Discover Low Cost Hedge Funds - The Smart Way to Invest

Hedge funds now hold over $2.5 trillion, showing their growing appeal. Low cost hedge funds stand out as a smart, affordable choice. They offer diversification and potentially attractive returns, making them a great alternative to traditional investments.

These funds have become more accessible and cost-effective. They are perfect for those wanting to save money while still earning good returns. With their ability to offer premium returns, it's no surprise they're gaining popularity among financial experts and big investors.

Introduction to Low Cost Hedge Funds

Low cost hedge funds are a smart investment choice in today's growing hedge fund market. They provide diversification and potentially attractive returns. This makes them a great option for those looking to improve their investment portfolios while keeping costs low.

Key Takeaways

- Low cost hedge funds offer a cost-effective way to invest in hedge funds, with potentially attractive risk-adjusted returns.

- These investment vehicles provide diversification and can help minimize expenses while maximizing returns.

- Low cost hedge funds are becoming increasingly popular among financial professionals and institutional clients.

- By leveraging alternative sources of return and different risk exposures, low cost hedge funds can help investors achieve their financial goals.

- Experts advise investors to focus on the cost of funds, as lower fees translate to higher returns on investments over time.

- Low cost hedge funds are an excellent option for investors seeking to optimize their investment portfolios and benefit from the expertise of experienced asset managers.

Understanding Low Cost Hedge Funds

Low cost hedge funds offer a special investment chance. They mix diversification with the chance for big returns. These funds use smart strategies but keep fees low, appealing to those looking for new investment paths.

These funds are known for their flexible investment strategies. They can invest in many assets and ways. This lets them adjust to market changes, aiming for better returns.

Definition and Characteristics

Low cost hedge funds are managed investment groups. They use different strategies to meet their goals. They often use quantitative strategies, relying on data and analytics for their choices.

Benefits of Investing in Low Cost Hedge Funds

Investing in low cost hedge funds has many benefits. These include:

- Enhanced portfolio diversification

- Potential for asymmetric returns

- Access to alternative risk exposures

These perks are great for those wanting to cut costs but still get good returns. Known as cheap hedge funds, they offer a budget-friendly way into the hedge fund world.

Knowing what low cost hedge funds offer helps investors make better choices. Their flexible strategies and chance for high returns make them a solid choice for those aiming to improve their investment results.

| Investment Type | Fee Structure | Minimum Investment |

|---|---|---|

| Traditional Hedge Funds | 2% management fee, 20% performance fee | $100,000 - $1 million |

| Low Cost Hedge Funds | 1.5% management fee, 15% performance fee | $50,000 - $500,000 |

The Rise of Low Cost Hedge Funds

Low cost hedge funds are becoming more popular. This is because people want affordable ways to invest. The hedge fund industry has grown a lot, with 8,832 businesses in the U.S. by November 2021, worth $103 billion. These funds help investors diversify and reduce risks at a lower cost.

Technology has helped lower costs for these funds. AI, machine learning, and automated trading make strategies cheaper. This makes investing more accessible to more people. Big names like Bridgewater Associates and Renaissance Technologies are using these technologies to cut costs.

Market Trends and Statistics

The hedge fund industry grew by 6.27% from 2015 to 2019. In the first quarter of 2021, hedge funds saw their highest returns since 2006, with a 1% rise to 4.8%. The HFRI Fund Weighted Composite Index returned 5.9% from March 1, 2019, to October 31, 2022. This shows low cost hedge funds can offer good returns while keeping costs down.

Affordable hedge funds are now more appealing to investors. They want to diversify without high fees. The pandemic years saw a 1.4% yield on the Bloomberg USAggregate Bond Index, but low cost hedge funds offer a better alternative. As demand grows, the industry will likely keep innovating, offering more options and better returns.

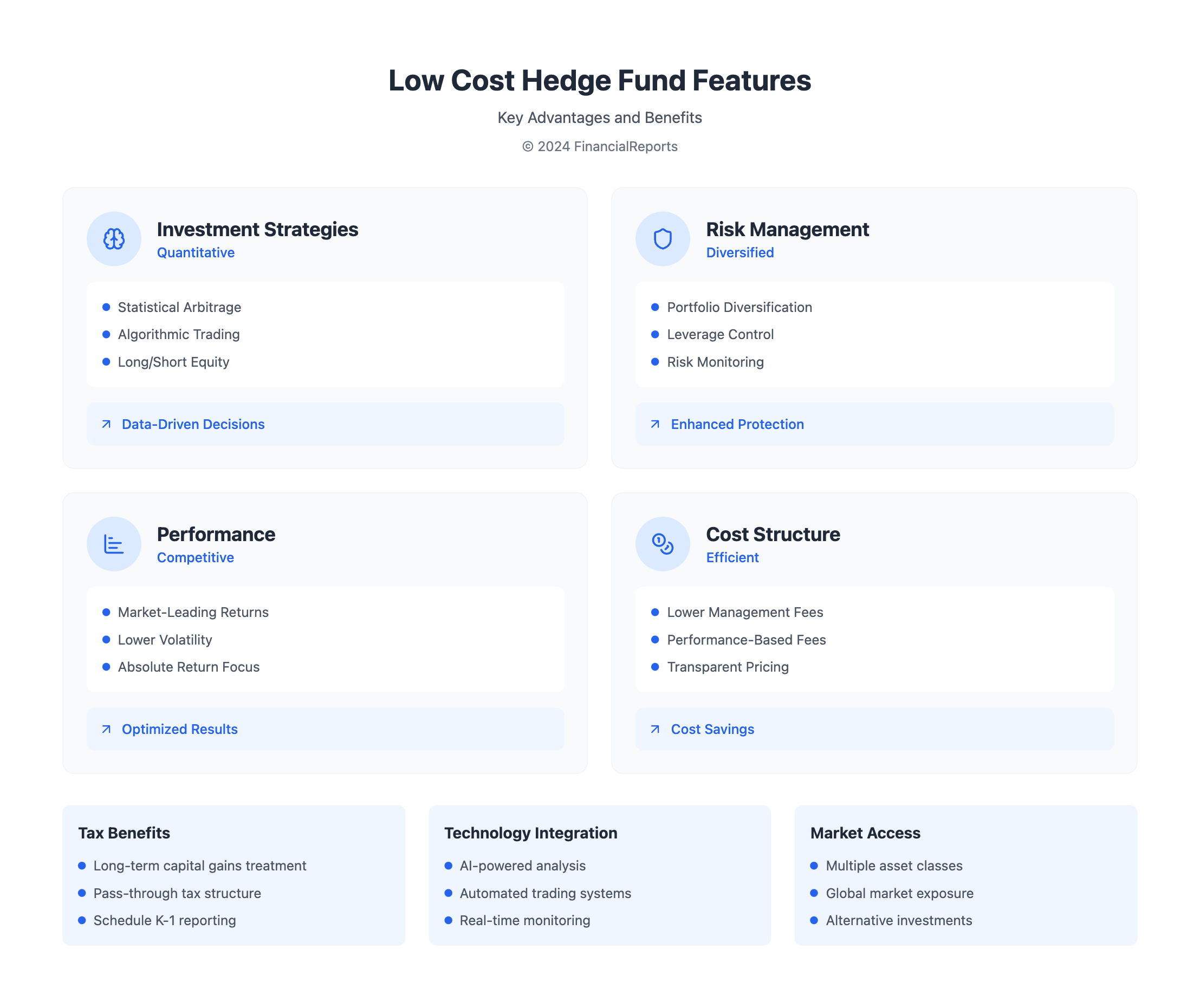

Key Features to Look for in Low Cost Hedge Funds

When looking at low cost hedge funds, it's key to check the fees. Traditional hedge funds charge 1% to 2% in management fees and 15% to 20% in performance fees. Cheap hedge funds, however, have lower fees, making them more appealing to investors. The minimum investment needed also varies a lot between funds.

Some important features to look for in low cost hedge funds include:

- Lower management fees and performance fees

- Flexible investment strategies, such as long/short equity or global macro

- Transparent reporting and regular updates on fund performance

- A clear and concise investment approach, with a focus on risk management

By looking at these factors, investors can make smart choices. This could lead to better returns on their investments. It's crucial to do your homework and find the best cheap hedge funds that fit your goals and risk level.

How Low Cost Hedge Funds Compare to Traditional Funds

When looking at investment choices, it's key to compare costs. Low cost hedge funds are cheaper than traditional ones. They have lower fees for management and performance. For example, hedge fund fees have dropped to 1.37% for management and 16.36% for performance.

Traditional funds, on the other hand, have lower fees. But they might not offer the same diversification or potential for gains. Hedge funds have shown less decline in tough times, unlike the stock market. Here's a table comparing fees and performance:

| Investment Type | Management Fee | Performance Fee | 1-Year Return |

|---|---|---|---|

| Low Cost Hedge Funds | 1.37% | 16.36% | -5.78% |

| Traditional Funds | 0.05%-5% | N/A | 24.23% |

Low cost hedge funds are a good choice for those looking for affordable options. They offer lower fees and a chance for absolute returns. But, it's important to know their limitations, like lock-up periods and less liquidity than traditional funds.

Strategies Employed by Low Cost Hedge Funds

Low cost hedge funds use many strategies to make money for investors. One way is through quantitative strategies. These use math models to find good investments. This includes statistical arbitrage and algorithmic trading, made easier by new tech.

Another method is long/short equity. This means buying and selling stocks at the same time. It can lower risk and boost returns. Equity hedge, which includes this strategy, is very common. The hedge fund minimum investment for these funds is often lower, making them more accessible.

These funds also use tech and data to keep costs down. They might use machine learning to spot market trends. This way, they offer benefits like diversification and risk management, along with the chance for growth over time.

| Strategy | Description |

|---|---|

| Quantitative Strategies | Using mathematical models to identify investment opportunities |

| Long/Short Equity | Taking simultaneous long and short positions in stocks |

Low cost hedge funds provide various strategies to help investors reach their goals. By knowing these strategies, investors can choose the right funds and how to spread their money.

Top Low Cost Hedge Fund Options for Investors

Investors looking for affordable hedge funds have many options. These funds use long-only strategies, which means they buy securities to make money when prices go up. They don't bet against any securities. Recent data shows that most hedge funds focus on their top 10 companies, showing a clear investment strategy.

Some affordable hedge funds use "Best Of" lists from long/short strategies. Others use long-only with derivatives to manage risk. These funds are often more liquid and have higher beta than traditional equity funds. For example, Interactive Brokers Group (IBG LLC) offers low margin rates and over 90 order types. This makes it a great choice for those looking for cheap hedge funds.

When picking affordable hedge funds, investors should look at management fees, performance fees, and investment strategies. Comparing these can help investors make smart choices. Here are some important things to consider:

- Management fees: Choose funds with low management fees to save money.

- Performance fees: Opt for funds with fees tied to performance to align with your interests.

- Investment strategy: Check if the fund's strategy and risk level match your goals.

Risks Associated with Low Cost Hedge Funds

Investing in low cost hedge funds can be appealing for those looking to diversify their portfolios. However, it's crucial to grasp the risks involved. Market risk is a big concern, leading to losses due to market changes. Leverage, derivatives, and short selling can also up the risk of losses.

Operational risks, like style drift and key person risk, can affect a fund's performance. Style drift happens when a manager strays from the fund's strategy, causing poor results. Key person risk is when a fund's success relies too much on one person, and their leaving can harm the fund.

To lessen these risks, diversifying is key. This means investing in various low cost hedge funds with different goals and risks. It's also vital to do deep research on the fund manager and strategy. By understanding and managing these risks, investors can wisely add these funds to their portfolios, keeping in mind the minimum investment requirements.

When looking at low cost hedge funds, consider these important factors:

- Investment strategy and risk profile

- Fee structure and expenses

- Performance track record

- Regulatory compliance and transparency

By carefully looking at these points and weighing the risks and benefits, investors can make smart choices. This way, they can benefit from low cost hedge funds, which offer a cost-effective way to explore hedge fund strategies.

Tax Implications of Low Cost Hedge Fund Investments

Investing in low cost hedge funds can offer many benefits, including tax advantages. Hedge funds are set up as pass-through entities. This means they pass their tax obligation to their investors or limited partners. Investors in these funds get a Schedule K-1 each year. It shows their share of the fund's profits or losses to report on their tax returns.

One major tax benefit of low cost hedge funds is long-term capital gains treatment. If a hedge fund holds assets for over three years, gains from selling those assets are taxed at a lower rate. This can greatly reduce an investor's tax liability.

Tax Efficiency in Hedge Funds

To make the most of tax efficiency, investors in low cost hedge funds should:

- Understand the tax implications of the hedge fund's investment strategy

- Consider the potential for long-term capital gains treatment

- Review the Schedule K-1 received from the hedge fund to ensure accurate tax reporting

By investing in affordable hedge funds and knowing the tax implications, investors can lower their tax liability. This can increase their after-tax returns. It's crucial to talk to a tax professional to follow all tax rules and maximize tax efficiency.

How to Get Started with Low Cost Hedge Funds

Investing in low cost hedge funds can be a smart move for diversifying your portfolio. First, you need to know the hedge fund minimum investment requirements. These can differ from one fund to another. Some cheap hedge funds have lower minimums, making them easier for individual investors to join.

When picking a low cost hedge fund, think about a few key things:

- Investment strategy and risk profile

- Management fees and performance fees

- Track record and team experience

Make sure your investment goals match the fund's. Also, understand the risks and costs involved.

After finding a good fund, open an account and fund your investment. Always read the fund's documents carefully before investing. With the right strategy, low cost hedge funds can enhance your portfolio.

| Fund Type | Minimum Investment | Management Fee |

|---|---|---|

| Equity Fund | $100,000 | 1.5% |

| Fixed Income Fund | $50,000 | 1.0% |

The Future of Low Cost Hedge Funds

Low cost hedge funds are set to be key players in the hedge fund world's future. Experts say the focus on specific bets in hedge funds is at an all-time high since before the pandemic. This shows investors want strategies that are efficient and can handle market ups and downs well.

Experts predict low cost hedge funds will keep growing. This is thanks to better financial tech and a push for cheaper options. With hedge fund investments going down, these funds offer a good deal. They can give strong returns without the high costs.

Also, ESG (environmental, social, and governance) factors are becoming more important. Low cost funds that focus on ESG might attract investors who want to match their values with their investments. As the world of alternative assets changes, low cost hedge funds could be the top choice for those looking to save money while diversifying their investments.

FAQ

What are low cost hedge funds?

Low cost hedge funds are a smart way to invest. They offer advanced strategies but charge less than traditional hedge funds.

What are the benefits of investing in low cost hedge funds?

They add diversity to your portfolio. They can also offer better returns and access to new risks without high fees.

What are the key drivers behind the growth of low cost hedge funds?

Technology has made them more affordable. It has cut costs and made strategies more efficient. More people want these options too.

What features should investors evaluate when considering low cost hedge funds?

Look at fees, strategies, risks, liquidity, and how transparent they are. These are key when choosing.

How do low cost hedge funds compare to traditional hedge funds in terms of performance and fees?

They offer good returns without the high costs. This makes them a better deal for investors.

What are the common investment strategies employed by low cost hedge funds?

They use tech and data for strategies like statistical arbitrage. They also do long/short equity trading. This makes them efficient.

What are some top-performing low cost hedge fund options for investors?

There's a list of top funds. It shows their strategies, past performance, risks, and fees. This helps investors find the right fit.

What are the risks associated with investing in low cost hedge funds?

There are market risks like losses from short selling. There are also operational risks like strategy changes. Diversifying and doing your homework can help.

What are the tax considerations for investing in low cost hedge funds?

They might offer tax benefits like long-term gains. But, there are complexities with tax reporting and K-1 forms to consider.

How can investors get started with low cost hedge fund investments?

Start by finding the right funds. Then, learn about opening an account and funding it. Make sure they fit your overall investment plan.