitative traders can use online resources, coding bootcamps, and academic programs. Remember, coding skills alone are not enough. You also need to understand mathematics and finance well to succeed in headline quant trading.

Staying Updated on Market Trends

To succeed in quantitative trading, it's key to keep up with market trends. Quant traders use complex algorithms and statistical models to analyze huge data sets. Knowing what quant traders do is essential for success. For those new to quantitative trading, staying current with market trends and tech advancements is vital.

For market news and research, check out financial publications, academic journals, and industry reports. The Journal of Financial Economics, the Review of Financial Studies, and the Financial Times are great sources. Quant traders can also use online forums, social media, and professional associations to connect with others and learn about market trends.

Networking within the Quant Community

Networking is key for success in the quant community. Going to conferences, like the Quantitative Trading Conference, and joining online forums, such as Quantopian or Kaggle, are great ways to learn from others. Some important events to attend include:

- Quantitative Trading Conference

- Global Derivatives Trading and Risk Management Conference

- Algorithmic Trading Conference

By keeping up with market trends and networking, traders can get ahead. Understanding how to get into quantitative trading and what quant traders do is vital for making smart decisions and achieving success.

| Resource | Description |

|---|---|

| Journal of Financial Economics | A leading academic journal in the field of financial economics |

| Quantopian | An online platform for quantitative traders to learn, develop, and execute algorithms |

| Financial Times | A leading financial publication providing news, analysis, and commentary on global financial markets |

Common Mistakes to Avoid in Quant Trading

As a quant trader, it's key to know what you're doing to avoid common mistakes. Quant trading uses math models to make investment choices. It needs a strong grasp of stats, probability, and market trends. Yet, many traders fall into traps that can cause big losses.

Some big mistakes include overfitting and underfitting models, not considering transaction costs, and ignoring risk management. Overfitting happens when a model fits historical data too well but fails in real markets. Underfitting is when a model is too simple and misses important data patterns.

Other mistakes include:

- Sticking to one strategy or market too much, which raises risk

- Not testing strategies enough, leading to overconfidence

- Jumping into live trading without proper prep, causing early losses

- Letting emotions guide trading decisions

To sidestep these errors, you must deeply understand quantitative trading strategies. Always keep an eye on and tweak your methods. This way, you can cut down on losses and boost gains, becoming a top quant trader.

| Mistake | Consequence |

|---|---|

| Overfitting | Poor performance in live markets |

| Underfitting | Failure to capture underlying patterns |

| Insufficient backtesting | Overestimation of strategy's effectiveness |

FAQ

Q: What is Quant Trading?

A: Quant trading, also known as quantitative trading, is a method of trading that uses mathematical models and algorithms to analyze and execute trades. It involves using data and statistical techniques to identify profitable trading opportunities and manage risk.

Q: How does Quant Trading differ from traditional trading?

A: Quant trading focuses on using mathematical models and algorithms to analyze and execute trades, whereas traditional trading relies on human intuition and experience. Quant trading aims to reduce emotional biases and increase efficiency by leveraging data and statistical techniques.

Q: What are the benefits of Quant Trading?

A: Quant trading offers several benefits, including the ability to analyze large amounts of data quickly, identify profitable trading opportunities, and manage risk effectively. It also allows for the automation of trading processes, reducing the need for manual intervention and increasing efficiency.

Q: What are the challenges of Quant Trading?

A: Quant trading faces several challenges, including the need for advanced mathematical and programming skills, the risk of algorithmic trading errors, and the need for continuous data analysis and model optimization. It also requires a deep understanding of market dynamics and trading strategies.

Q: What are some popular Quant Trading strategies?

A: Some popular Quant Trading strategies include trend following, mean reversion, and statistical arbitrage. Trend following involves following the direction of market trends, while mean reversion focuses on identifying undervalued or overvalued assets. Statistical arbitrage involves exploiting price discrepancies between different markets or assets.

Q: What are the different types of Quant Trading?

A: Quant Trading can be categorized into several types, including high-frequency trading, which involves executing trades at extremely high speeds, and long-term trading, which focuses on holding positions for extended periods of time. There are also different types of Quant Trading strategies, such as trend following, mean reversion, and statistical arbitrage.

Q: What are the tools and technologies used in Quant Trading?

A: Quant Trading relies on various tools and technologies, including programming languages such as Python and R, data analysis libraries like Pandas and NumPy, and trading platforms like Interactive Brokers and QuantConnect. These tools enable traders to analyze data, develop and execute trading strategies, and manage risk.

Q: What are the career opportunities in Quant Trading?

A: Quant Trading offers several career opportunities, including quant analyst, trading strategist, and portfolio manager. These roles involve developing and implementing trading strategies, analyzing market data, and managing risk. Quant Trading careers often require advanced mathematical and programming skills, as well as a deep understanding of market dynamics and trading strategies.

Q: How can I get started in Quant Trading?

A: To get started in Quant Trading, it is important to develop a strong foundation in mathematics, programming, and data analysis. You can start by learning programming languages like Python and R, familiarizing yourself with data analysis libraries, and exploring trading platforms. It is also beneficial to gain practical experience through internships or working with a trading firm.

FAQ

What is quant trading?

Quant trading uses math and computers to find and make trades. It's all about using data and algorithms to find good trading chances.

How does quant trading differ from traditional trading methods?

Quant trading is more scientific and uses computers to make decisions. It tries to avoid emotional mistakes by using data and algorithms. Traditional trading often relies on personal experience and feelings.

What types of data are used in quant trading?

Quant traders look at lots of data, like market trends and economic signs. They also use new data sources like satellite pictures and social media. Being able to handle and analyze big data is key.

What programming languages are commonly used in quant trading?

Skills in languages like C++, Python, R, and MATLAB are important. These help with analyzing data, creating strategies, and running automated systems.

How do quant traders develop their trading strategies?

They start with finding signals, building portfolios, and managing risks. They test their strategies with past data to see if they work before using them in real trading.

What are the key risks in quant trading, and how are they managed?

Quant traders face risks like market changes and system failures. They use tools like Value at Risk (VaR) models to manage these risks. This helps keep their trading safe and successful.

What are some common quant trading models and techniques?

Popular models include statistical arbitrage and momentum investing. Trend following and mean reversion are also used. Machine learning and AI are making strategies smarter and more flexible.

How can aspiring quant traders develop the necessary skills?

You need to know programming, math, stats, and finance. Getting advanced degrees or taking coding classes can help. Staying up-to-date with market trends and tech is also important.

What are some common mistakes that quant traders should avoid?

Avoid not diversifying, relying too much on models, and ignoring costs and risks. Understanding your models' limits and adapting to market changes is key to success.

What are the emerging trends and technologies shaping the future of quant trading?

AI, machine learning, and big data will shape the future. Blockchain and cryptocurrencies could also play big roles. Staying informed about these trends is vital for staying ahead.