Income Statement vs Cash Flow: Key Financial Reports

Understanding a business's financial health involves looking at key reports. The income statement and cash flow statement are crucial. They play a major role in financial reporting and analysis. This helps stakeholders understand a company's financial performance and liquidity.

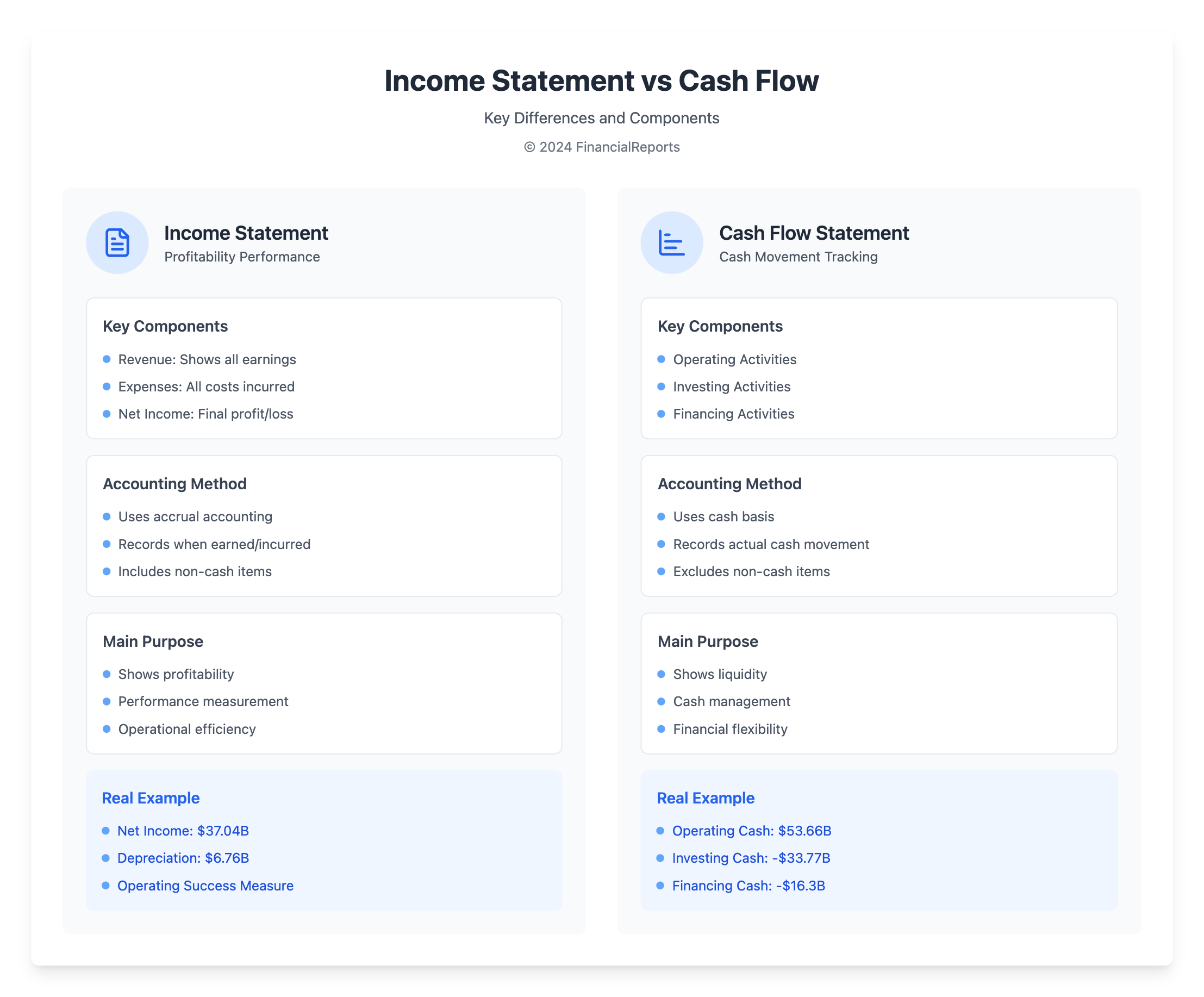

The income statement and cash flow statement serve different purposes. The income statement shows how a company has performed financially over time. It shows everything from income to profits or losses. It reflects the company's operational efficiency, including all expenses. The cash flow statement, however, focuses on cash inflows and outflows. It shows how well a company manages its cash, crucial for daily operations and survival.

These statements give a full picture of a company's financial health. The income statement uses accrual accounting, which might not match actual cash flow. The cash flow statement breaks down cash movements into different activities: operational, investing, and financing. This offers a detailed view of a company's finances.

Key Takeaways

- The income statement provides a detailed view of a company's financial activities over time, focusing on income and expenses.

- Cash flow statements show cash movements and are essential for evaluating a company's financial health and liquidity.

- Understanding the effects of accrual and cash basis accounting on these statements is key to accurate financial analysis.

- Financial ratios derived from these statements help in assessing a company's profitability, efficiency, and liquidity.

- Income statements can include non-cash items like depreciation; cash flow statements focus only on cash transactions.

- It's important to recognize differences in how revenue and expenses are timed in these statements for precise analysis.

- The direct and indirect methods of reporting cash flow offer insights into a company's cash management abilities.

Understanding the Income Statement

The income statement is a key financial report for any company. It shows the company's financial performance for a certain time. This statement lists revenues, costs, and the final profit or loss. It's very important for understanding if the business is doing well. It helps companies make the right choices for their future financial plans.

Definition and Purpose

An income statement gives a full picture of a company's profit and how efficiently it operates. Its main job is to show net income. This is done by taking away total costs from total revenues. This statement is key to see if the company can make money from its business activities. It uses a method called non-cash accounting. This is where revenues and expenses are counted when they're earned or owed, not when cash changes hands.

Key Components of an Income Statement

| Component | Description | Impact on Financial Performance |

|---|---|---|

| Revenues | Total income from operations | Primary indicator of business scale and market position |

| Expenses | Includes COGS, selling, administrative, and other expenses | Direct impact on operational efficiency and profitability |

| Gross Profit | Revenue minus COGS | Measures product profitability before operational costs |

| Net Income | Final profit or loss after all expenses, including taxes | Key metric for assessing overall financial health and operational success |

Common Terminology

- Gross Profit: Calculated as revenue minus cost of goods sold (COGS), showing how effective the main operations are.

- Operating Income: Also known as operating profit; comes from gross profit minus operating costs. It's important for understanding everyday business profit.

- Bottom Line: This is the net income or the ultimate profit or loss after all costs, non-operating items, and taxes. It's crucial for reports to stakeholders and making investment choices.

By looking at an income statement, investors and managers can keep an eye on revenues and expenses over time. They can spot financial trends and see if business plans are working well. This important review helps not just in showing current financial performance. It also helps in planning for future profit and making changes in business or financial strategies as needed.

Understanding Cash Flow Statement

The statement of cash flows is essential for understanding a company's liquidity. It shows cash movements during a certain period. The report divides cash movements into operational activities, investing activities, and financing activities. This helps people see how a company makes and spends its cash. It reveals the company’s financial health and how efficiently it operates.

Definition and Purpose

A cash flow statement tells us how much cash a company generates and uses. It focuses on activities that either bring in cash or need cash spending. Unlike other financial reports, it uses cash-basis accounting. This method gives a clear picture of the company's liquidity by showing cash flow.

Types of Cash Flow

There are two ways to prepare a cash flow statement: the direct method and the indirect method. Most companies use the indirect method. It starts with net income and adjusts it for cash-based transactions. This includes changes in balance sheet items.

Key Components of Cash Flow Statements

The statement of cash flows has three main sections:

- Operational Activities: This part has transactions from the company's main operations. It includes money from selling goods and services and paying for things like supplies and salaries.

- Investing Activities: Here we find transactions for buying or selling assets not counted as cash, like equipment.

- Financing Activities: This section has transactions that change the company's financial structure. It includes things like issuing stocks, paying dividends, and loan repayments.

| Category | Examples of Cash Inflows | Examples of Cash Outflows |

|---|---|---|

| Operational Activities | Revenue from sales, Receipts from services | Payment to suppliers, Salaries, Rent |

| Investing Activities | Sale of property, Sale of equipment | Purchase of property, Investment in equipment |

| Financing Activities | Issue of new shares, Borrowings | Repayment of loans, Dividends paid |

The statement of cash flows is vital for assessing a business's financial flexibility and liquidity. By examining this statement, stakeholders can see how well a company controls its cash. This means ensuring they have enough money to cover their bills.

Primary Differences Between Income Statement and Cash Flow

Understanding the difference between income and cash flow statements is key to managing finances. These documents give important financial insights but focus on different things.

Measurement Focus

The income statement shows the company's profitability within a time frame. It covers all revenues and expenses, including non-cash items like depreciation. The cash flow statement, however, tracks cash's ins and outs from various activities. It gives a clear picture of a company's cash on hand, which is vital for assessing financial health.

Time Period Considerations

The income statement uses accrual vs cash accounting. This means it records earnings and spends when they happen, not when the cash moves. The cash flow statement logs cash activity as it occurs. This makes it crucial for understanding the business's actual cash status at any moment.

| Financial Statement | Focus | Key Benefit | Common Use |

|---|---|---|---|

| Income Statement | Profitability Measurement | Assesses overall financial performance | Used by investors for profitability assessment |

| Cash Flow Statement | Cash Management | Provides real-time cash position | Used by management to gauge liquidity and operational cash needs |

By analyzing both statements, companies can plan and make better financial decisions. They combine profitability insights and cash flow details for a stronger financial strategy.

Importance of Income Statement for Businesses

The income statement is key for businesses to analyze finances and manage them well. It helps in understanding how a company makes and spends money. This makes it a crucial part of checking a company's operational success and financial health.

Profitability Analysis

The income statement breaks down profits and losses in detail. This lets businesses see how profitable they are over time. It's very important for managing how much money they make and spend.

Income statements are great for tracking how well a company does compared to others. They show important things like gross and net profit margins. This helps in knowing where a company stands in its industry.

Performance Evaluation

Income statements offer a detailed look at a company's performance. They show where the company earns money and where it could be better. This detail helps in making important business decisions.

By checking income statements often, companies can quickly respond to changes in the market. This helps them use their resources better and stay ahead. It ensures businesses can manage their expenses and income effectively.

Importance of Cash Flow Statement for Businesses

For any organization, mastering cash management is key. The cash flow statement is vital for keeping a company financially healthy. It shows how well a company manages its cash, revealing its ability to pay bills and operate smoothly.

Cash Management

Effective cash management is about knowing cash inflows and outflows. The cash flow statement divides into operating, investing, and financing activities. This gives a clear picture of a company's operational efficiency. For example, Apple's excellent cash management strategies show how important this is for success and having enough cash for all expenses.

Financial Health Assessment

Companies use the cash flow statement to check their financial strength and how well they operate. This helps them make sure they have enough money for daily activities and to meet financial commitments. By tracking cash transactions, they can forecast future cash positions and plan ahead. Microsoft, for instance, improves cash flows from software products to allocate capital wisely. This supports their growth even when the market changes.

But, businesses like Blockbuster and Kodak show how bad cash flow management can lead to failure. Understanding cash flow helps companies avoid such issues. They can assess and adjust their liquidity in time. This analysis helps judge if a business can stay profitable, invest more, or survive financial challenges.

So, the Cash Flow Statement is more than a financial report. It's a strategic tool for financial health. It helps companies manage resources well and adapt to market changes.

How Income Statements Impact Financial Decision-Making

Income statements are vital for strategic financial planning. They help in making strong financial strategies. These include predicting revenue, estimating costs, and deciding on important investments. Financial experts use them to understand how a business did in the past. They can also guess how it will do in the future.

Budgets and Forecasts

For making accurate budgets and forecasts, income statements are key. They show past money made and spent. This info helps make good predictions for the future. The accuracy in forecasting revenue that comes from income statements is crucial. It helps businesses align their work with their financial goals.

Investment Strategies

Income statements are also key in deciding how to invest. They show the net income. This tells a company how healthy it is financially. From the past financial data, companies learn where to invest their money. This helps them grow and stay stable at the same time.

| Financial Aspect | Insight from Income Statement | Impact on Financial Decision-Making |

|---|---|---|

| Revenue Trends | Analysis of periodic revenue fluctuations | Guides revenue forecasting and helps in setting realistic financial targets |

| Expense Management | Detailed breakdown of costs and expenditures | Informs cost estimation and resource allocation strategies |

| Net Income | Total revenue minus total expenses | Central to assessing the net income impact and tailoring investment strategies accordingly |

| Financial Health | Overall profitability and operational success | Supports strategic financial planning, directing future financial policy formulation |

The strategic use of income statements is crucial. It helps with both daily decisions and long-term financial health. By using the insights from these statements, businesses can grab opportunities. They can also avoid financial problems before they happen. This is all part of smart financial planning.

How Cash Flow Statements Influence Business Choices

Understanding operational liquidity through cash inflows analysis is key in today's financial world. Cash flow statements are vital for making smart business choices. They show the money coming in and going out of a business. We'll look into how these statements impact areas like operational decisions and financing.

Operational Decisions

Companies check their cash flow to keep operations smooth. They look at money from core business activities. This helps them fund operations well, avoiding any cash issues or debt troubles.

If cash flow looks good, a company might expand its operations. This makes sure growth is stable and secure.

Financing Activities

What a cash flow statement shows influences a company's financing strategy. It tells how well cash is managed, affecting decisions on debts and loans. Companies might decide on new equity or loans based on this data.

A strong cash flow means a company might not need outside funding. This can save on interest costs and increase value for shareholders.

| Year Start Cash | Cash from Operating Activities | Cash from Investing Activities | Cash from Financing Activities | Year-End Cash |

|---|---|---|---|---|

| $10.75 billion | $53.66 billion | -$33.77 billion | -$16.3 billion | $14.26 billion |

| Net Income | Depreciation | Dividends Paid | Stock Repurchased | New Debt Issued |

| $37.04 billion | $6.76 billion | $10.56 billion | $22.86 billion | $16.89 billion |

Using cash flow statements for decisions is smart. It helps with managing operational liquidity and planning financing strategies. Companies stay healthy financially and can quickly adapt to new opportunities.

Interrelation Between Income Statements and Cash Flow

Income statements and cash flow statements tell a company's financial story over time. They are closely linked, showing how a business is doing financially. Understanding their relationship helps in making smart financial and strategic decisions.

How Income Affects Cash Flow

An income statement shows a company's revenue and expenses, ending with net income. This net income is crucial because it starts the cash flow calculation. It uses the indirect method. However, an income statement shows earnings that may not be cash received. This is where the conversion from profit to actual cash flow is eye-opening. Adjustments are made in the cash flow statement to show real cash positions.

Adjustments for Non-Cash Items

To turn net income into real cash flow, we need to adjust for non-cash items:

- Depreciation and Amortization: These are added back to net income. They don’t require cash spending.

- Changes in Working Capital: More receivables or inventory is deducted. More payables or accrued expenses are added.

- Provisions for Future Losses: Also added back. They don’t need cash now.

These changes make sure the cash flow statement shows the true cash available.

Both income and cash flow statements show a company's financial performance and cash-making ability. They help stakeholders see the full picture of a company’s financial health. This goes beyond just profit shown by the profit and loss statement.

Common Misconceptions About Income Statements

The income statement is key for understanding a company's performance. But, there are income statement misconceptions that confuse many. People often mix up reported profit and actual cash flow, which affects important financial choices.

Profit vs. Cash Flow Confusion

Many get profit and cash flow mixed up in finance. An income statement's profit doesn't mean cash is ready to use. For example, a successful brewery could still shut down due to cash problems.

This shows the difference clearly. Profits are sometimes shown before cash is actually received. If not managed well, this can cause big financial issues.

Importance of Context in Evaluation

Understanding an income statement requires looking at the big financial picture. It's about seeing how things like depreciation and revenue recognition affect what's reported. If ignored, decisions may rely on incomplete info.

Businesses focusing too much on income statements miss out without also considering the balance sheet and cash flow statements. This can lead to misunderstood finances.

| Aspect | Importance in Financial Reporting |

|---|---|

| Accrual Accounting | Can lead to profits being reported before cash is received, influencing liquidity perception. |

| Cash Management | Essential for operational sustainability; requires analysis beyond the income statement. |

| Contextual Analysis | Necessary to avoid misinterpretations that could affect strategic decisions. |

| Integration with Other Financial Statements | Provides a more holistic view of the financial health than the income statement alone. |

Addressing income statement misconceptions lets pros make more accurate, strategic financial analyses. It's key for strong fiscal health and smart decision-making.

Common Misconceptions About Cash Flow Statements

Clearing up myths about cash flow statements is key for right financial decisions. A common cash flow statement misconception is thinking that high profits mean good cash flow. Yet, cash versus accrual accounting can show a very different financial health.

Even if a company's income statement shows profits, its cash flow may tell another story. This happens because of the timing when companies recognize money coming in and going out.

Cash Flow and Profit Are the Same

Many people wrongly believe that cash flow and profit are the same. This leads to confusion about a company’s financial health. In fact, 82 percent of business failures come from poor cash flow management, not profit issues.

Profit is about how much money a company makes in a time period including both cash and non-cash items. Cash flow, however, is the actual cash moving in and out during that same time. Confusing things like bank overdrafts as cash can make cash flow understanding complicated.

Understanding Cash Flow Fluctuations

Cash flow can change for many reasons, requiring a look deeper than just the surface numbers. For example, shifts in money owed between companies don’t always represent true cash flow from operations. This makes understanding cash flow more complex.

Costs from buying other companies might be shown differently if financial statements are combined. This changes how cash flow from investing activities looks. Small businesses especially need good tools, like monthly cash flow forecasts, to handle these challenges and keep stable.

Knowing the details and correctly applying cash vs accrual accounting is crucial. It's important to put activities like money deals in the right category. This shows a business's true financial state. Thus, knowing the difference between cash from running the company and cash from financing activities is essential for staying financially sound.

To wrap up, tearing apart the cash flow statement misconceptions aids in better financial planning. Understanding operating cash flow's role in fiscal health leads to smarter choices. This improves financial management, which is key to business success.

Analyzing Financial Health: Income Statement vs. Cash Flow

Understanding a company's financial health is vital. Financial experts use various tools to dive into income statements and cash flow reports. They aim to uncover immediate financial conditions and insights into the company's efficiency and market position.

Key Ratios from Both Reports

Financial ratio analysis is crucial in assessing a company's financial health. Key ratios drawn from income statements and cash flow statements include:

- Gross Profit Margin and Net Profit Margin show how profitable a company is from its sales. They take into account the cost of goods sold and other expenses.

- The Current Ratio and Quick Ratio measure a company's ability to meet short-term obligations. They show if the company can pay its immediate dues without selling inventory or getting more money.

- Return on Equity (ROE) and Return on Assets (ROA) compare how well financial resources are used to earn profits. They are mainly focused on insights from the income statement.

- Looking at Cash Flow from Operations is crucial for understanding liquidity. It's a key part of examining cash flows.

Interpreting Insights

Comparing financial statements gives a complete view of the business scene. For example, seeing the net income and EPS of YYZ Corp decrease over two years can point out issues in core operations or external market effects.

Cash flow study is key when profitability is good, but cash management is poor. It shows if cash usage aligns with the company's operations. This helps spot financial strategies or issues not clear from just the income statement.

The relationship between income statement and cash flow data offers not just a current financial picture but a deeper look into future sustainability and growth. Using detailed analysis is essential for advising accurately and making smart decisions.

Best Practices for Reviewing Income Statements and Cash Flow

Analyzing financial reports is not a once-a-year job. It requires ongoing effort. This is because keeping an eye on income statements and cash flows helps businesses stay on track. It leads to financial success and stability. Regular reviews help spot trends and areas that need quick action.

Regular Monitoring

When checking cash flow statements, it's critical to look at cash from different activities. These include operating, investing, and financing activities. This approach offers a peek into the company's overall financial health. For example, having more cash from operations than net income signals strong financials. It shows the company is doing well. Measures like cash flow per share and free cash flow are key for investors. They reveal if a company can grow, handle debts, and reward shareholders.

Strategic Analysis

Strategic analysis combines different data to understand a company's financial story. Looking at income statements in detail is part of this. It allows comparing revenue, expenses, and profits across the industry and time. This review includes checking net sales, operating income, and net income. For instance, if a company reports strong earnings and growth, it shows the value of such analysis. In essence, these practices foster a culture of careful financial management and improvement.

FAQ

What is the difference between an income statement and a cash flow statement?

An income statement shows a company's financial performance. It includes revenue, expenses, and profit or loss over time. On the other hand, a cash flow statement tracks cash movement, showing liquidity and ability to pay bills. While income statements use accrual accounting, cash flow statements track actual cash transactions.

Can a positive cash flow indicate a company’s profitability?

A company with positive cash flow has more money coming in than going out, indicating good liquidity. However, this does not mean it is profitable. A business can have a positive cash flow and still report a net loss. Similarly, a company can be profitable with a negative cash flow.

How does the income statement affect financial decision-making?

The income statement shows profitability. It is useful for budgeting, forecasting, and strategic investments. It helps to assess financial health, guide how resources are used, and affects investor confidence.

Why is the cash flow statement important for a business?

Cash flow statements are key. They show a company's ability to pay expenses and avoid new debt. The statement details cash income and spending, showing if financial practices can be sustained.

What are key components of an income statement?

An income statement includes revenues, cost of goods sold (COGS), gross profit, and operating expenses. It also lists operating and net income. These elements help determine a company's profit-making ability.

What are key components of a cash flow statement?

The cash flow statement is divided into three parts: operating, investing, and financing activities. This breakdown provides a full picture of how cash moves in relation to business activities.

How do income statements and cash flow statements interrelate?

The income statement's net income starts the cash flow statement. Non-cash transactions and working capital changes are then accounted for. This explains how profits turn into available cash, detailing the earnings and spending.

What common misconceptions exist about income statements?

Many think income statements show a company's cash level, which isn't accurate. Accrual accounting means income and expenses are logged when earned or incurred, not when cash changes hands.

How are income statements and cash flow statements used in financial health analysis?

Both statements play a role in financial health analysis. They help analysts examine profitability, liquidity, and sustainability. By reviewing ratios and trends, analysts can understand performance and predict future outcomes.

What best practices should be followed when reviewing income statements and cash flow reports?

It's crucial to regularly review both statements. This means closely watching financial metrics and analyzing data strategically. Identifying trends and understanding financial dynamics guide better decision-making and promote financial well-being.